Debt Ceiling Default Shock: Mortgage rates 8.4%, Unemployment 8.3%, Home Sales down 23% (CHARTS)

Jeff Tucker and the Zillow economics team have a chart set that models what would happen to the housing economy if the U.S. defaults on its debt. Zillow says that in a default scenario:

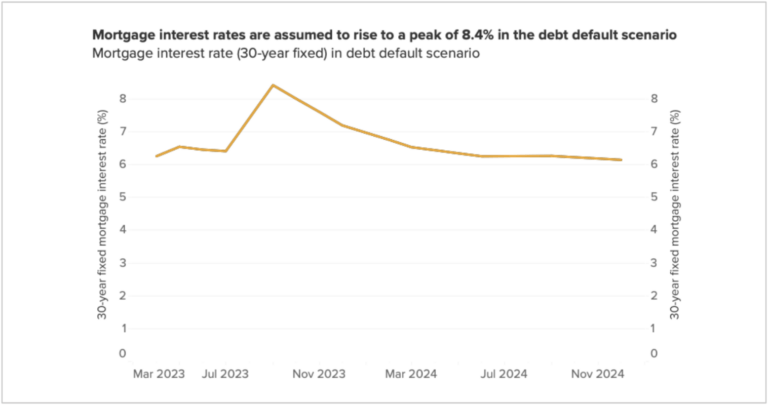

– Mortgage rates could rise to 8.4%. Rates today are about 6.5%.

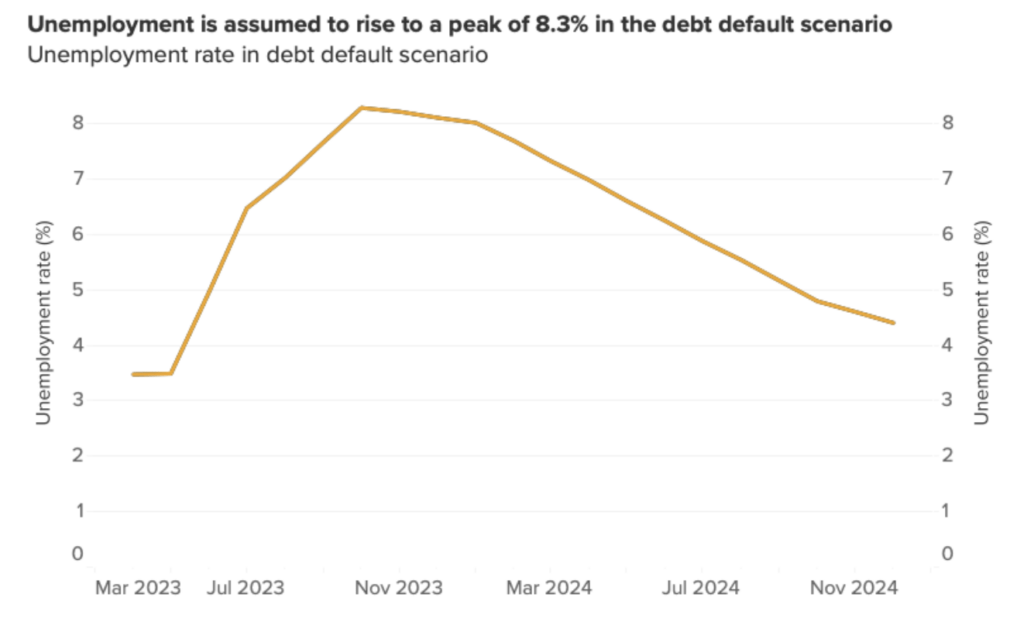

– Unemployment could rise to 8.3%. Unemployment today is 3.4%.

