STAT FIGHT! Who pays more for car loans: Millennials, Gen X, or Boomers?

In case your dinner table conversations have been too civil since we last encouraged family strife, here’s some argument fuel.

We all know student debt is the millennial cross to bear (but boomers hate them), but every generation has to deal with paying for cars.

So who has it the worst when it comes to auto loans?

Time for a Stat Fight!

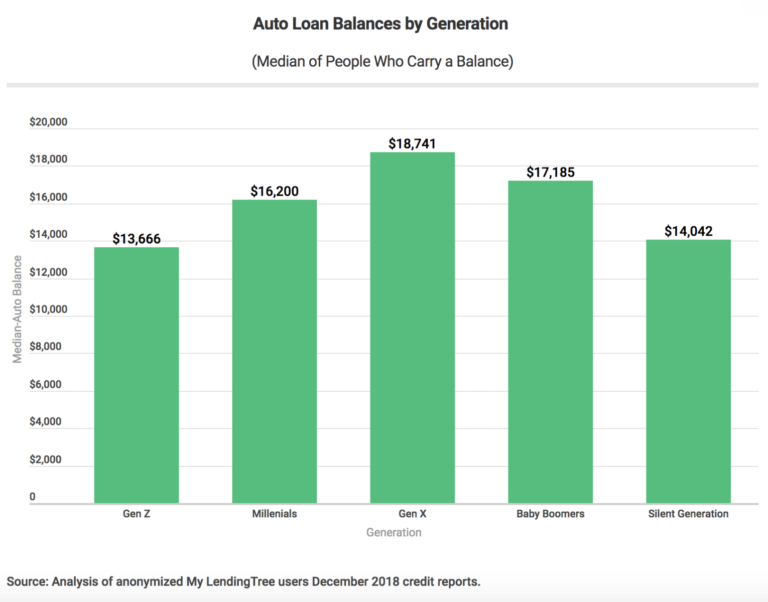

According to new LendingTree data, it’s Gen X!

Or at least it seems that way—Gen Xers have the highest median auto loan balance at $18,471. More of them also have a car loan than any other generation—59.7% of Gen Xers have an auto loan, compared to 55% of millennials and 53.9% of boomers.

Older Gen Xers have more of a license to complain than younger ones, too—Xers aged 45 to 54 have the highest median balances.

But wait! Don’t millennials make less than Gen Xers, so won’t those balances hurt their finances more?

And if Gen Xers have the highest auto loan balances, doesn’t that mean they qualify for loans for more expensive cars? So who’s really worse off here?

Well, you’re the one having the dinner table argument, so it’s up to you to find out. I’m just the messenger.

Most of Gen Z, ages 4 to 24, can barely drive yet, so only around 30% of them have a car loan. They can complain in a few years when they get their drivers’ licenses.

LendingTree pulled data on more than 1.5 million customers to figure this out, so the data’s legit. Let us know how dinner goes tonight.

___

Reference:

– LendingTree Study Finds Gen Xers Carry the Biggest Auto Loan Burden (LendingTree)