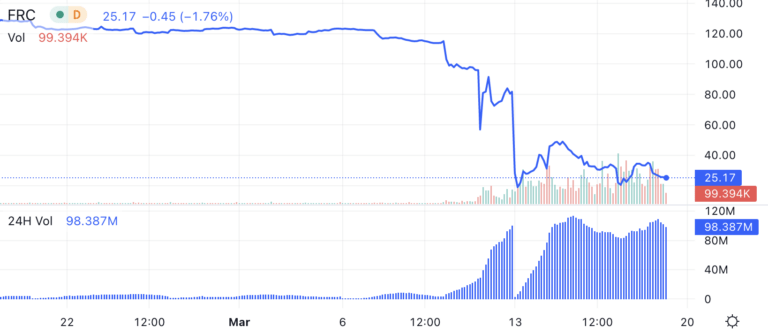

First Republic drops despite rescue by 11 big banks. Dividend cut or sale rumors?

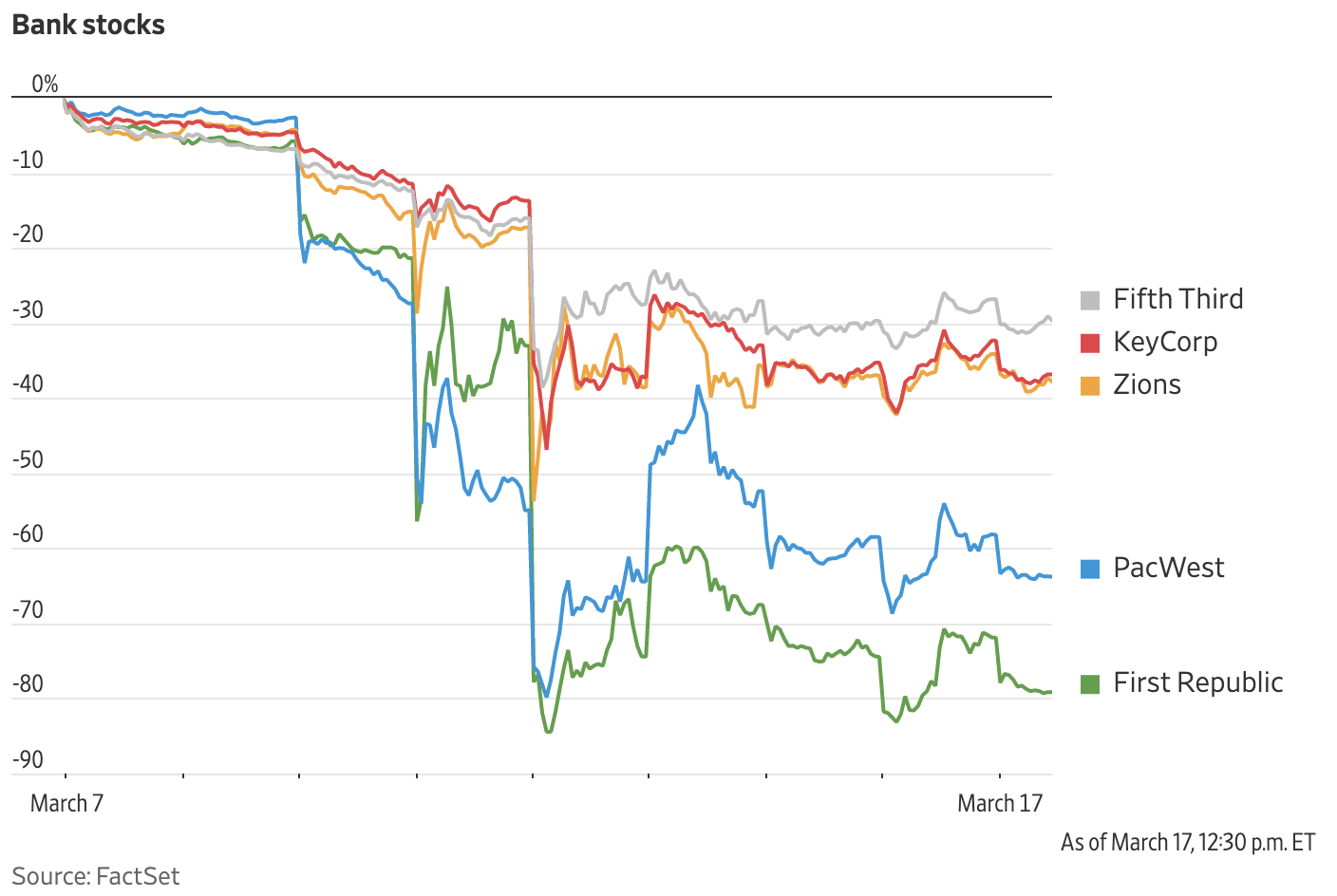

Despite getting a $30 billion deposit lifeline from 11 big banks yesterday, First Republic stock dropped again today (chart above), dragging regional bank stocks down with it (chart below). Is it because of First Republic sale rumors? A dividend cut?

KBW bank analyst Christopher McGratty said in a research note that the rescue was a ‘temporary lifeline’ and that:

The significance of these shifts in the balance sheet — along with an announced dividend suspension — paint a grim outlook for both the company and shareholders.

As of midday Friday, March 17, there’s no reporting of a renewed bank run.

So this might be investors selling first on the dividend cut and sale rumors, and asking questions later.

McGratty is right that the $30 billion in big bank deposits are a temporary lifeline — the minimum period those assets have to stay (per Treasury, Fed, FDIC, OCC, who banks worked with on the deal) is 120 days.

As for First Republic cost of these funds, they’re paying what appears to be non-punitive “market rate” terms (per First Republic announcement yesterday, in first link below) for the $30 billion in deposits received from 11 big banks.

Atlantic Equities downgraded First Republic, said they may need $5 billion more in capital, and analyst John Heagerty said:

Management is exploring different strategic options which may include a full sale or divestments of parts of the loan portfolio. The limited information provided implies that the balance sheet has increased substantially, which may well necessitate a capital raise.

Below are links to First Republic rescue details plus First Republic sale details, which now appears to be back on the table.

The First Republic rescue doesn’t look great for them today in the market.

But it was still the right thing to do by regulators and big banks to stem contagion.

The first link below explains why. Even though hedge fund titan Bill Ackman disagrees.

___

Reference:

– Why First Republic rescue by 11 banks right for consumers & system

– Hedge fund titan Bill Ackman disagrees. Sort of.

– If First Republic goes up for sale, it won’t be first time

– Today’s briefings from CNBC (free) and WSJ (paywall)