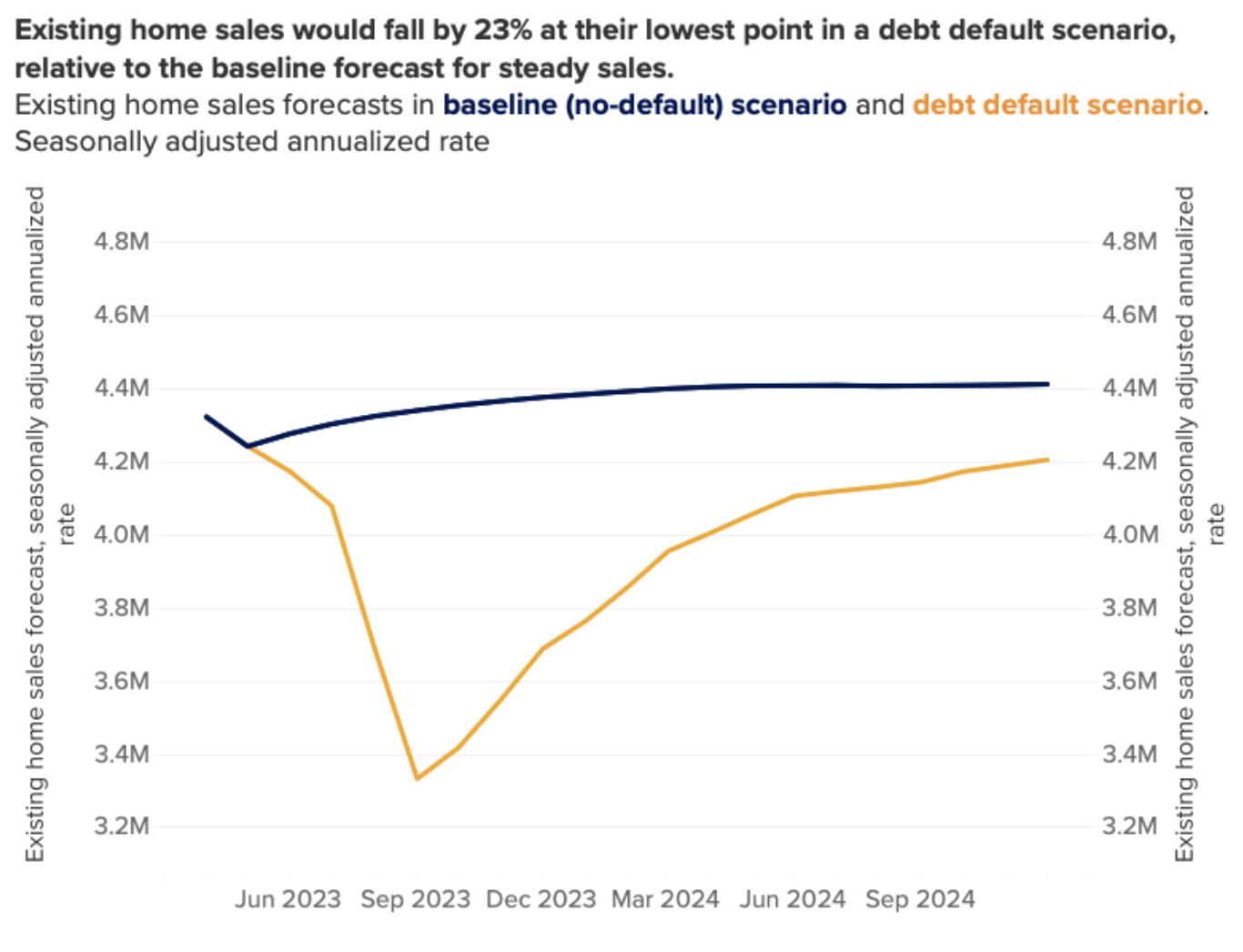

– Existing home sales could drip 24%. Existing home sales today are tracking at 4.4m sales for 2023.

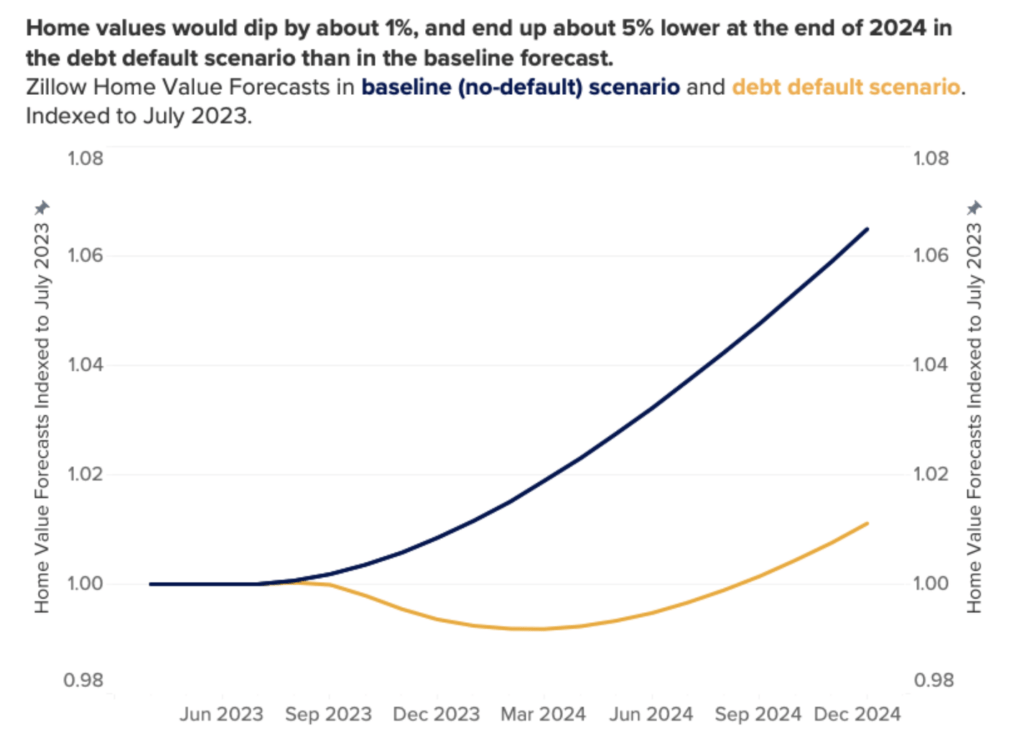

– Home values could drop 1-5%. Home values are down 2% from a year ago as markets come off pandemic highs.

Select charts are here, and full post is below.

U.S. debt default unlikely but Zillow scenarios show housing shock if it does happen. Here are charts from Zillow economics team.

___

Check It Out:

– A debt ceiling default would send the U.S. housing market back into a deep freeze