LIVE BLOG: Day 1 of Fintech Nexus USA 2023 NYC – In a Fintech State of Mind

Last week, I attended America’s largest fintech conference, Fintech Nexus USA 2023, at the Javits Center in New York, and this massive post below is a live blog of Day 1.

(Here’s Fintech Nexus USA 2023 Day 2 Live Blog)

The Basis Point live blog format is supposed to be fast to capture quotes and takeaways, and just have fun shouting out all the participants and attendees. Our daily work on other posts is where the deeper analysis comes.

So what you see below are quick hits on as many of the sessions as I could attend in the two days at Fintech Nexus USA 2023.

We’d like to thank the Fintech Nexus leaders and friends Peter Renton, Bo Brustkern, Todd Anderson, and the whole team for having The Basis Point.

And to the whole fintech community, it’s been a bumpy road since the cycle turned sharply last year, but the energy at Javits with this crowd was palpable, and fintech is as vital as ever.

Market corrections are necessary to fine tune and get sharper, and that was evident throughout the entire Fintech Nexus USA 2023 event.

The Quiet Before The Fintech Nexus USA 2023 Blogging Storm

In place for main session marathon…

Goldman Sachs On AI In Fintech & Banking

Marco Argenti of Goldman Sachs did a great discussion on the hottest topic in the world right now: AI.

Here are a few tidbits from Marco…

Financial services is not constrained by physics.

I wasn’t anticipating what was coming, this AI revolution, but I felt that something was there.

Right now you can’t escape the topic of AI.

He wrote an article recently about generative AI and compared it to the invention of the printing press.

There are two ways to think about AI, but they’re not mutually exclusive:

1. Think of AI as a Sustaining technology – which essentially makes your business more productive.

2. Think of AI as a Disruptive (especially in the area of knowledge) technology which will make your business more competitive.

And here’s Marco on ChatGPT, which is my favorite quote:

ChatGPT is like a book that explains itself.

For the first time, the reader and the writer are at the same level.

Imagine the impact that it can have on society and corporations.

