Inflation peak & Fed hike recap. Everyone worried about money, but worst is over.

When the Fed’s preferred** Core PCE inflation gauge came out last month, we did a fun reminder about the inflation peak. The loudest pop culture moment in this inflation cycle was rapper Ice-T’s March 2022 viral tweet about getting robbed at a gas station. Core PCE peaked at 5.2% then, hit that peak again September 2022, and is now down to 4.6%. A May 3 Fed rate hike is likely since 4.6% inflation is still way above their 2% target.

Below is a recap of this inflation cycle, with peaks noted.

Also below is a Fed hike recap.

MARCH INFLATION FLAT AT 3.6% ANNUALIZED

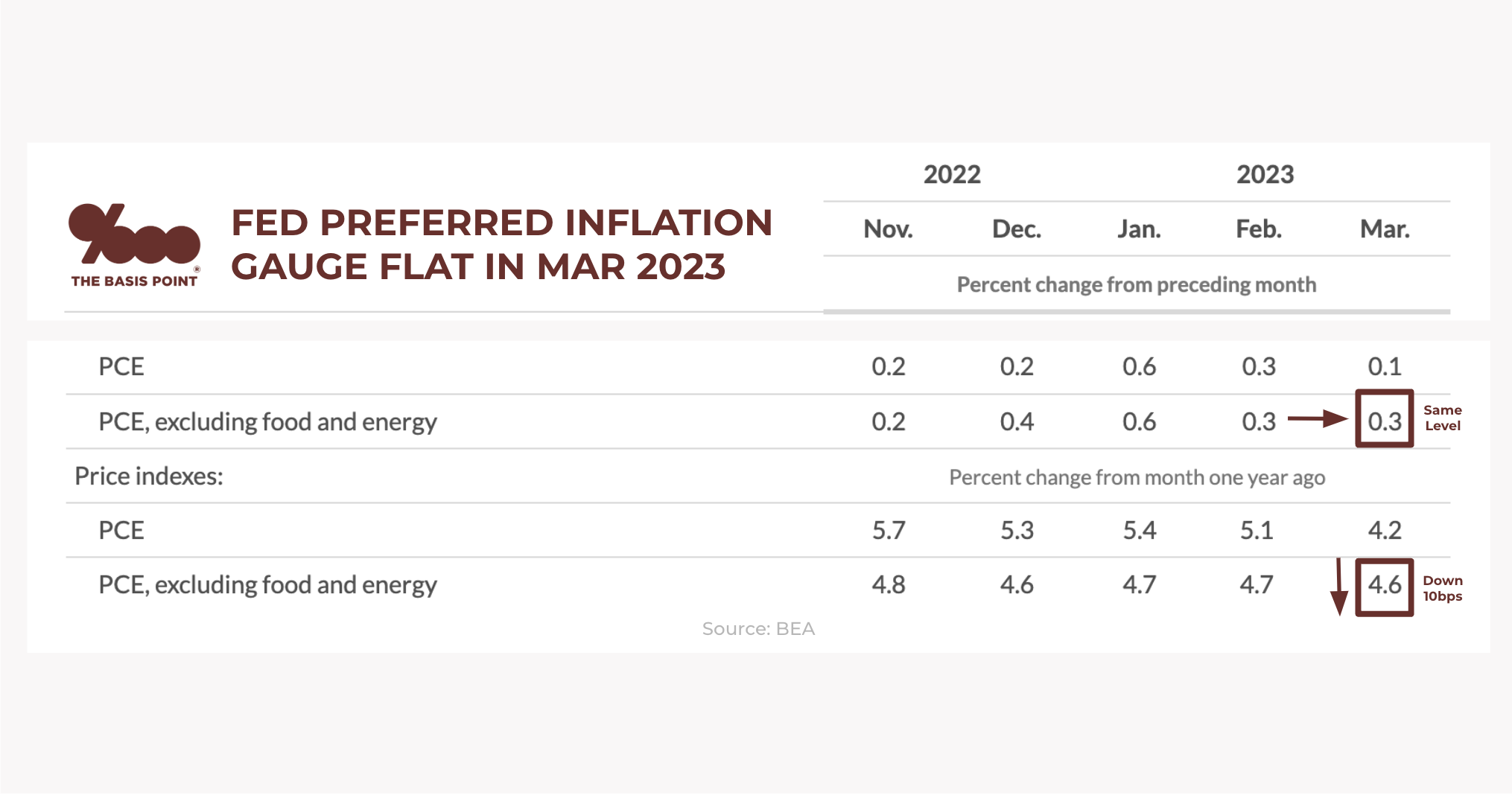

Annual March PCE inflation is 4.2% Overall and 4.6% Core, which excludes volatile food and energy costs.

Overall annual PCE is down a full 90 basis points from 5.1% in February, and Core is down just a hair from 4.7% in February.

The Fed follows Core PCE very closely to make rate policy.

On a monthly basis, Core PCE held at 0.3% from February to March, which is 3.6% annualized.

This starts to get us closer to the Fed’s 2% target.

But monthly and annual Core figures are likely still too high for a May 3 Fed pause.

I’ve highlighted the March Core PCE inflation adjustments in this table:

And below I’m listing 13-month inflation levels for both Core PCE and Core CPI, with peaks noted.

CORE PCE INFLATION (ANNUAL) LAST 13MO

Mar 2022: 5.2% (peak)

Apr 2022: 4.9%

May 2022: 4.7%

Jun 2022: 4.8%

Jul 2022: 4.6%

Aug 2022: 4.9%

Sep 2022: 5.2% (same peak)

Oct 2022: 5.1%

Nov 2022: 4.8%

Dec 2022: 4.6%

Jan 2023: 4.7%

Feb 2023: 4.7%

Mar 2023: 4.6%

CORE CPI INFLATION (ANNUAL) LAST 13MO

Mar 2022: 6.5% (almost peak)

Apr 2022: 6.1%

May 2022: 6.0%

Jun 2022: 5.9%*

Jul 2022: 5.9%

