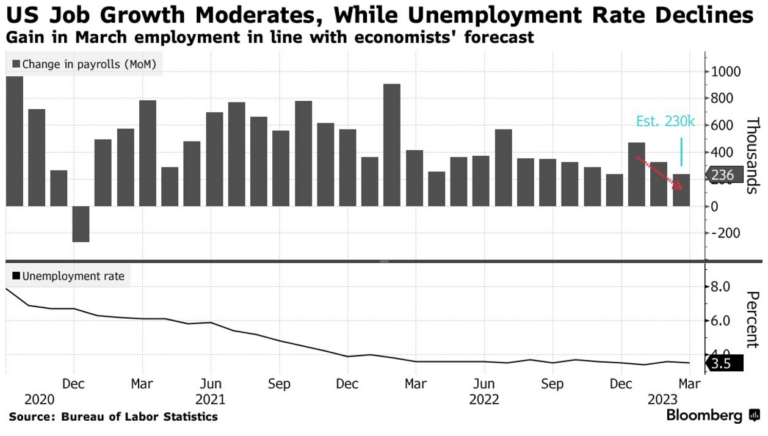

Mortgage rates rise on strong +236k Mar jobs & low 3.5% unemployment

Today’s jobs report showed the U.S. economy added 236k new jobs in March which, per Goldman Sachs, exceeded expectations for the 12th straight month on continued strength across leisure, healthcare, and business services sectors. Mortgage rates, after dropping to around 6.25% so far in April, look like they’ll end in the mid 6s if today’s mortgage bond selloff holds.

Here’s a quick rundown of jobs and mortgage rates.

March began with mortgage rates over 7% on concerns about the Fed’s continued aggressive inflation battle.

Rates rise when mortgage bond prices drop in a selloff, and bonds sell on inflation fears because inflation erodes future returns paid to bond investors.

As the banking crisis played out in March, the Fed did still increase overnight bank-to-bank lending rates for a 9th straight time within 1 year.

This helped bond markets bet the Fed would slow hikes or pause May 3 or June 14.

This bet on future inflation moderating causes mortgage rates to drop as bond prices rally on more buying.

This rally was also helped by investors seeking the safety of mortgage bonds as the March bank crisis played out.

But today’s stronger jobs report has flipped investors back to Fed Inflation Fight mode.

Rates are up as bonds sell on a bet the Fed hikes May 3.

Wage growth is a key inflation-watch part of the jobs report, and March wages grew 0.27%, which was below estimates of 0.3%.

It’s possible the Fed will like the fact that wage inflation isn’t spiking.

Less aggressive wage growth isn’t great for workers but is good for the inflation fight.

Also notable: today’s jobs report didn’t reflect a different stat on job market cooling.

The number of February job openings fell below 10 million for the first time in 21 months. Link below.

Also below are links to income needed to buy homes at today’s 6.5% rate range.