QED Nigel Morris on Future of Fintech

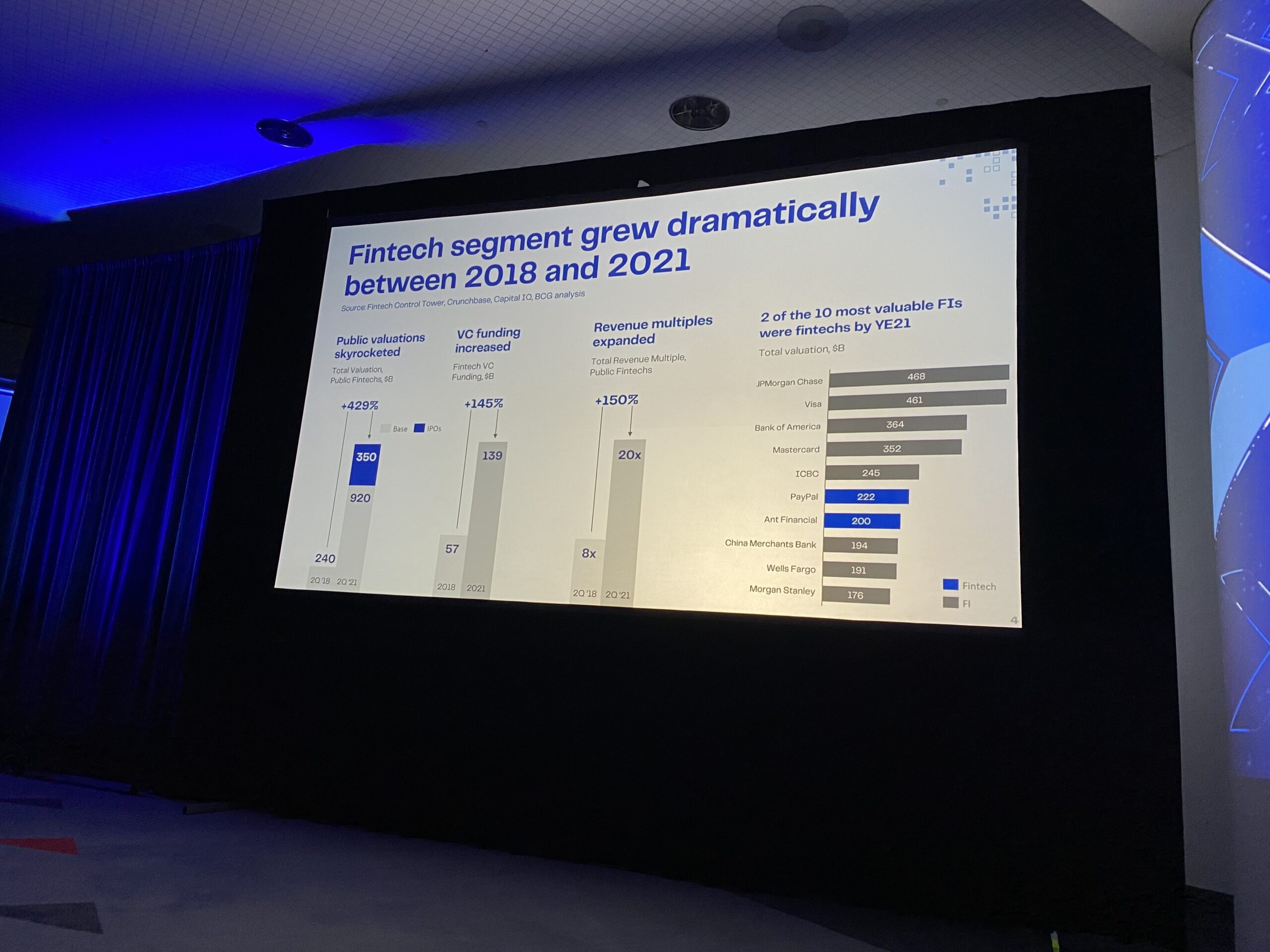

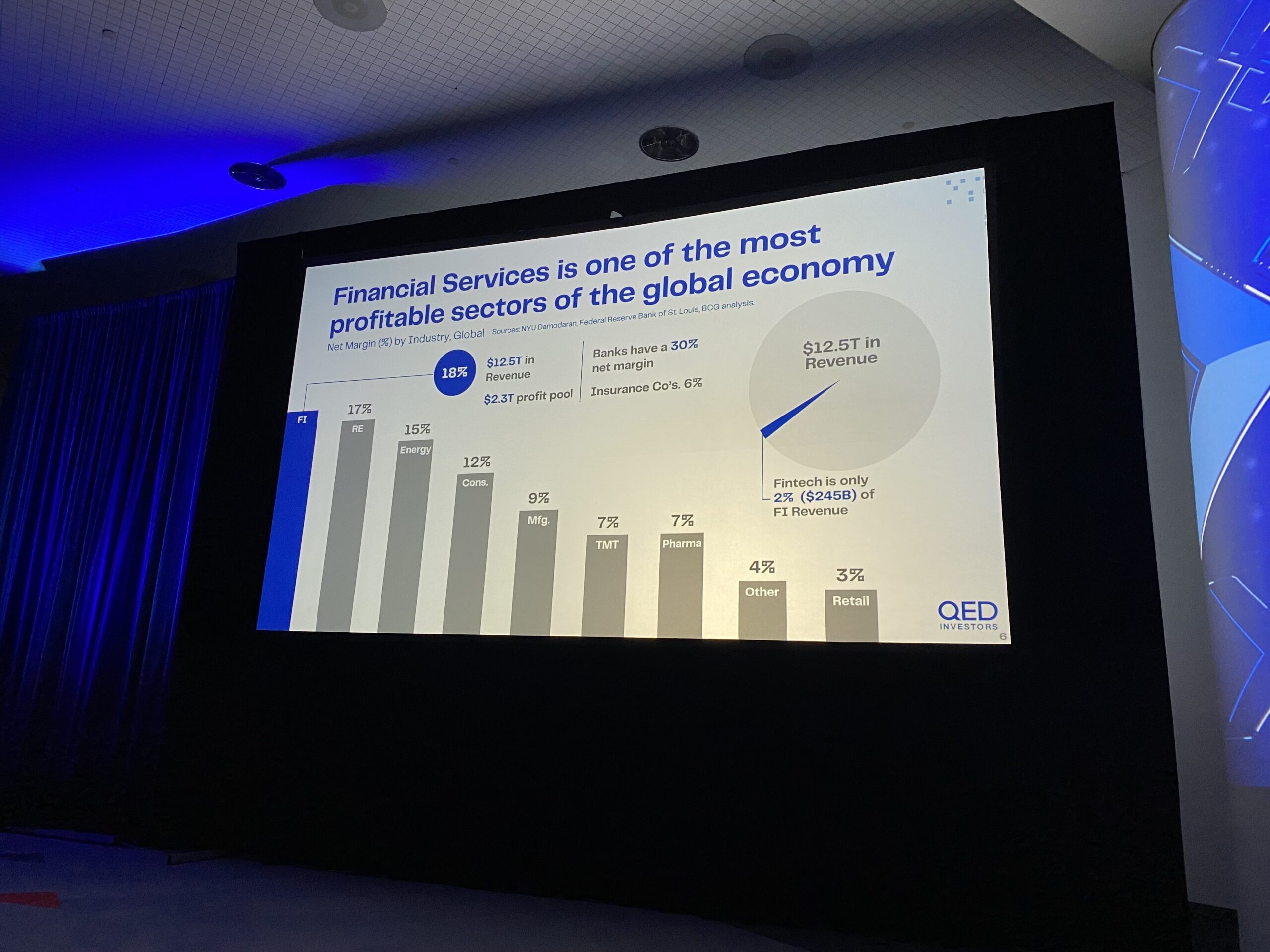

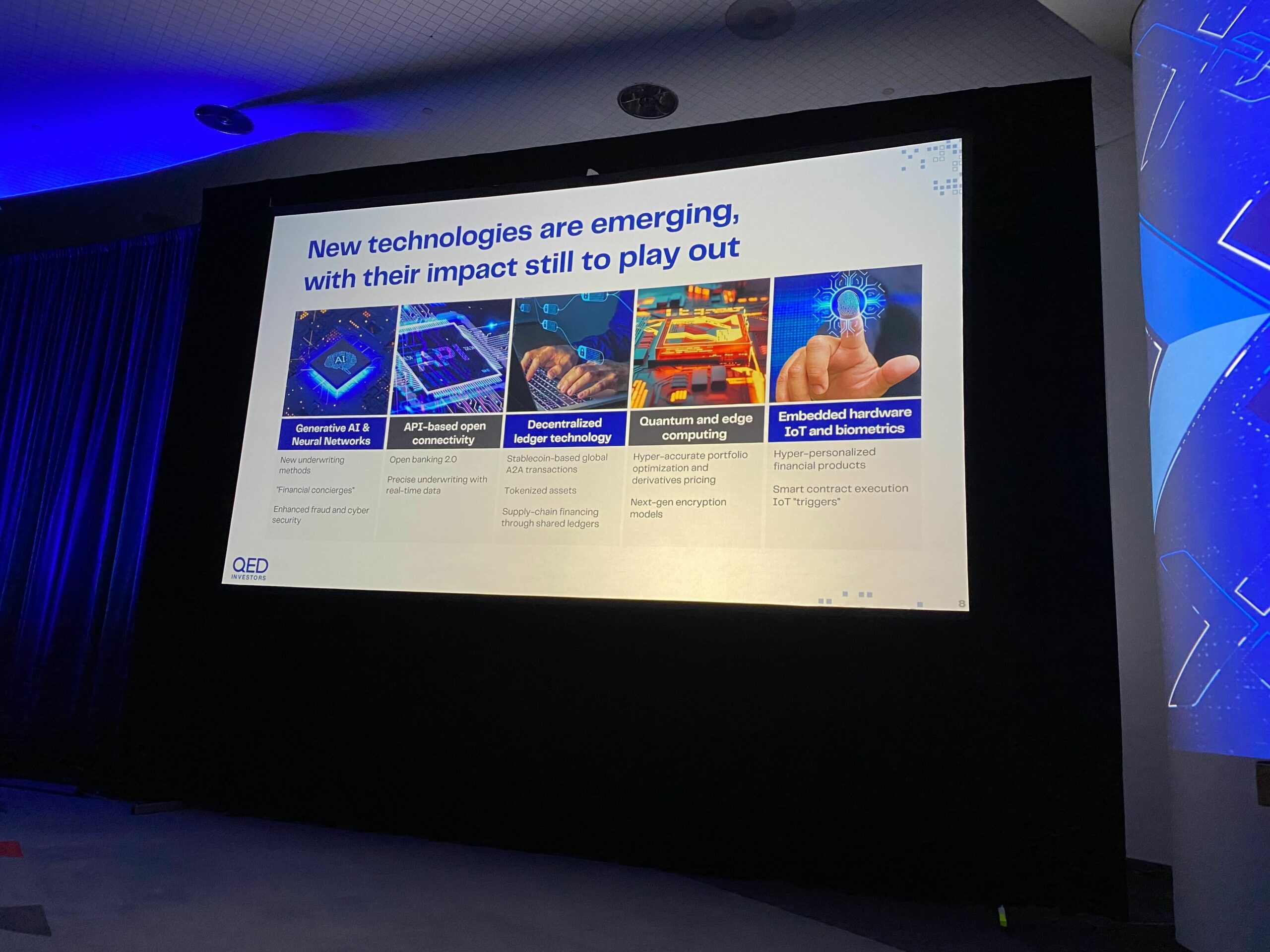

QED Managing Partner did a deep dive on the future of fintech using a study QED did with BCG on the future of fintech – based on over 100 interviews with