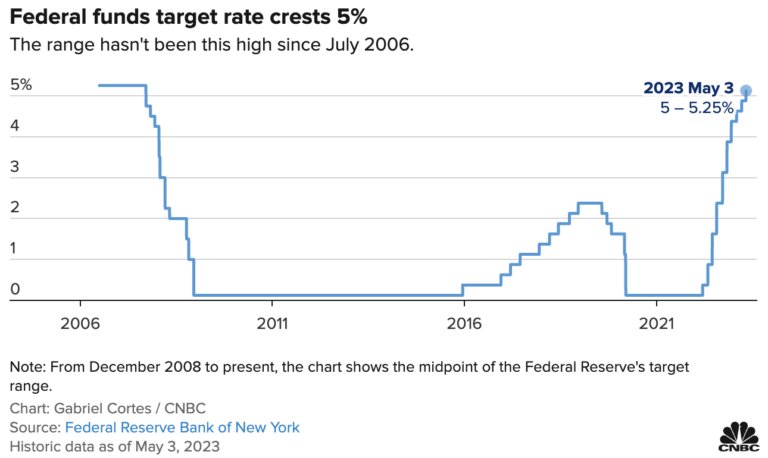

Details on 10 straight Fed hikes totaling 5% and what this did to inflation, jobs, mortgage rates

Fed has hiked overnight bank-to-bank lending rates to 5.25% using 10 straight hikes totaling 5% in 2022-23 as follows:

+0.25% May 3, 2023

+0.25% March 22, 2023

+0.25% February 1, 2023

+0.5% December 14, 2022

+0.75% November 1, 2022

+0.75% September 21, 2022

+0.75% July 27, 2022

+0.75% June 15, 2022

+0.5% May 1, 2022

+0.25% March 15, 2022

Here’s how inflation, jobs, and mortgage rates have behaved during this time.

-Headline CPI peaked 9% in June 2022, latest 4.9% as of March 2023

-Core PCE peaked 5.2% in March 2022, latest 4.6% in March 2023

-30yr mortgage rates peaked October 10, 2022 at 7.375%, are 6.5% May 3, 2023

-Unemployment 3.5% in March 2023, near 50-year low

___

Reference:

– Fed increases rates a quarter point and signals a potential end to hikes

– Inflation peak & Fed hike recap. Everyone worried about money, but worst is over.

– Are we within 3 months of CPI inflation dropping enough for Fed to chill out?