The Rent In CPI Is Too Damn High. Also 5.5% Core CPI way above Fed target. What now?

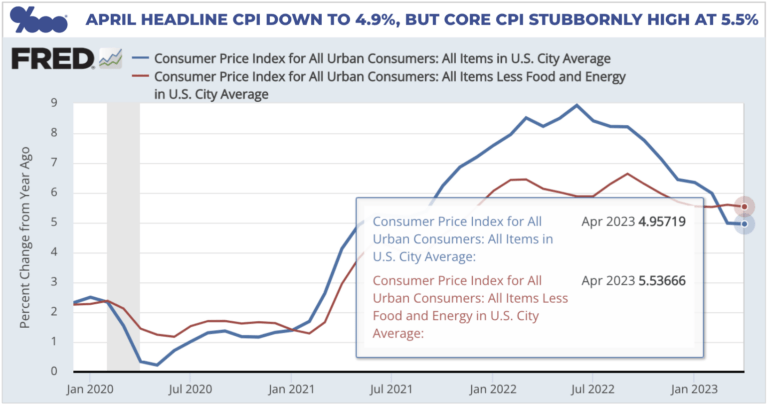

In March, headline CPI inflation dropped meaningfully from 5.9% to 4.9% and today’s April report held this line at 4.9%. But April annual Core CPI, which excludes volatile food and energy costs, is stubbornly high at 5.5%, down just slightly from 5.6% in March. Still, inflation is trending down, and after 10 rate hikes in 14 months, the Fed may pause at its June 14 meeting. Here are a few key takeaways.

The March-to-April monthly Core CPI level is 0.4%.

Good news: If you annualize this, it’s 4.8%, which is trending down.

Bad news: The actual annual number is still 5.5% (see chart above).

More good news:

Peak headline CPI inflation was 8.9% in June 2022 vs. 4.9% in April 2023.

Peak Core CPI inflation was 6.6% in September 2022 vs. 5.5% in April 2023.

So what’ll it take for Core CPI inflation to drop from here?

Hint: lower housing costs may help.

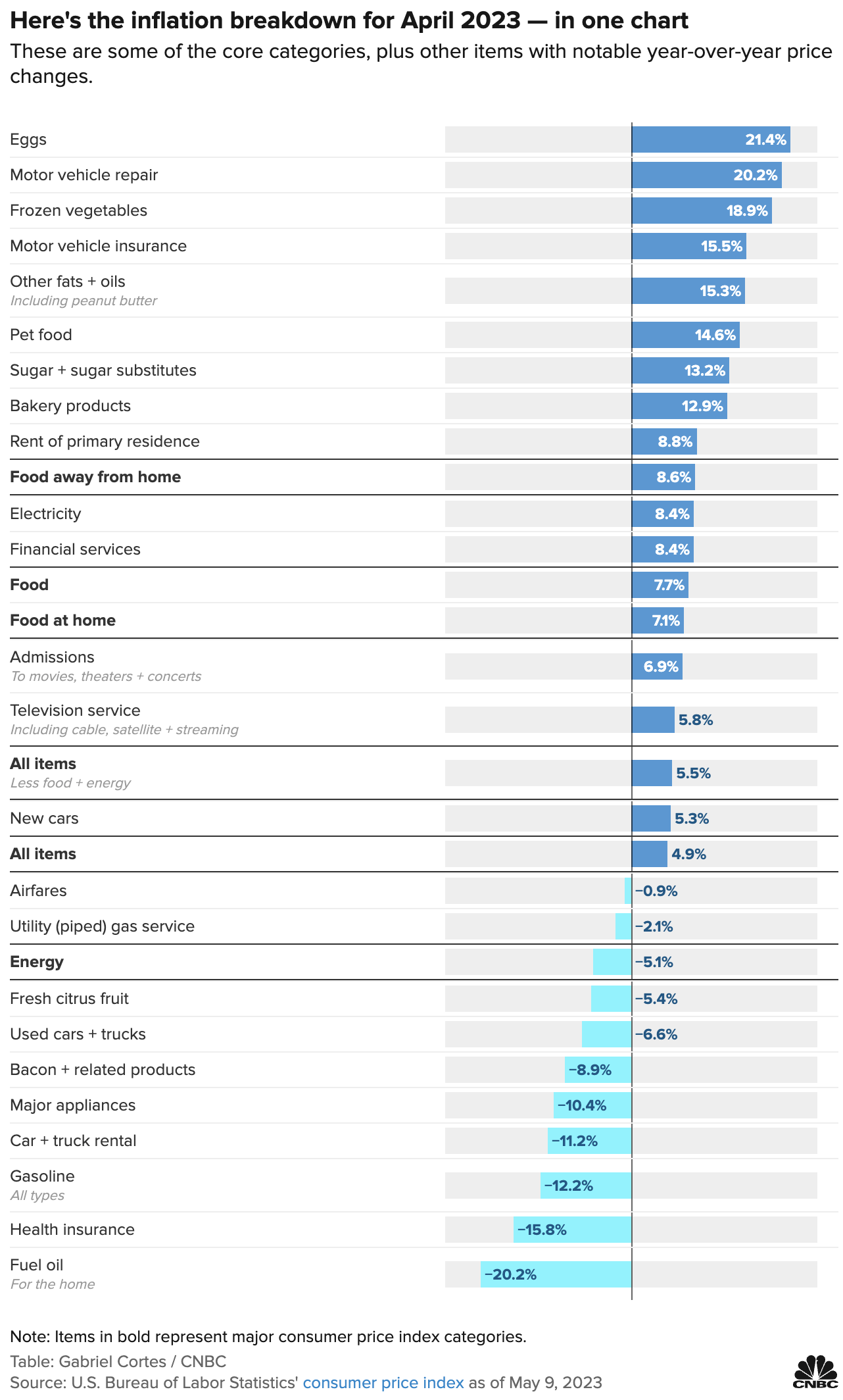

The rent component of CPI is still 8.8%, which contributes to these high inflation readings.

But CPI measures existing rents people are paying, using leases signed up to a year ago.

Meanwhile, Rent.com reports March 2023 advertised rents were down to $1937, the first yearly decline in 36 months.

Advertised rents indicate what we’d pay to rent today.

So if this trend continues a few more months, the rent component of CPI should come down.

This would in turn bring Core CPI down.

Here’s what this means for mortgage rates:

Rates are up to about 6.625% after a strong April jobs report Friday.

But they may come down a bit after today’s encouraging inflation trend.

We don’t have to get to the Fed’s 2% Core CPI target for mortgage rates to drop.

If the market sees Core CPI drop closer to 5%, mortgage rates may begin to drop too.

Mortgage bonds will rally as they perceive inflation is coming under control.

This rally will happen long before Core CPI ever gets to 2%.

And rates drop when bonds rally like this.

To track how this plays out, please subscribe to our newsletter.

And please reach out with questions.

___

Reference:

– Inflation peak recap and Fed hike recap

– Rent.com shows advertised rents are still high, but coming down

– All April inflation categories in one chart (CNBC)