incumbents, fintechs, venture firms, and others who are active in the community.

The goal of the study was to answer the question of where we are in this fintech journey – at the beginning or towards the end?

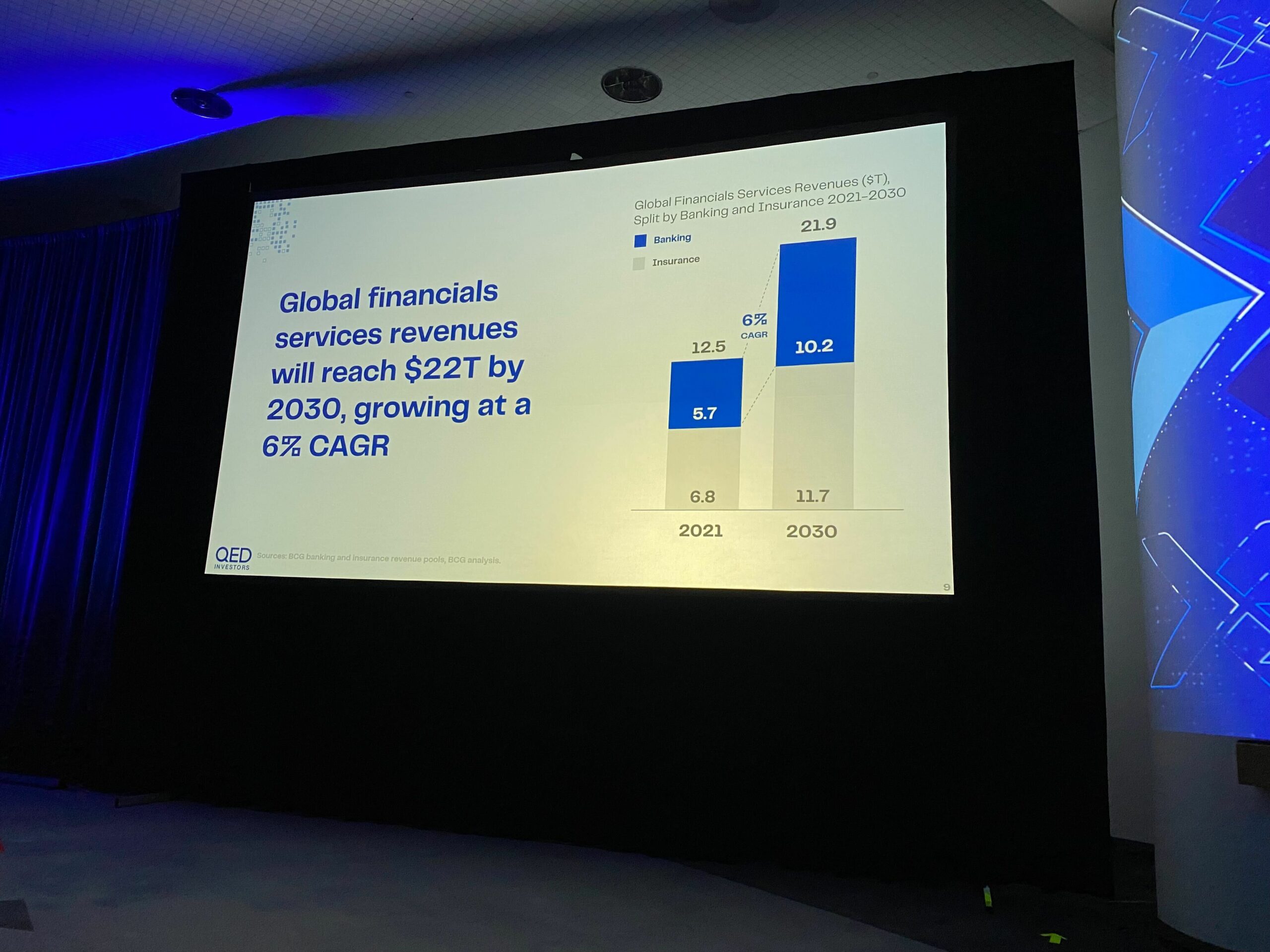

His first few slides showed where fintech stands in the economy today.

