Non-U.S. War Makes U.S. Homes (Slightly) More Affordable

Even with mortgage rates near 8%, 3.5 million people will still finance home purchases this year, and households need to make $98k to $120k to qualify for home purchases with 5% down. This is strained, but doable. Let’s take a look.

IMPACT OF WAR ON MORTGAGE RATES

U.S. home pricing is local but U.S. mortgage rates are global.

In reaction to the Israel/Hamas war investors buy safe securities like U.S. Treasury and mortgage bonds, which pushes bond prices up and rates down.

Mortgage rates were rising toward 8% following the Fed’s September 20 pledge to keep up the inflation fight for longer than bond investors originally expected.

Per Mortgage News Daily, rates peaked at 7.875% Friday, October 6, just before the Hamas attack on Israel, and now rates are down .25% to 7.625% as the war escalates.

INCOME NEEDED TO BUY A HOME WITH 5% DOWN

Using this rate and a 5% down payment to buy an existing home at today’s median price of $407,100, all-in monthly cost is $3511, and you need to make $98k to qualify* if you have no other debt. If you have $600 in other car, student, or credit card debt, you need to make $115k.

Using this rate and a 5% down payment to buy a newly built home at today’s median price of $430,300, all-in monthly cost is $3705, and you need to make $103k to qualify* if you have no other debt. If you have $600 in other car, student, or credit card debt, you need to make $120k.

Needing household income of $98k to $120k to finance a home purchase sounds high, but MBA projects 3.5 million people will finance home purchases this year.

So you should consult a local lender rather than headlines on home affordability in your area.

WHEN WILL INFLATION & MORTGAGE RATES DROP?

As for the Fed’s inflation fight, and whether mortgage rates will drop more soon, there are key considerations:

– CPI and Core PCE inflation don’t need to hit the Fed’s 2% target for mortgage rates to drop.

– If these inflation figures can get to and stay in the 3% range, bond markets will rally and rates will drop in the coming months.

– Right now, Core PCE is 3.9% after being stuck in the 4-5% percent range during 2022 and 2023. If this continues to drop, rates will follow, and the next Core PCE report is October 27.

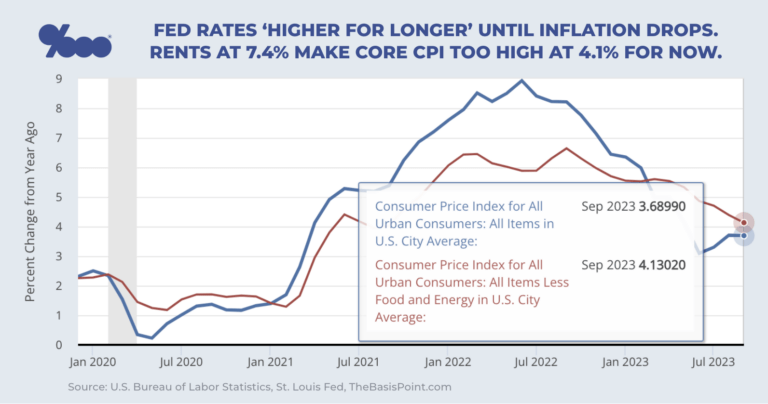

As for CPI, the September 2023 headline number is 3.7% (chart above), same as last month, and way down from a June 2022 peak of 8.9%.

– But September 2023 Core CPI is stubbornly higher at 4.1% (revised down from 4.4% last month) because the rent component of Core CPI is still 7.4% (revised down from 7.8% last month).

– This Rent figure in monthly CPI reports is for leases signed a year earlier.

– So it’s coming down, but it peaked recently at 8.8% for 3 straight months in February, March, April 2023.

Until the Fed sees this come down, they’ll maintain their tougher inflation fight stance.

HOME PRICE & MORTGAGE RATE OUTLOOK

Remember: the Fed’s actions are designed to slow housing. This hurts right now, but it’ll help keep home prices from spiking and eventually bring mortgage rates down.

Accordingly, MBA predicts home prices to rise just 1.5% this year and 1.1% next year.

For mortgage rates, Fannie Mae and MBA project 6.5% and 5.4%, respectively, by the end of next year.

These projections show next year with lower rates and very similar home prices as today.

That’s news we’d all welcome, and encouraging for homebuyer strategy.

___

Reference:

– In Higher For Longer inflation war, how does Fed chief Jay Powell stay so calm?

– Fed hiked 11 times since March 2022. How long is this Higher For Longer phase?

– Live updates on Israel/Gaza war (Aljazerra)

– Latest CPI Inflation Figures (BLS)

– * To arrive at these qualifying income numbers, The Basis Point uses 43% debt-to-income ratio that Federal regs allow for lenders to approve mortgages of this size in America. We use Mortgage News Daily for rates.