Rent In CPI Still Too Damn High, But Inflation (and Rents!) Dropping

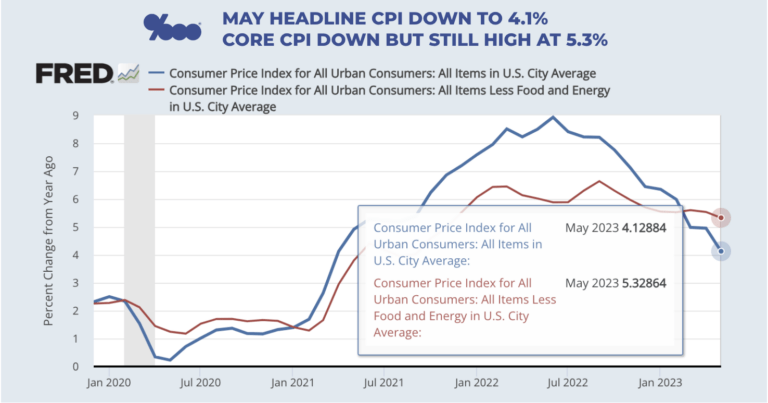

Headline CPI inflation keeps coming down. It dropped from 5.9% in February to 4.9% in March and April, and today’s May CPI dropped to 4.1%. But May annual Core CPI, which includes rent but excludes food and energy costs, is stubbornly high at 5.3%, down just slightly from 5.5% in April. Still, inflation is trending down, and after 10 rate hikes in 15 months, the Fed may pause at its June 14 meeting. Here are a few key takeaways.

The April-to-May monthly headline CPI level is 0.1%, which is great.

The April-to-May monthly Core CPI level is 0.4%, which is not great.

But it’s not terrible either.

It annualizes to 4.8%, which is lower than today’s actual annual figure of 5.3%.

More good news:

Peak headline CPI inflation was 8.9% in June 2022 vs. 4.1% in May 2023.

Peak Core CPI inflation was 6.6% in September 2022 vs. 5.3% in May 2023.

What’ll it take for Core CPI inflation to drop from here?

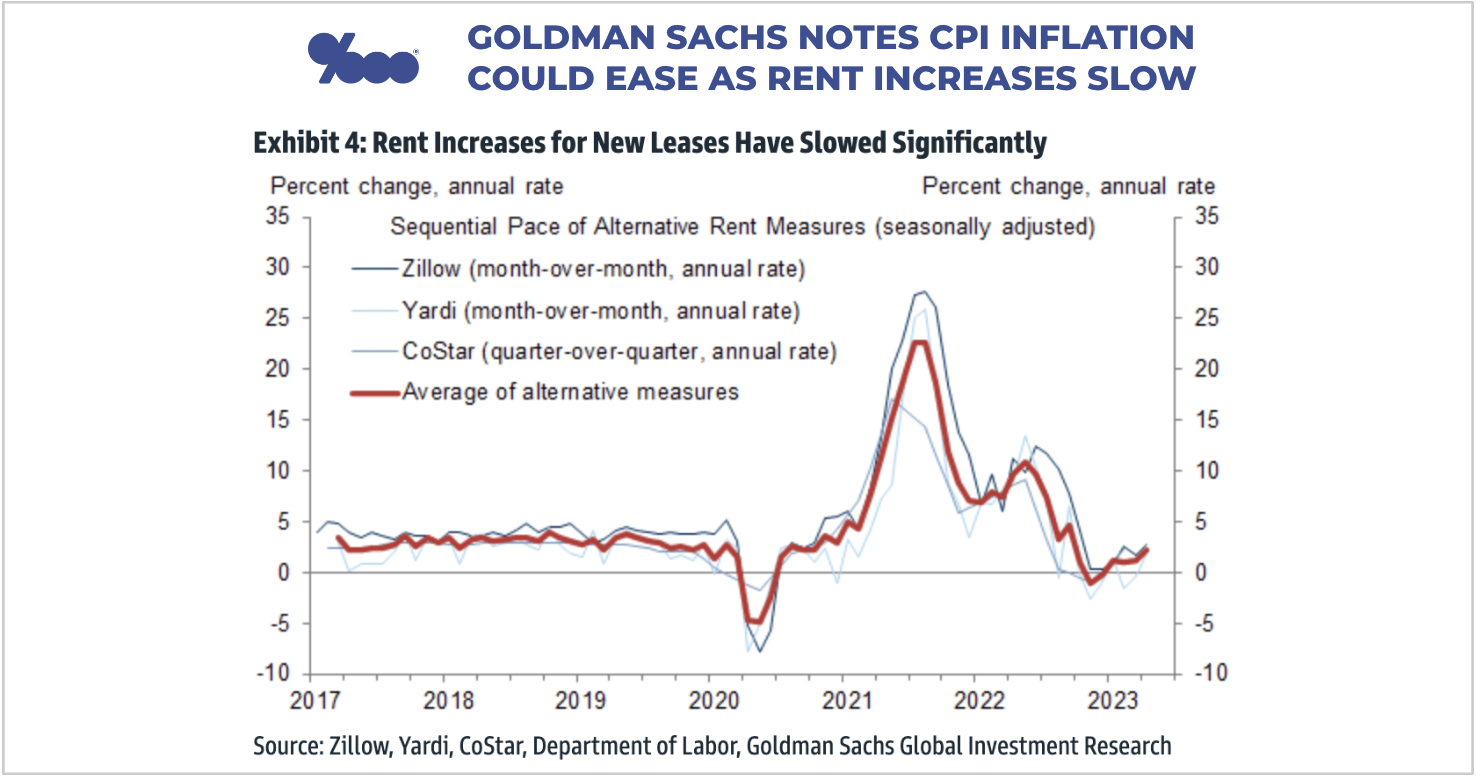

Lower housing costs may help.

