I heard you finance houses. How about this one from The Irishman?

As I shift from holiday TV binge to full workload cringe, I can’t shake a phrase that got stuck in my head last weekend. “I heard you finance houses” is my variation on Jimmy Hoffa’s phrase that inspired Martin Scorsese’s The Irishman.

Why is it stuck in my head?

I Heard You Finance Houses

The actual phrase union boss Hoffa said to mob multitasker Frank Sheeran is: I heard you paint houses.

This was code for: I heard you kill people.

Hoffa hired Sheeran to kill people, among other things, until Sheeran perhaps killed Hoffa.

The Irishman is based on the 2004 Charles Brandt book I Heard You Paint Houses.

The book is Sheeran’s confession/claim to killing Hoffa at top mob boss Russell Bufalino’s request.

The movie is a great story about what led to Bufalino’s request.

Its 3.5 hour runtime is perfect for lazy holiday viewing.

Here’s a picture of the house where Sheeran (maybe) offed Hoffa.

Zillow lacks data for an estimated value on the home, but Redfin says it’s worth $53,290.

I think it’s likely to gain Hollywood hype value from here forward.

Whether or not the Hoffa hit actually happened there is less relevant. It’s just a good story that appeals to certain people.

And the price certainly has some upside potential.

I Heard 6 Million People Need Houses Financed

Only a few will say ‘I heard you finance houses’ to a lender about the Hoffa house.

But 6.26 million may say it about some other house in 2020.

5,552,000 existing homes and 712,000 new homes will be sold in America in 2020.

The median prices of those existing and new homes will be $281,400 and $325,800, respectively.

And $1.29 trillion in mortgages will be made to home buyers in 2020.

30-year mortgage rates will be in the high-3-percent range to start 2020.

This means you’ll pay about $1,700 per month on a $300,000 home purchase with 10% down.

That $1,700 will cover mortgage payment, property tax, insurance, and mortgage insurance.

If this price buys you a home the same or better than you can get for a $1,700 rental, you should buy.

Even if you have $700 in non-housing bills like credit cards, student loans, and a car loan on top of this $1,700, you need to make $67,000 per year to qualify to buy the home.

More on this next time, but the short story for now is homes are more affordable than most think.

I Heard Financial Elitists Say Economic Inequality Is Overstated

A lot of the home affordability questions are rooted in inequality theory.

The boomers and Gen X-ers took all the good housing opportunity.

There’s nothing left for Millennials and Gen Z.

These are the claims, but new research suggests otherwise. Income share of America’s top 1% may have been little changed since 1960.

That’s the stuff of Stat Fight, and we can have a more sprawling brawl later.

For now, let’s focus on the property part.

Yes, property owners have done better than non-property owners.

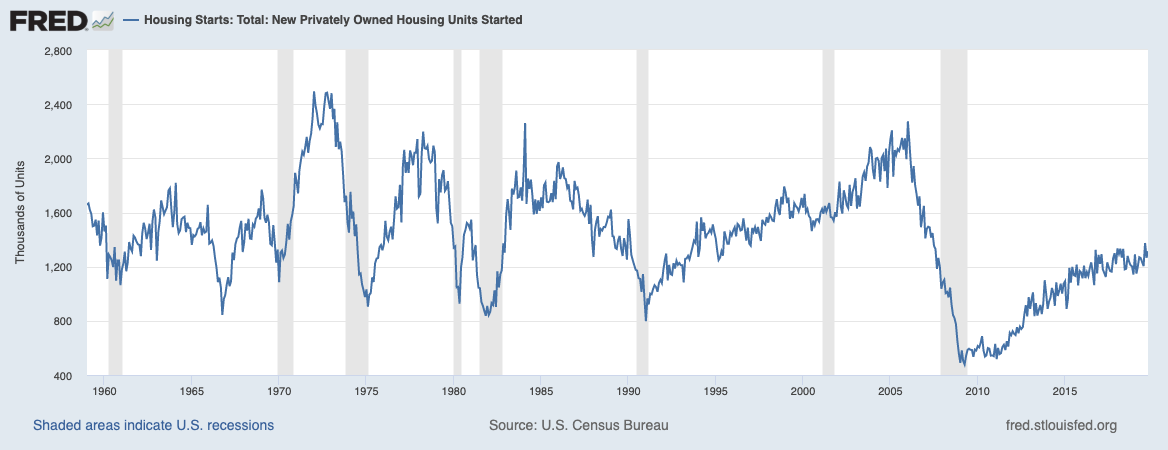

But look at this chart showing how many new homes construction has begun on each month.

The average since 1959 is 1.4 million per year and 2020 is set to cross 1.3 million.

That’s good news, but consider new construction languished in the 400,000 to 500,000 range in early post-crisis years.

There’s still a big backlog causing inventory shortages.

Stiffer local building regulations have been a key culprit.

Another culprit is labor cost for good builders (which creates a conundrum for those claiming there’s no good paying jobs outside of elite office jobs).

But now finally we’re seeing construction catch up to historical norms.

Hopefully this will slowly moderate property prices.

I Heard My Favorite Political Candidate Will Save Us

We can debate this stuff till we’re blue.

And we can bet on presidential candidates who don’t have local power to change this.

Meanwhile property prices will slowly rise.

So the most productive action is to do the math on home buying vs. renting.

Barring some perennially overpriced markets, you’d be surprised how affordable most cities are when you understand the math.

Cheers to all of you who will be saying ‘I heard you finance houses’ to some lender in 2020.

I’ll be rooting for you.

And we’ll keep doing our best to help you focus on what matters.

Now why don’t you read about this unconventional method of financing your home: rent to own.