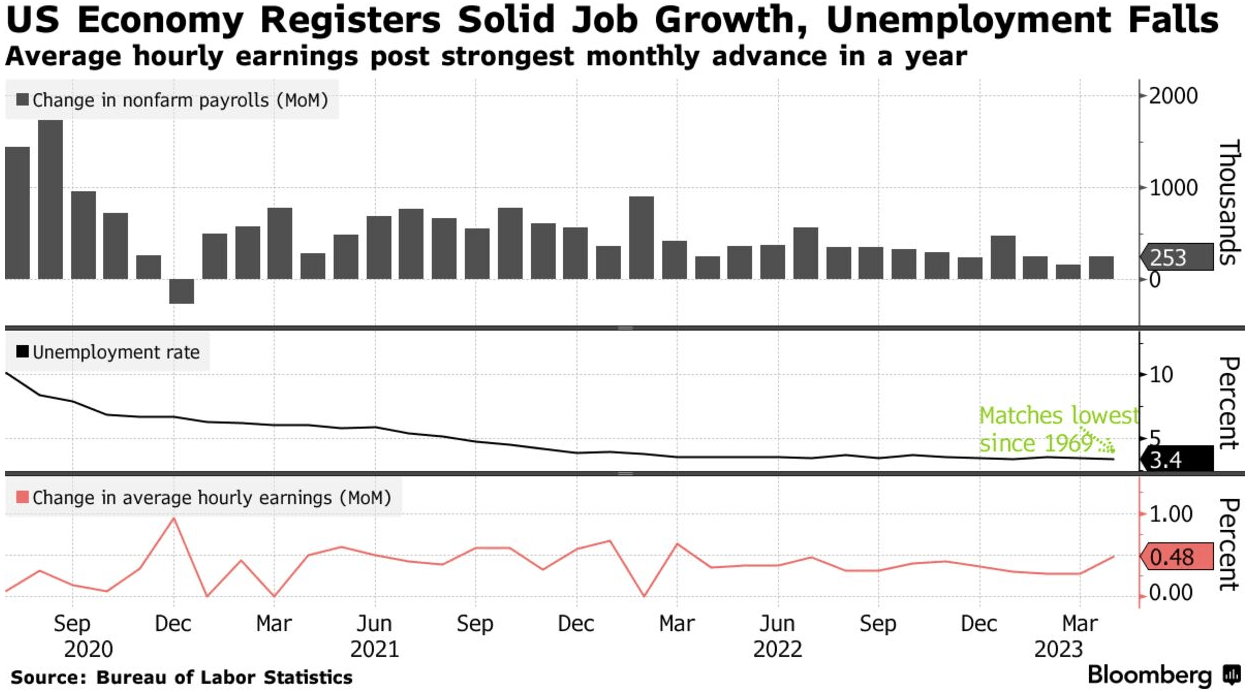

Mortgage rates up on strong +253k Apr jobs & low 3.4% unemployment

Today’s jobs report showed the U.S. economy added 253k new jobs in April, beating expectations for 180k new jobs on continued strength across leisure, healthcare, and business services sectors.

Unemployment is at a 50-year low of 3.4% and wages are up 0.5%, which is a key inflation signal for the Fed.

The initial reaction for mortgage rates was up, and they may end today around 6.5% if today’s mortgage bond selloff holds.

Mortgage rate reaction so far reflects a bet the Fed may hold overnight bank-to-bank rates higher for longer.

Here’s a quick rundown of jobs and mortgage rates.

April began with low mortgage rates of 6.125% on bets the Fed would slow hikes or pause May 3 or June 14.

Then rates rose to around 6.75% mid-April after Core CPI inflation came in stubbornly high at 5.6%

Despite the Fed on May 3 easing its urgent inflation language after it’s 10th straight rate hike, they did warn about inflationary pressures of a super hot job market.

On May 3, Fed chair Powell said:

“The labor market is very, very strong, whereas inflation is running high, well above our goal.”

This is a key factor in mortgage rates trading up today.

Here are 2 other factors:

Unemployment dropped from 3.5% to 3.4%, which is a 50-year low.

Wage growth is a key inflation-watch part of the jobs report, and April wages grew 0.5%, which was above estimates of 0.3%.

This is may be the top reason rates are worse today. Higher wages mean a hawkish Fed.

Aggressive wage growth is great for workers but bad for inflation.

Below are links to income needed to buy homes at today’s 6.5% rate range.