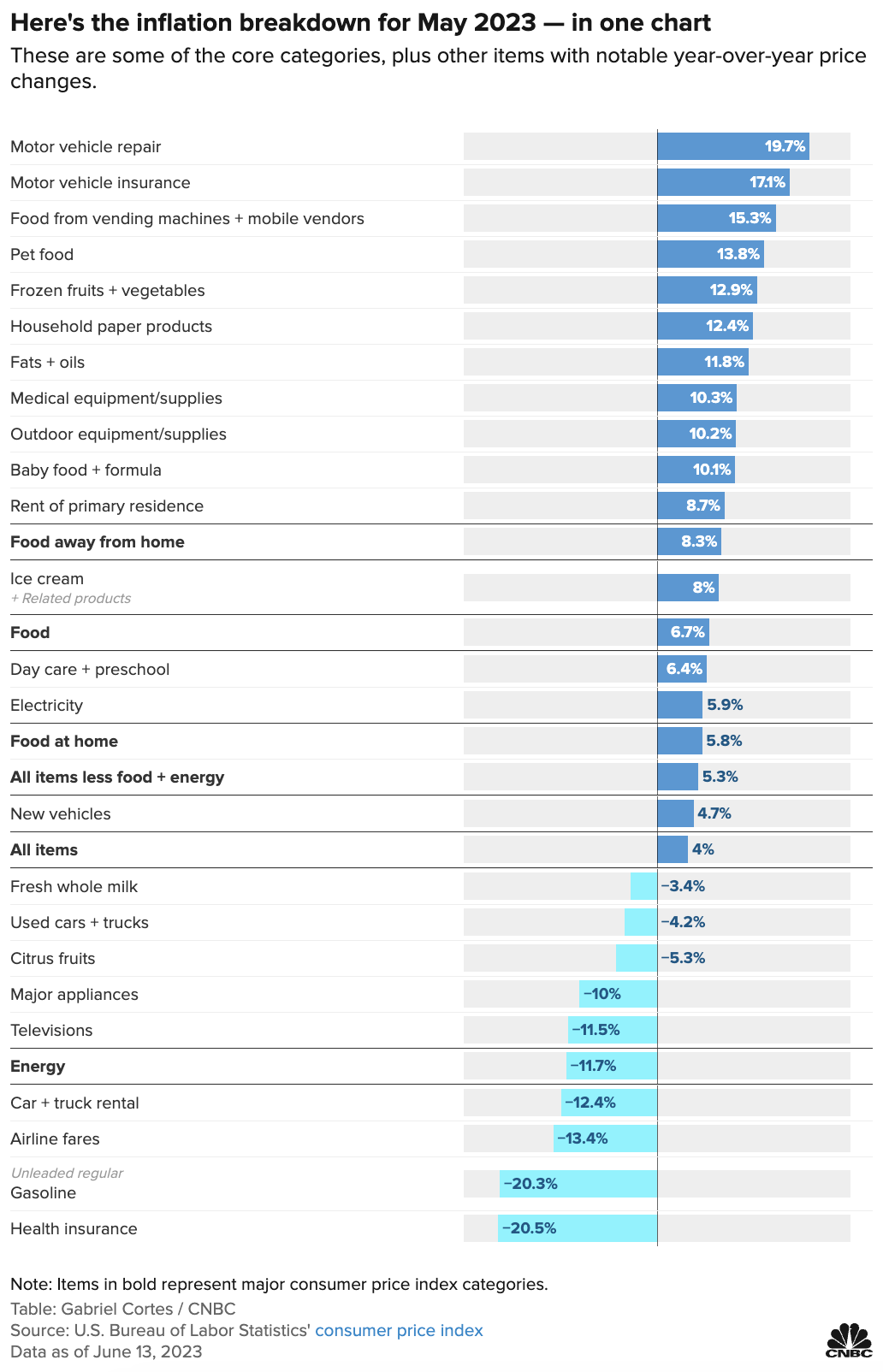

The rent component of CPI is still 8.7%, which contributes to these high inflation readings.

But CPI measures existing rents people are paying, using leases signed up to a year ago.

And Goldman Sachs notes (chart below) how rent increases for new leases have slowed significantly.

So if this trend continues, the rent component of CPI should come down.

This would in turn bring Core CPI down.

Here’s what this means for mortgage rates:

Rates are still around 7% as we kick off summer 2022.

We won’t see any rate movement until the Fed meeting tomorrow.

The Fed is expected to pause but then maybe hike July 26, then watch data closely until September 20.

So the summer will be volatile and cautious in the mortgage rate market.

Don’t expect a massive rate drop until we see Core inflation below 5%.

The June Core CPI reading comes July 12.

As for Core PCE, the April annual reading was actually UP to 4.7%.

The May Core PCE reading is released June 30.

To track how this plays out, please subscribe to our newsletter.

And please reach out with questions.

___

Reference:

– Inflation peak recap and Fed hike recap

– Mortgage Rates Near 7% To Start Summer (Real-Time Chart from MND)

– All May inflation categories in one chart (CNBC)