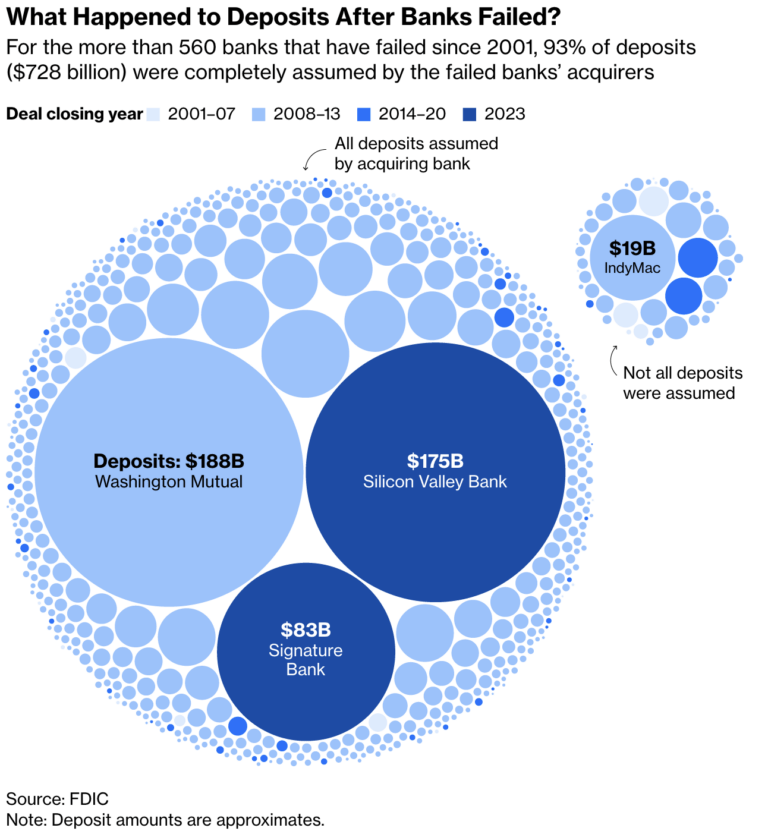

Of 560+ failed banks since 2001, 93% of deposits fully assumed by acquiring banks

Paul Davies and Elaine He have a great piece following the money for Silicon Valley Bank. The (paywall) link is below. Of particular note is the chart above showing that, despite all the Bank Failure headline chaos this past month, almost all bank deposits remain safe as they eventually make their way to acquiring banks.

It’s also worth noting that, for the 2 biggest bank failures of the current era — Silicon Valley Bank and Signature Bank — the FDIC placed both with new banks.

Here are details on First Citizens taking over SVB and NYCB taking over Signature.

See Paul Davies and Elaine He charts that analyze where money went as Silicon Valley Bank balance sheet troubles led to the second biggest bank failure in U.S. history.

___

Check It Out:

– Silicon Valley Bank’s Fall and the Way Forward for US Banking