Aug 2022: 6.3%

Sep 2022: 6.6% (peak)

Oct 2022: 6.3%

Nov 2022: 5.9%

Dec 2022: 5.7%

Jan 2023: 5.5%

Feb 2023: 5.5%

Mar 2023: 5.6%

Asterisk and footnote by June 2022 denote when Overall (non-Core) CPI peaked.

FED INFLATION FIGHT & RATE POLICY SUMMER 2023

When CPI came out April 12, I asked:

Are we within 3 months of CPI inflation dropping enough for Fed to chill out?

I asked that because the Fed has 3 summer 2023 rate policy meetings:

– May 3

– June 14

– July 26

For now, the consensus is a 25 basis point Fed hike May 3, then maybe some pause language.

If so, it would be a 10th straight Fed hike.

Fed has hiked overnight bank-to-bank lending rates to 5% using 9 straight hikes totaling 4.75% in 2022-23 as follows:

+0.25% March 22, 2023

+0.25% February 1, 2023

+0.5% December 14, 2022

+0.75% November 1, 2022

+0.75% September 21, 2022

+0.75% July 27, 2022

+0.75% June 15, 2022

+0.5% May 1, 2022

+0.25% March 15, 2022

Despite everyone always worrying about money, the worst inflation is over.

Please reach out with comments and questions.

And please subscribe to our newsletter!

___

Reference:

– Table above from BEA’s March 2023 PCE inflation report

– Are we within 3mo of inflation dropping enough for Fed to chill out? (TBP)

* NOTE: June 2022 is when headline CPI inflation peaked at 8.9%

** The Fed prefers PCE to CPI because CPI covers a broad scope of stuff we buy in general, whereas PCE better measures what we actually buy, so it shows more current views of how we change what we buy to account for rising prices. And the Fed prefers Core PCE (and Core CPI) because Core excludes volatile food and energy prices.To be clear, the Fed looks closely at Core and non-Core PCE and CPI to make decisions.

– Here’s Dennis’ artwork from our Ice-T inflation post last month