Not Cool: 78% Will Carry 2019 Holiday Debt, Most With Rates 15-25%

Here’s a 2019 holiday debt recap before we start the first 2020 work week. Notable: Gen X added most debt to keep Gen Z kids and Boomer parents happy. Not Cool: 78% Will Carry 2019 Holiday Debt, Most With Rates 15-25%. Don’t be lazy! Find out what to do below.

OK, CHEAPSKATE BOOMERS!

– 57% of consumers didn’t plan on adding holiday debt, but 44% added debt anyway.

– Of these 44% of consumers adding holiday debt, 52% were Gen X, 50% were Millennials, and 36% were Boomers.

– Chart below shows consumers added $1325 on average.

– It doesn’t show Gen X added $2,076, Millennials added $1,215, Boomers added $606.

– OK, cheapskate boomers! What’s up with that?

– I’m Gen X, and though we supposedly like to watch the world burn, we’re also straight up middle gen. Must spend on Gen Z kids and Boomer parents.

– Also in all seriousness regarding Boomers, they may have (better have!) used cash for presents.

MOST NEED MONTHS TO PAY HOLIDAY DEBT

– Chart below shows 78% won’t be able to pay off debt come January.

– This includes 15% who will only make the minimum payment.

– Definitely not great but trying to make people happy is understandable.

– 36% said their most expensive gift purchase was for their child.

– 32% said their most expensive gift purchase was for their spouse/significant other.

– Lots of happy families out there.

– Still if debt takes months to pay off, the super high interest adds up fast.

– See next section for high rates and solving lazy attitudes lowering those rates.

DON’T BE LAZY ON HIGH INTEREST DEBT!

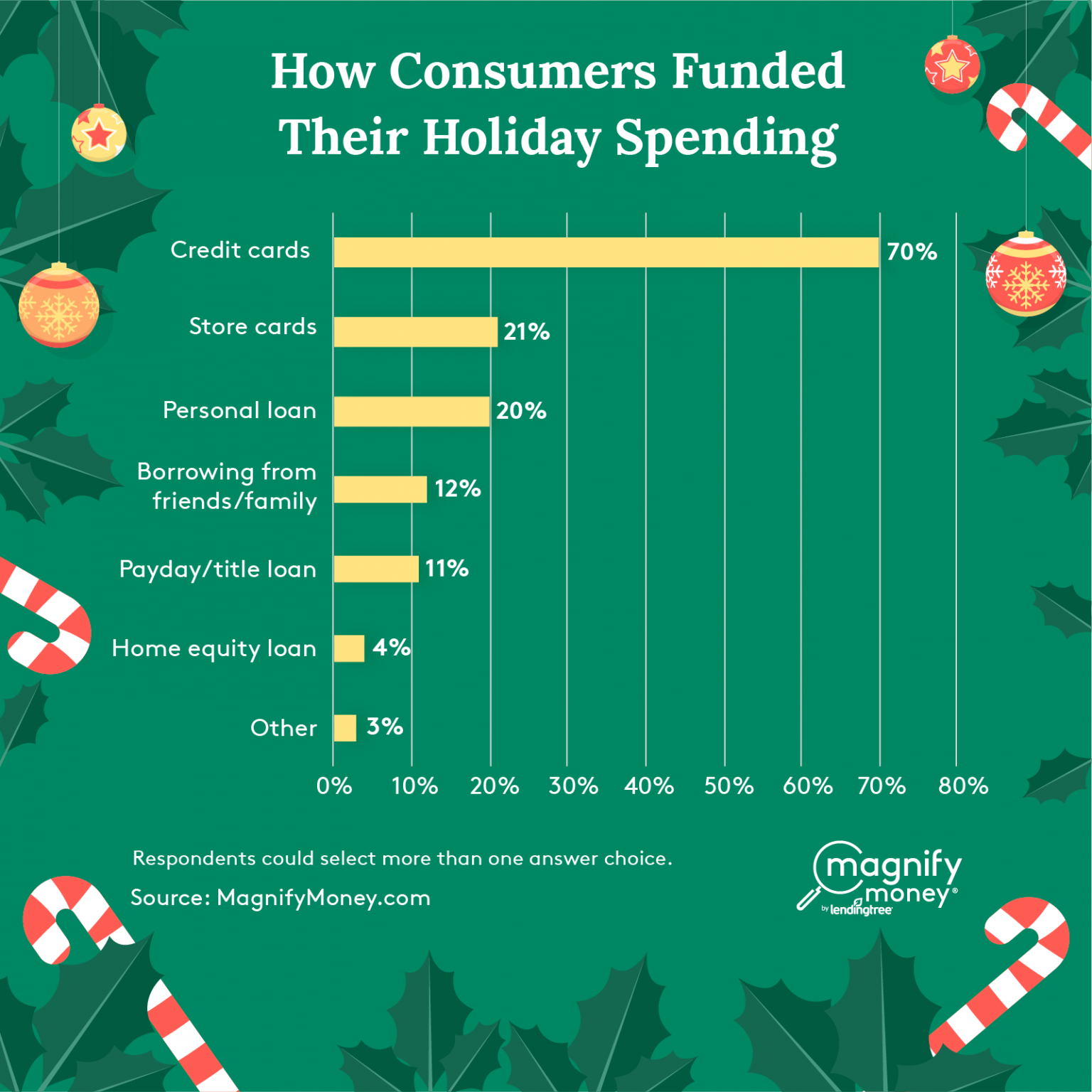

– 70% used credit cards for 2019 holiday shopping, which have rates of about 15%.

– 21% used store cards, double the 2018 percentage, which is insane because these cards have rates of about 25%.

– 20% used personal loans, double the 2017 percentage.

– The personal loan space is competitive so these rates can be lower.

– But 36% of survey respondents said their rate (on whatever debt type they have) is 20% or more.

– GOOD NEWS: 40% plan to consolidate debt and/or shop for lower balance transfer rates.

– TERRIBLE NEWS: more than half won’t shop because 20% think it’s not necessary, and 18% don’t want to switch banks.

– If you’re going to hold debt more than 6 months and/or make minimum payments, don’t be lazy! You can find lower rates easily.

Good survey data from Magnify Money. Source link with more info below.

___

Reference:

– Source: Magnify Money 2019 Holiday Spending Survey

– Record Online Sales Boost 2019 Holiday Spending (CNBC)