Will U.S. regulators broker a First Republic sale like Swiss did with Credit Suisse?

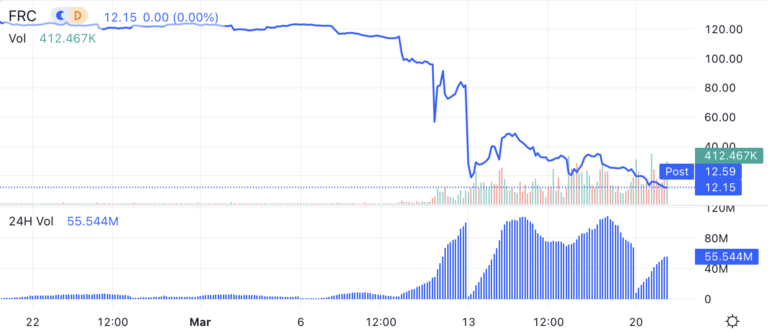

First Republic Bank is being watched closely as a key signal for the overall health of America’s regional bank sector. The stock Monday resumed last week’s record 72% drop, and is trading below $20 now, after another downgrade Sunday. Will U.S. regulators broker a First Republic sale like Swiss did with Credit Suisse? FDIC has already sold 1 of 2 failed regional banks (Signature), and Treasury, Fed, FDIC, and OCC already helped 11 big banks backstop First Republic. Bloomberg reported:

[First Republic] was downgraded S&P Global Ratings for a second time on Sunday after being cut to junk just days ago, even after the bank received $30 billion from 11 US banks to stave off a potential collapse.

“The biggest open question is First Republic, which suffered a run after being somewhat unfairly linked to Silicon Valley Bank and Signature Bank,” said Todd Baker, a senior fellow at Columbia University’s Richard Paul Richman Center for Business, Law and Public Policy. “I am expecting a private capital infusion or an M&A deal soon there so that the bank can hold onto primary banking relationships with its core base of wealthy individuals and their businesses.”

As for two other regional banks that the FDIC seized, Signature Bank and Silicon Valley Bank, the FT said this Friday:

“We are actively marketing both institutions,” said a spokesman for the FDIC. “We haven’t set a deadline for bids but we hope to have them resolved within a week.”

The FT piece also noted:

U.S. regulators are willing to entertain the prospect of backstopping losses at Silicon Valley Bank and Signature Bank if it helps push through a sale of the failed lenders.

Regarding Signature, This morning, New York Community Bancorp announced (below) that their Flagstar Bank subsidiary acquired certain of Signature Bank’s deposits, loans, teams, and branches. Here’s an excerpt from their announcement saying what they bought:

– Purchased assets of approximately $38 billion, including cash totaling approximately $25 billion and approximately $13 billion in loans.

– Assumed liabilities approximating $36 billion, including deposits of approximately $34 billion and other liabilities of approximately $2 billion.

– Also included in the transaction is Signature’s wealth-management and broker-dealer business.

– The deal includes all of legacy Signature’s core bank deposit relationships, including both the New York and the West Coast Private Client teams, as well as the wealth management and broker-dealer business. The Private Client teams account for the majority of deposits we assumed.

– The purchased loans consist exclusively of commercial and industrial loans (“C&I”).

– The Company did not acquire any digital asset banking or crypto-related assets or deposits, nor did it acquire loans or deposits related to the fund banking banking business.

– The Bank will take over all of Signature’s branches. This includes 30 branches in the New York City metro area and several branches on the West Coast. These branches will open tomorrow morning and operate under the Flagstar Bank brand.

– On the lending side, the Bank added several attractive new verticals, including middle market specialty finance, healthcare lending and SBA lending, while adding to its existing verticals in mortgage warehouse lending, as well as traditional C&I lending.

Regarding this deal, Bloomberg reported the FDIC’s potential benefit:

Taking a page from the last financial crisis, the FDIC negotiated to get equity appreciation rights in New York Community Bancorp common stock that the agency said could ultimately be worth as much as $300 million.

As for First Republic, there’s a Fed meeting tomorrow and Wednesday, and the WSJ reports:

The market’s reaction to developments at First Republic and Credit Suisse could influence how the Federal Reserve approaches its rate-setting meeting this week, where officials face a finely balanced decision over whether to raise interest rates by a quarter-percentage point or to forgo an increase altogether.

Fed officials have raised rates rapidly to slow the economy and fight inflation by tightening financial conditions, such as by lifting borrowing rates and pushing down asset prices. A significant question at their two-day meeting, which ends Wednesday, is how much additional tightening they expect to get from the markets turmoil and the banking sector.

It’s also important to note that Treasury, Fed, FDIC, and OCC closely coordinated with the 11 big banks who deposited $30 billion in First Republic last week.

Certain sell side analysts Friday again began mentioning a First Republic sale as a possible outcome.

Because of this — and because of close coordination between regulators and big banks to aid regional banks — a government-assisted First Republic sale is a possible scenario.

This is how it played out this weekend when Swiss regulators brokered a deal for UBS to buy Credit Suisse for $3.25 billion.

In that deal, the Swiss government provided UBS with a $9.7 billion loss backstop and $108 billion in liquidity.

In the U.S., increasing FDIC deposit insurance limits above $250,000 has also been discussed. It’s supported even by Washington players critical of Wall Street like Elizabeth Warren.

This would help regional banks, including First Republic, which has larger deposits given its wealthier client base.

But would it help fast enough?

___

Reference:

– First Republic Bank looms large for US regulators after Credit Suisse sale (WSJ-paywall)

– US regulators open to sharing losses to smooth sale of SVB and Signature (FT-paywall)

– US Banks on bumpy path as First Republic troubles persist (Bloomberg-paywall)

– First Republic sale rumor recap (TheBasisPoint)