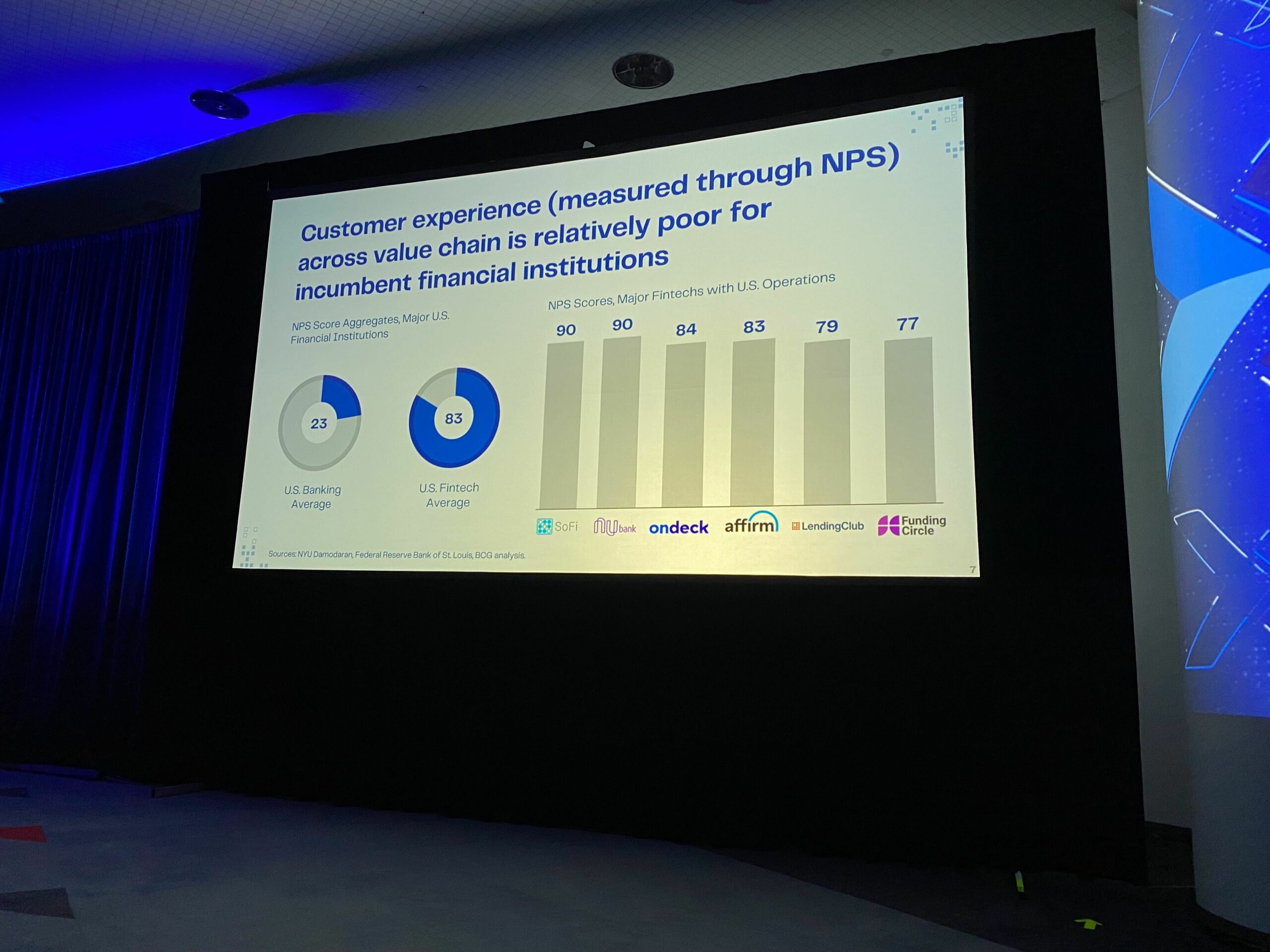

He continued on to share net promoter scores of some of the companies we all know.

Then he said:

What that tells you is that fintechs start with “What’s the problem that the customer has”?” and work backwards from that.

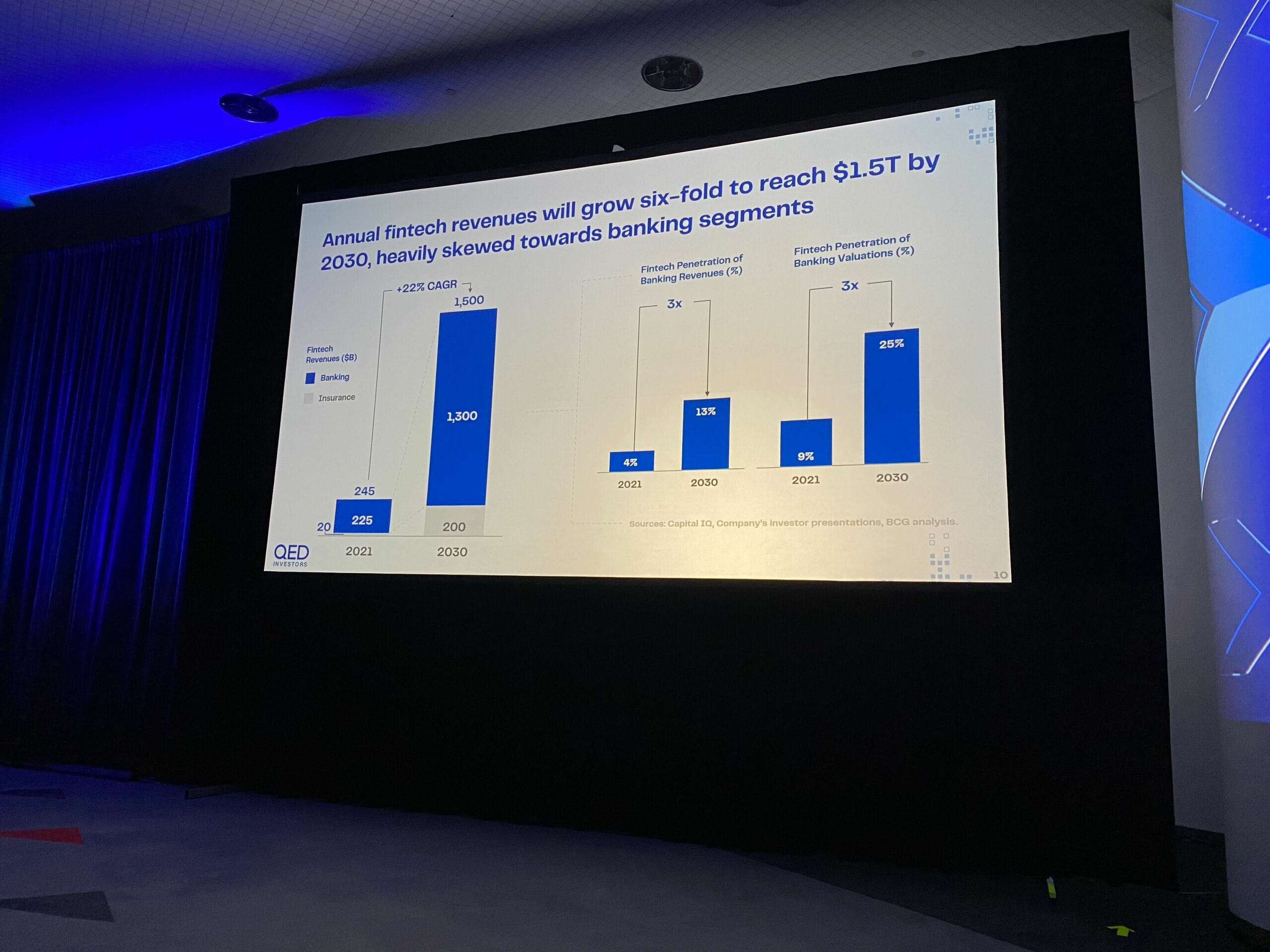

Here are a couple more great slides & stats that Nigel took us through.