===

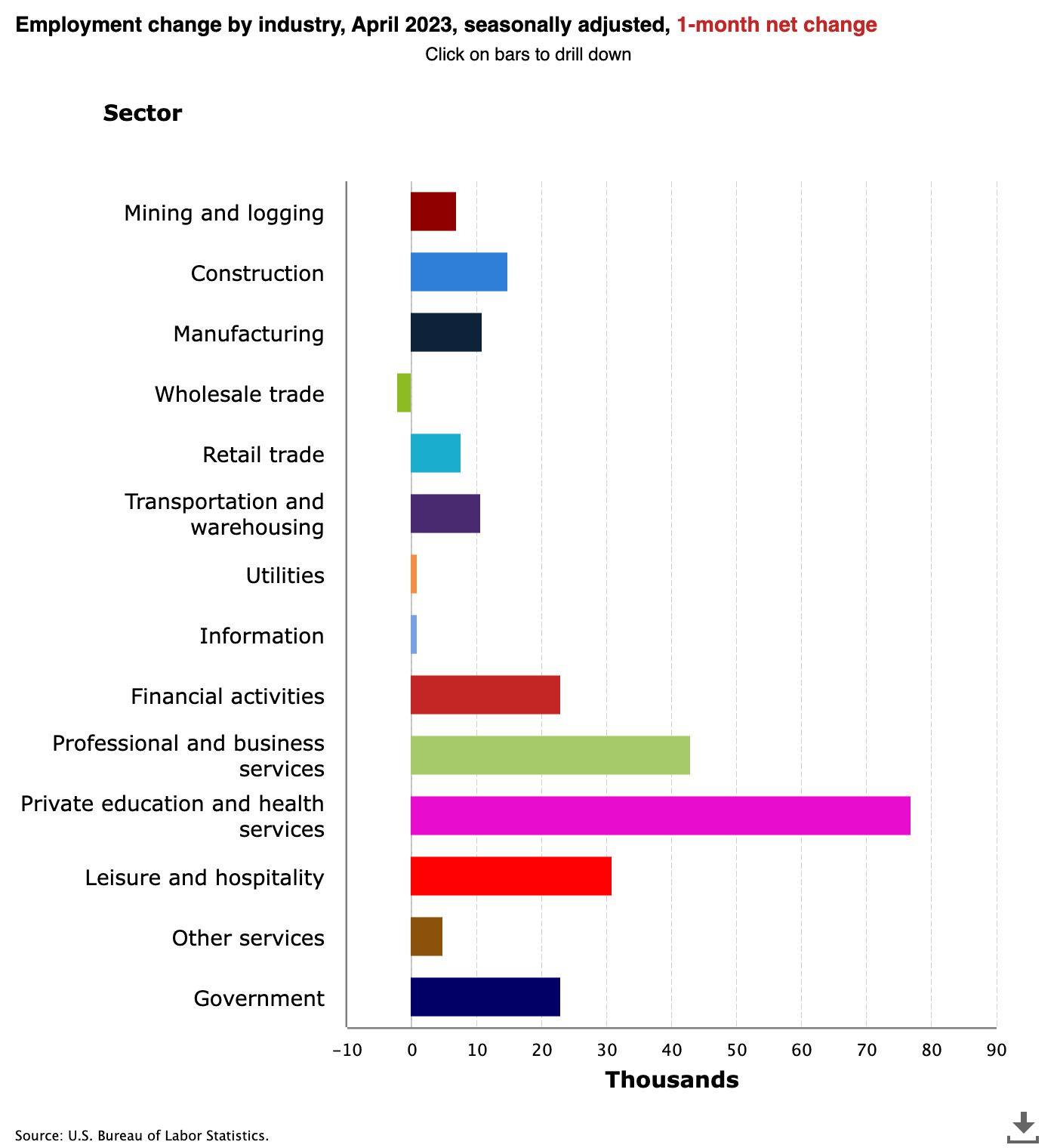

Here are the industries where April jobs grew the most. Leisure, healthcare, and business services led the gains.

===

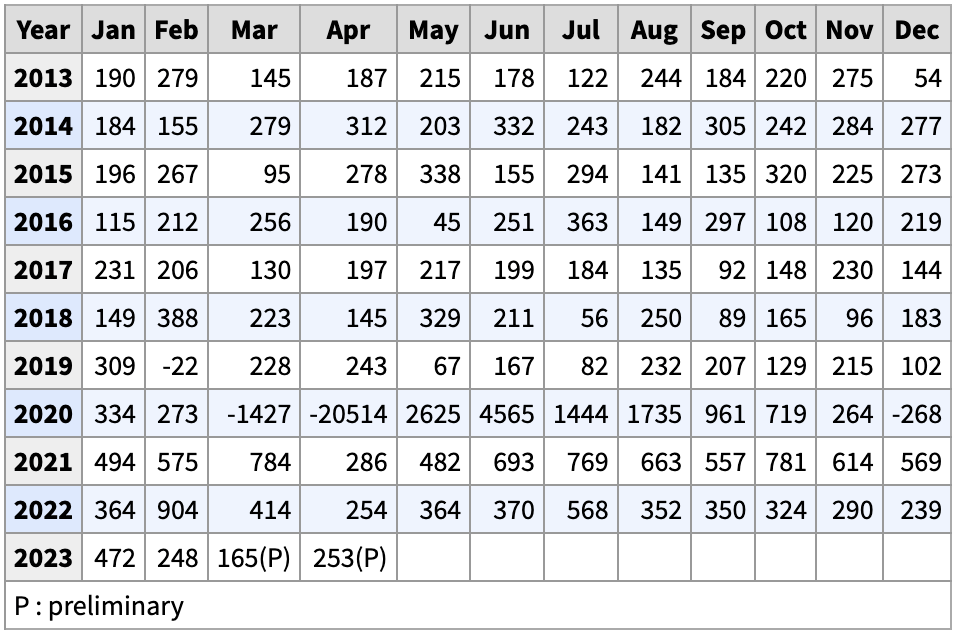

And here’s a handy Bureau of Labor Statistics table showing monthly job gains 2013 to present.

===

Please comment below or reach out with questions.

___

Reference:

– April Jobs Report Shows 253k jobs added, 3.4% Unemployment (BLS)

– Income you need to afford a new home or existing home at today’s prices

– What 10 straight Fed hikes did to rates, inflation, jobs so far

– Fresh inflation pressure as April hiring & pay rise (Bloomberg)

– The Basis Point works with our friends at MBS Live to track rate markets. Check them out for real-time mortgage market analysis.