How much of SVB deposits did startup banks vs. big banks get?

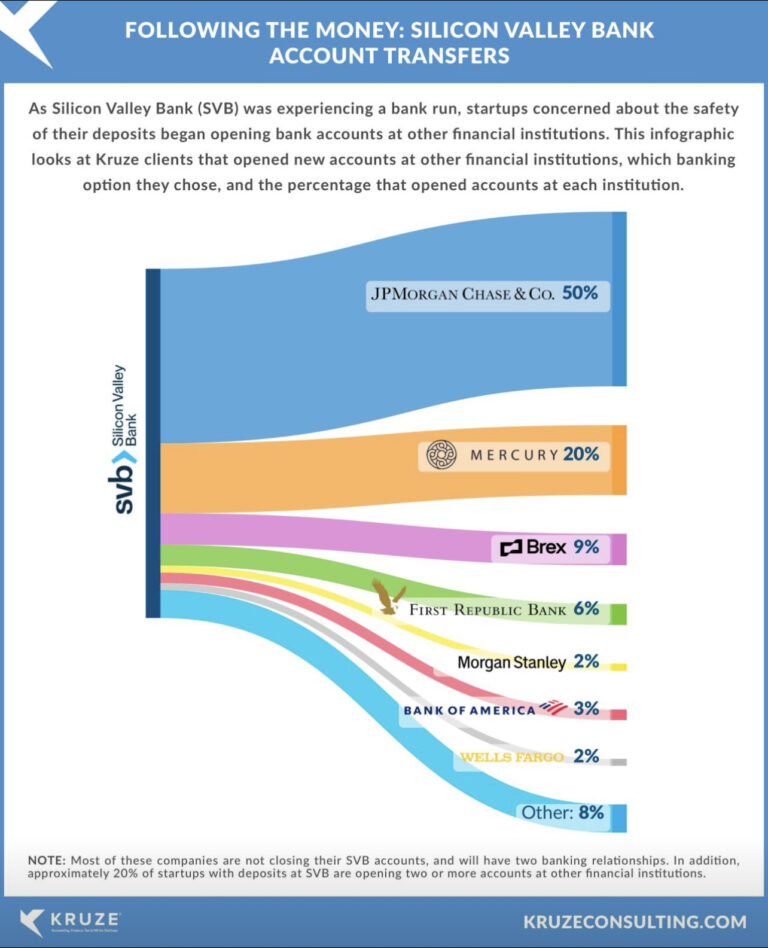

A company called Kruze Consulting that provides outsourced financial management for startups — accounting, tax, fundraising help, etc. — tallied how many of their clients moved money from Silicon Valley Bank (SVB) to other banks. This is a decent proxy for what happened to $42 billion in deposits that left in a bank run that leveled SVB. Big banks won but startup banks did pretty well too. Here are a few takeaways.

– Big banks got new accounts from 61% of the Kruze startups who left SVB, with JP Morgan Chase getting most of that (50%).

– Startup banks got 29%.

– This 29% went to 2 key banking startups: Mercury (20%) and Brex (9%).

– Big banks win for people’s perceptions of stability and FDIC insurability.

– Startup banks aren’t actually banks, which seems bad in the headlines but has benefits in reality.

– Startup banks are backed by FDIC insured banks.

– Because of this, startup banks can offer more FDIC insurance when they’re backed by multiple FDIC-insured banks.

– For example, Brex offers up to $6 in FDIC insurance.

– And Mercury offers up to $5 in FDIC insurance.

– Also these 2 firms have a far superior software user experience than big banks.

– And it’s WAY easier to set up accounts with these firms.

– You do it all on your phone and never have to visit a branch.

– DOWNSIDE: this digital ease is partly why the SVB bank run happened so fast.

– So while startup banks make it super easy to get funds in, this ease is a deposit flight risk if they came under strain.

– Kruze also notes about 20% of startups with funds at SVB kept those funds there.

– Now that First Citizens is assuming SVB deposits, it’s worth watching if startups stay with First Citizens.

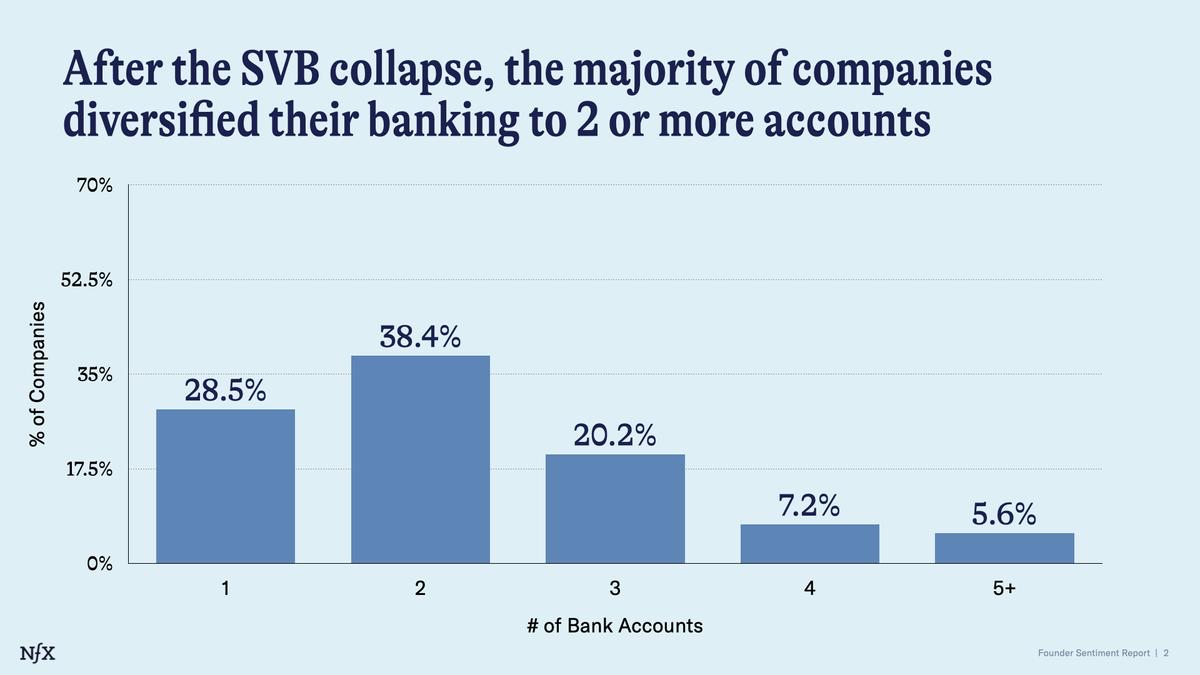

– And diversification of deposits by startups is much higher now.

– VC firm NFX reported 42% of startups had 2+ bank accounts before SVB failed. Now 71% do.

___

Reference:

– Will SVB depositors stay with First Citizens now that it owns SVB?

– Info on Brex $6m FDIC insurance and Mercury $5m FDIC insurance

– How Brex AI for CFOs & finance teams helps expense reports & budgeting

– 42% of startups had 2+ bank accounts before SVB failed. Now 71% do.

– Kruze Consulting – outsourced financial management for startups