This last slide indicates to me that we are very much at the beginning (and not the end) of this fintech journey.

When beginning to wrap, Nigel brought up the following and said…

We are firm believers that if you’re in the investing game, you have to have a global outlook.

He continued on…

The incumbents must embrace the fintechs. Banks cover what the fintechs have and fintechs cover what the banks have. Today they’re talking past each other. … My advice to the C-Suite of the banks is you cannot put your head in the sand. You’ve got to be asking ‘How can you partner? How can you learn WITH?’

Here is a link to the full QED/BCG study, and a great full session recap from Fintech Nexus.

Upgrade, Inc. CEO Renaud Laplanche on “Why fintechs shouldn’t become banks”

In this session, CNBC’s Hugh Son is interviewing Upgrade’s CEO, Renaud Laplanche who starts off by introducing Upgrade’s approach to credit cards.

The worst feature of credit cards is the monthly min payment. It is designed to keep consumers in debt.

We made a more responsible credit card that is meant to help consumers get out of debt. The idea of a responsible, more affordable credit card really took off.

Regarding the session topic, Renaud says…

The question “Should fintech companies become banks?” has been around a while.

What happened with Silicon Valley Bank and First Republic is really a reminder that there are risks.

We’ve created a network with about 200 small community banks and credit unions. … well diversified…. each of them is pretty small.

Instead of trying to match assets and liabilities within our own balance sheet, we have this network where we get that same benefit of raising deposits and funding loans but instead of us managing the balance sheet and BEING the bank, we are able to freely outsource that function to make it work a lot better/more efficiently.

Fintech Nexus covered the session in detail here.

6th Annual Fintech Nexus Industry Awards

For the first time, Fintech Nexus presented their annual Industry Awards on the main session stage and I had a front row seat. Was fun to see all the nominees and the winners accepting their awards. Congrats to all! Following are the winners for each category and some shots from the stage.

‘Fintech Innovator of the Year’ is SQUARE

-

AWARD NOMINEES

– Upgrade

– Intuit

– Square (WINNER)

– Plaid

– MoneyLion

‘DEI Trailblazer’ is Esusu

-

AWARD NOMINEES

– Esusu (WINNER)

– Fintech is Femme

– BHG Financial

– Oportun

‘Exec of the Year’ is Luvleen Sidhu of Bmtx

-

AWARD NOMINEES

– Chime, Chris Britt

– Bmtx, Luvleen Sidhu (WINNER)

– Plaid, Zach Perret

– Intuit, Rania Succar

– Financial Health Network, Jennifer Tescher

‘Emerging Fintech Innovator’ is argyle

(most promising young fintech in any vertical)

-

AWARD NOMINEES

– Percent

– argyle (WINNER)

– SecureSave

‘Innovation in Lending’ winner is BHG Financial

-

AWARD NOMINEES

‘Innovation in Payments’ is The Clearing House

-

AWARD NOMINEES

‘Best of Blockchain in Financial Services’ is Chainalysis

-

AWARD NOMINEES

‘Top Service Provider’ is brighterion (a Mastercard co.)

-

AWARD NOMINEES

‘Excellence in Financial Inclusion’ is Tricolor

-

AWARD NOMINEES

– Fairplay

– Tricolor (WINNER)

– BMO

‘Innovation in Digital Banking’ is Current

-

AWARD NOMINEES

Galileo and Provident on Conversational AI improving customer experiences (and settling disputes with spouses)

Scott Hurlbert, SVP, Digital Channels for Provident Bank and David Feuer, Chief Product Officer for Galileo Financial Technologies engage in a conversation, moderated by Glenn Grossman, Director of Research for Cornerstone Advisors, about the effect conversational AI has on the customer experience.

Scott starts off with a few comments…

The “promise” is to meet customers where they are and be able to solve those problems in a way that the phone call or app isn’t doing.

The next step is we all have to identify ways to make use of this in ways that make us look good and provide help for the customer.

There are risks and concerns with deployment of a digital system. The product itself has to align to strategy of organization. Banks are not here to create AI to be cool. We could be growing a new market, or acquiring customers via acquisition and need to onboard. Business drivers – need to attach these solutions as the main drivers.

David follows up by emphasizing empathy in the process…

C-Suite is thinking cost containment. Part of today’s challenge is How do I think about the next gen of consumers who really don’t want to talk to a human? Followed by a seamless handover where the human picks up where the digital assistant left off and customer is not burdened with re-explaining where they left off.

Brand is much more than your logo. It’s how you position your company and how people feel about your company. Is my AI assistant conveying that?

Scott stresses that you need to NOT go to C-Suite with the argument “hey everyone else is doing it and we should too.” You need to build a coalition internally to say, I think we can really succeed with this, and then show how.

David explains that consumer expectations are such that they want their bank to be there when they want it to be there, and disappears when they don’t.

Then he discusses sentiment and the need to understand the context of the customer — not just what experience they’re having, but the behaviors, age, and culture of the customer.

Banks are looking for opportunities to inject that information/context into the relationship which then creates more trust.

Scott puts it into a real-world example about being in a dispute with a spouse about eating out too frequently:

You can just ask a chatbot how many times you have eaten out so far this year to settle a dispute with your significant other. Where you would be less likely to go and look it up in your bank statements.

It needs to recognize the signs, however, when someone is getting frustrated with the experience and needs to be transitioned to a human.