===

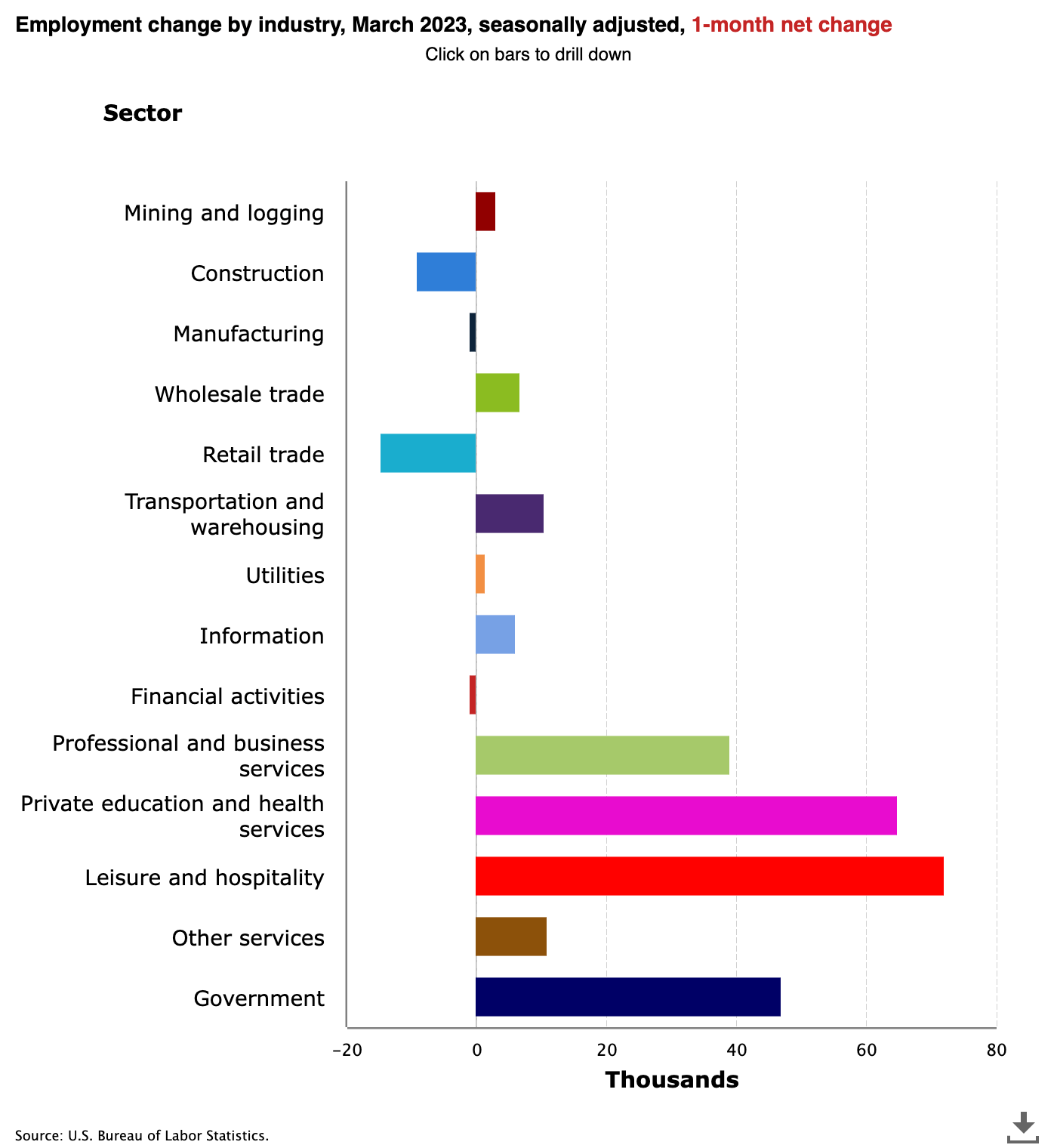

Here are the industries where March jobs grew the most. Leisure, healthcare, and business services led the gains.

===

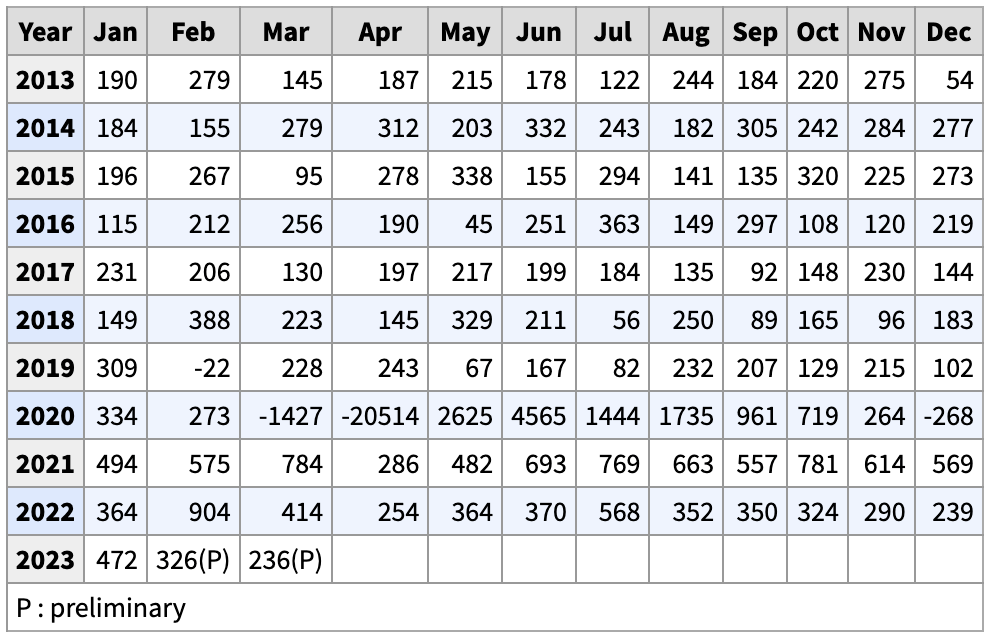

And here’s a handy Bureau of Labor Statistics table showing monthly job gains 2013 to present.

===

Please comment below or reach out with questions.

___

Reference:

– March Jobs Report Shows 236k jobs added, 3.5% Unemployment (BLS)

– At 6.5% rates, here’s math on new home affordability and existing home affordability.

– Is Fed inflation fight killing jobs? Feb 2023 openings below 10m 1st time in 21mo.

– Job Market Steady, Keeping Fed on Track for May Hike (Bloomberg)

– The Basis Point works with our friends at MBS Live to track rate markets