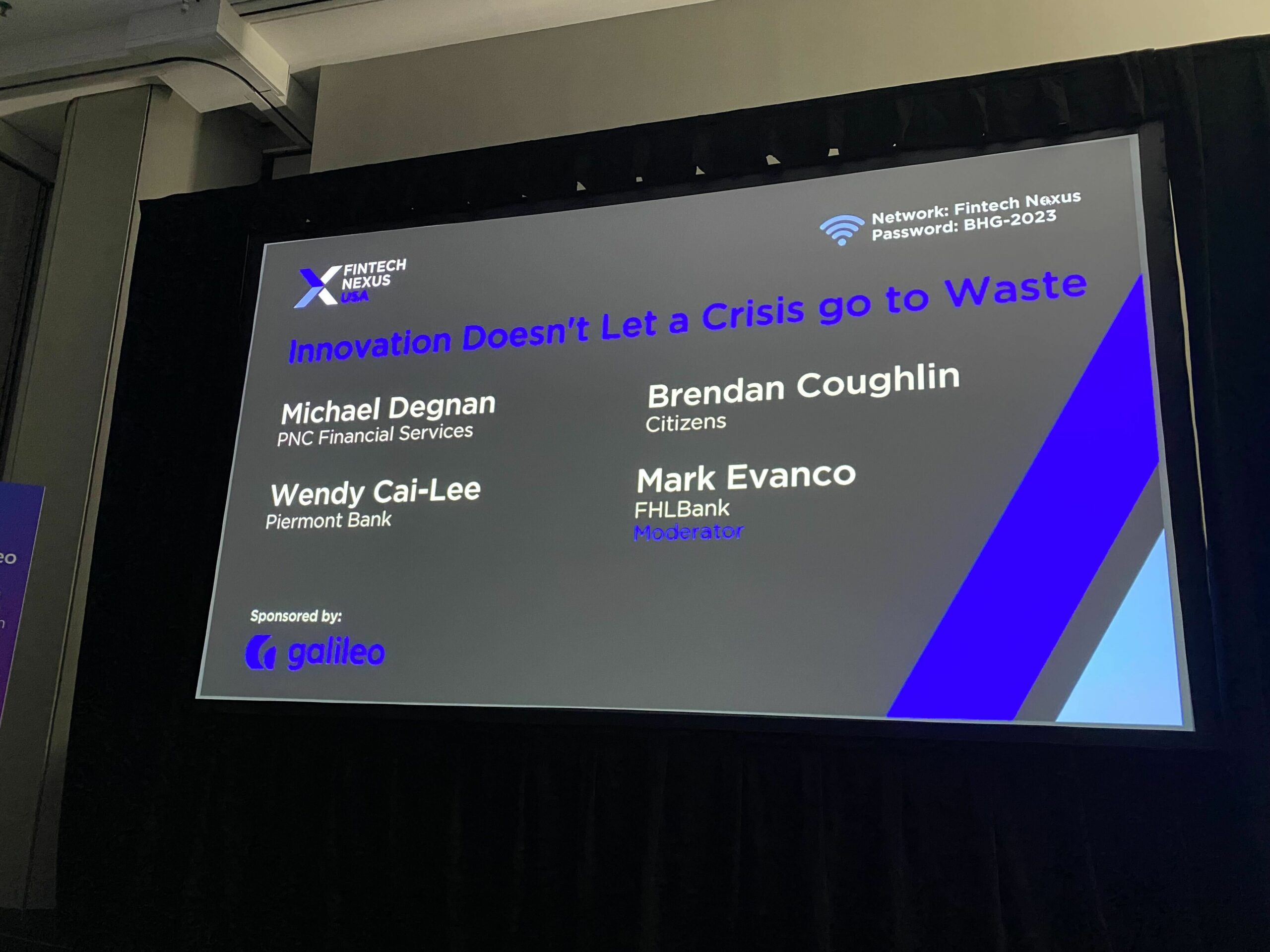

What both big and small banks think about crisis-fueled innovation

Mark Evanco, Chief Business Development and Strategy Officer, FHLBank – Session moderator

Wendy Cai-Lee, Founder & CEO, Piermont Bank – Completely digital and tech driven. Opened in 2019 during crisis.

Brendan Coughlin, Vice Chairman & Head of Consumer Banking, Citizens – Mission to modernize the bank – on the edge of innovations, one of the first to get into BNPL, first bank to launch student loan refinancing, innovation journey for last decade or so.

Mike Degnan, Head of Enterprise Innovation, PNC Financial Services – Variety of journeys including tech and innovation. Ran digital banking for Santander. And now runs innovation for PNC. Tend to look at bringing new things into PNC (emerging trends, market technology, R&D, business development, etc).

WENDY: We can all anticipate much heavier scrutiny from regulator standpoint. Regulators are trying to identify and recalibrate in terms of their role of regulating non-banks. We should all fully anticipate that scrutiny. We can only sit here and hope it’s not going to swing to the other side where it’s going to be counter productive.

How do we bridge the gap knowing that there will be more regulations, between innovation and the scrutiny?

You cannot continue to operate and grow and scale if you don’t innovate your own internal operations and processes.

How do we innovate our own products so we can remain relevant to the marketplace?

BRENDAN: Banks choose to not innovate at their own peril.

Customers used to pick banks based on convenience, which used to be geographically based and now convenience is determined by digital.

Innovation needs to start from the customer. What’s the need you’re trying to solve. Then, what are the solutions? Starting with the technology is like running around with a hammer and trying to find a nail.

MIKE: PNC has been adopting things like design-thinking, human center design, emerging technologies. Which allows you to respond when opportunities arise.

That’s the result of constantly putting yourself in position to take advantage of opportunities when they present.

WENDY: We’re going to see a lot more innovation coming from banks. The speed part is the most difficult part for traditional banks. That’s why I built a bank from scratch.

We have the luxury. We are built and run like a fintech.

Speed is how banks get beat by fintechs.

Banks know risk management. How do we overlay that expertise and then speed up too?

Remote deposit capture was born out of the 9/11 crisis.

How do we prevent a bank run in the digital world? What tech innovation can we come up with to prevent that?

BRENDAN: As a fintech you need to answer the following. Are you a disrupter of banks? Or are you an enabler/partner of banks who are disrupting?

MIKE: There’s a tremendous opportunity out there. We’re going to shift increasingly towards collaboration with fintech.

There’s two types of crisis right now. There’s a funding crisis within the startup community. There’s turbulence within the financial system.

We’re always looking for the next best thing that we can go and plug into our environment.

Acquisitions are also viable ways for banks to take advantage of what fintechs can provide.

Industry pros on why U.S. needs to step up blockchain game

(left to right as pictured)

Rob Morgan, CEO, USDF Consortium

Mark Fernandez, Head of Crypto Product, Checkout.com

Kevin Greene, CEO & Chairman, Tassat Group, Inc.

Sarah Milam, Partner, Dechert

Michael Greenwald, Global Lead Digital Assets & Financial Innovation, AWS

KEVIN: Regulators are like refs in a game. Not everyone is going to like what they have to say, but we need them to play the game.

MARK: Something that we think about at Checkout is how do we constantly improve on user experience for payments. The reality is that payments are actually extremely good but on the backend, the UX isn’t as good.

ROB: Reality is that the dollar is already digital today.

KEVIN: The issue here is the use of “blockchain technology.” There are tons of applications that have nothing to do with crypto currencies.

The crypto world is interesting but that’s .1% of the economy.

In the banking world, every bank spends a fortune to prevent fraud. The power of blockchain is that it is efficient, low cost, and highly secure.

SARAH: Regulators, and everyone, need to look at full process of transaction and moving money. There’s a whole system behind this and a lot is held up by not being able to move money quickly. It minimizes capital available to tech companies and to the consumer. I think regulators need to recognize what an important part of the economy this system is.

ROB: Blockchain can help drive down costs but is not a silver bullet. Risk management is key.

KEVIN: Technology is not adaptive when an industry is doing well. Innovation happens when we have a crisis.

Big advantages of blockchain properly applied: it can be done relatively inexpensively. The good thing about blockchain is that it levels the playing field between mega banks and regional/smaller banks.

The beauty of blockchain is that you can program in risk management components. The rest of the world is so far ahead of us and we have to catch up — just about every part of Europe, and all of Asia. We have to figure out a way to participate in it.

This cannot become the domain of just 10 large banks.

ROB: We think blockchain can help empower banks to do more. We think it can help keep smaller institutions competitive.

MARK: If you think about modern financial tech, we are a laggard.

MICHAEL: The U.S. needs to step up and recognize the reality that we’re in.

Yankees & puppies at lunch? Yes, please.

This is when I take a break, grab lunch, charge my phone (took SO many pictures), and stumble upon TWO unexpected, yet pleasant, surprises…

First, Fintech Nexus is giving away an Aaron Judge signed jersey? Sign me up! I fully intend to win so stay tuned for my acceptance speech tomorrow.

And wait … there’s a ‘Puppy Park’ on the show floor?

If I don’t make it back to the sessions after lunch, you’ll know where to find me. Chillin’ on the fake grass talking fintech with Fido. 😉

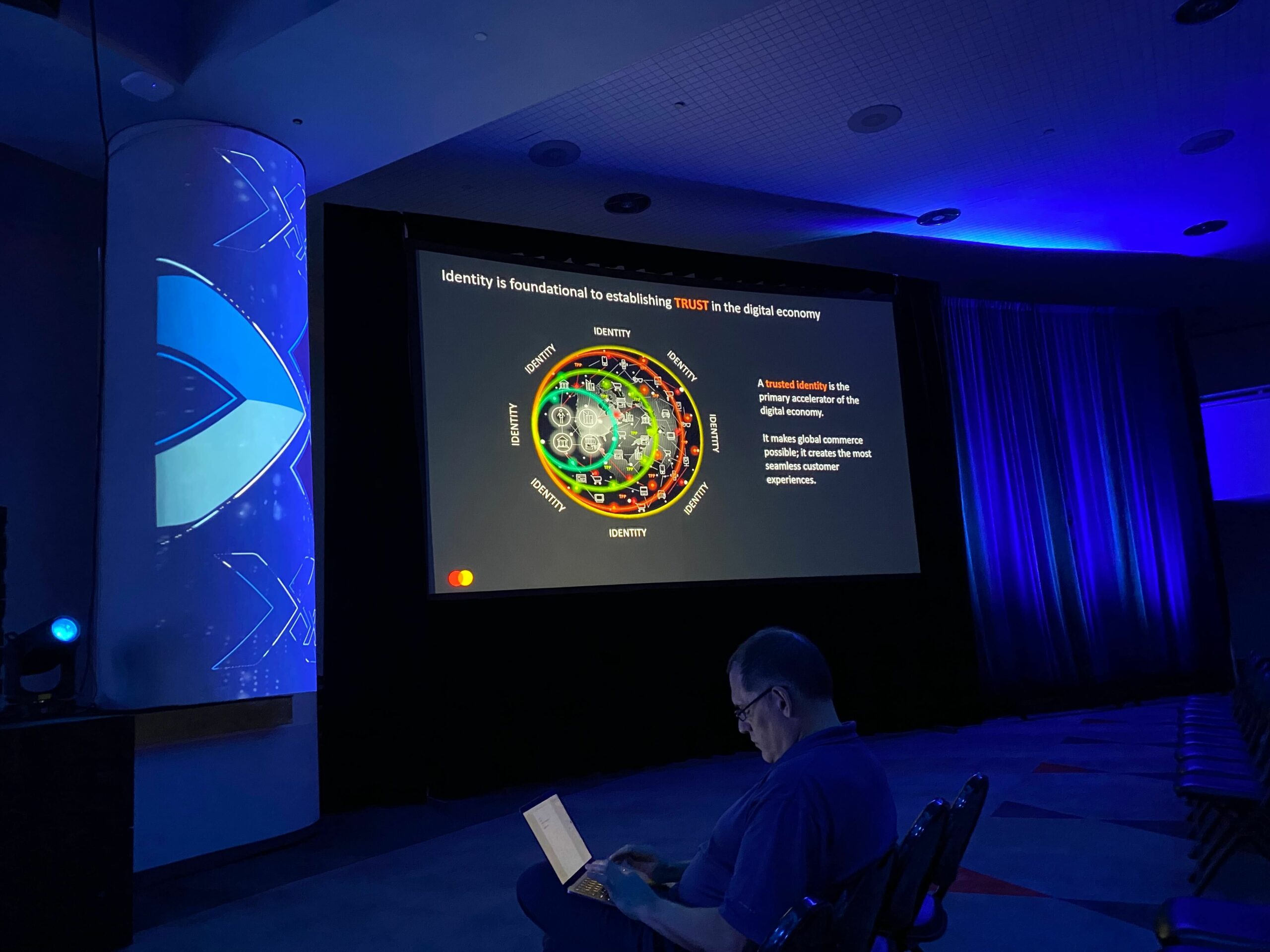

Mastercard on how identity is foundation for trust in digital world

I tore myself away from the show floor Puppy Park just in time to catch Mastercard’s SVP of Cyber & Intelligence Solutions, Ranjita Iyer take the main stage and talk to the audience about how fintechs can gain trust in today’s digital economy. She focused heavily on the following question.

How do you prove that who say you are is who you are in this digital world?

In this sort of an ecosystem how do you ensure that the person you are talking to across that digital divide who they claim to be?

She shared the following 2 slides to support her point:

We’re passionate about financial inclusion to help underserved or underbanked come into the ecosystem through different sorts of models that cater to them.

More than 21 million Americans don’t have access to the traditional ID systems that are require to gain access to finance.

Every other week there seems to be some sort of breach, fraud, or attack reported in the news.

Fraudsters steal passwords and email addresses and are scamming consumers into legitimately sending them money. We need to be vigilant and use AI to flag this behavior.

You don’t even really need to go to the dark web anymore. This is all available in the regular web for fraudsters to use.

There are services out there that help you create a fraudulent business in minutes. You don’t have to be that smart or sophisticated or be an AI guru. You just need a little bit of time and willingness to do it.

What we’re doing at Mastercard to help is launching a solution to verify that customers are who they say they are in on one single session. Based on both traditional and other sources of data to help triangulate to one person.

Fintech Nexus covered Ranjita’s presentation if you wish to hear more.

Fraud Fight Club: ChatGPT and Fraud/Scam Implications

Frances Zalazny, Founder & CEO, Anonybit

Jeff Finocchiaro, Fraud Chief Data Scientist, Bank of America

Simon Taylor, Head of Strategy, Sardine (Moderator)

Frances Zalazny of Anonybit and Jeff Finocchiaro of BofA, moderated by Simon Taylor (Sardine) got together in the Fraud Fight Club ring to discuss implications of ChatGPT and fraud & scam implications.

Not only is the room set up like a boxing ring, it’s also packed. I totally chose the wrong seat and don’t have a good view of all the panelists (see below), but I was able to catch some of the conversation (also below).

JEFF: Think about if you have a very contextually appropriate message being sent to you that is accompanied with details and a voice. You’re going to see a substantial increase in the threats being generated and an expansion in use of these technologies as they get better.

Financial fintechs, do you really know how well you’re doing against fraud? Every time you approve or decline a transaction, you’re sending a signal back. There’s very aggressive hand to hand combat going on here and institutions need to be nimble.

The first step is understanding the space a bit more. Embracing ethical and responsible AI. How do you leverage this in a way that is actually responsible?

They (AI tools) will fall into the hands of bad actors and there are going to be advancements with those tools. There will also be wonderful advancements in the areas of learning and education and improving the things that you need help with.

FRANCES: It will change the way we do code reviews and look at third party risks and supply chain risks, and how we assess readiness to deploy. It will require people to be analytical to code that is generated by ChatGPT and recognize things.

The risk is when we don’t understand that there is a risk, but as long as we understand there is a risk, we will be able to meet it. (This was such a great point she made.)

Real-Time Payments: Catching up with the rest of the world

(left to right on stage)

Stephany Kirkpatrick, Founder & CEO, Orum.io

Nick Thompson, Bank Partnerships, Modern Treasury

Ajay Andrews, Transfers & Payments, Plaid

Jenny Johnston, Founder, Stealth

STEPHANY: With Amazon, you don’t care how the package got to your front door. You care how fast. That’s what we do for payments.

NICK: Today there is a huge opportunity for people to build product experiences and businesses that are going to change people’s lives, because a large part of population is constantly having to think about where their money is and when it’s coming.

AJAY: Promise of real time payments is catching up with the rest of the world. In 2023, it’s a travesty that money is not moving as fast as it should.

NICK: This is the first time in 40 years that there has been a new rail. There’s a little bit of a waiting game from the smaller banks and bigger banks are trying to push forward and innovate to claim their place in the space.

(re: RTP) We encouraging ppl to hold tight with the banks that they have. But adding an additional bank who might have RTP. Always ensure that one of the banks that they’re working with/partnering with, is RTP enabled.

STEPHANY: RTP – Is it the next coming of payments or will it be another thing that sticks around and isn’t adopted? How many banks have the capability to receive a faster payment?

Speed has risk parameters that are different than we’re used to seeing.

AJAY: You’re going to see multiple rails leading to more end consumer coverage and unit cost of end payments dropping.

STEPHANY: In mid June, list of participating banks (FedNow) that will launch in mid July will be out.

The problem is now we have two disparate systems. You’re going to end up with banks that have one, and not the other (FedNow and RTP).

Consumer Reports helps fintech improve while measuring impact on the industry

(left to right on stage)

Jo Ann Barefoot, CEO & Co-founder, Alliance for Innovative Regulation

Delicia Reynolds Hand, Director, Financial Fairness, Consumer Reports

Delicia sat with Jo Ann to discuss how Consumer Reports is not only measuring the impact of fintech, but also prompting improvements on both consumer and provider sides. Some of the points she made are below.

DELICIA: We’re trying to provide some agency in the consumer experience. Providing ratings according to fees, costs, safety, privacy, whether there meaningful transparency, etc. Giving the consumer data points helps them to make a more meaningful choice.

After examining the products, we meet with the companies and share the data and ask them to improve certain things.

Consumers have better data helping them choose.

And product companies make improvements as a result.

We’re focusing on product areas that consumers are utilizing and have interest in. We assess consumer need and wants. We look at baseline and set ceilings in terms of principles that should govern financial services.

Instead of going into a store, buying and testing, we’re downloading and running packages and doing a combination of quantitative and qualitative data. We observe testers using products and have testers who use the apps.

There’s opportunity to lean into the facilities, the operational facilities. We can see who is doing what, and then encourage companies to do what their competitors are doing.

We’re seeing interesting things. There may be some gaps. Assumptions on the part of the mobile service provider or the fintech company is thinking the bank has it with regards to certain regulations. There are opportunities for more alignment in a basic app-based transaction environment.

Innovation happens at such a rapid pace, so looking at various apps, you almost always see your data. If you’re a CA resident, you will have more opportunities to see your data, correct it, control it, delete it, have more agency over it. What happens to the rest of the country?

Privacy is one of the principles within the framework that they examine. What happens to consumer data? What data is collected when a consumer downloads a financial services app? Who is party to the consumer’s journey by way of their application?

Should the default be a data minimization approach?

Here’s a really cool shot I got of someone snapping a pic during the session.

TO BE CONTINUED…

And that’s a wrap for Day 1. I’ll be back with more tomorrow so stay tuned for Day 2 Live Blog.

Until then, I will run my old commuter routine.

I have 3 words:

Don’t. Miss. This.

[UPDATE: Here’s Day 2 Fintech Nexus USA 2023 Live Blog]

Want The Basis Point To Live Blog YOUR Event?

By the way, if you want us to Live Blog your industry or corporate event, please reach out.

Here are two other Live Blog samples.

===

This one is from Goldman Sachs:

===

And this one is from bank marketing fintech Total Expert: