How Zillow & Opendoor’s Instant Home Buying Can Help Sellers During Coronavirus

Coronavirus economics got real in America this week. Yesterday was the worst day in stocks since Black Monday, and the Fed said it’ll buy bonds to keep rates low.

But even with low rates, will homebuyers hold off to make sure they have jobs?

And do home sellers even want people in their house?

The best seller solution may be “instant buyers” (iBuyers) like Opendoor and Zillow, who buy your home outright in days with no open houses.

Is this a way for sellers to get ahead of home price declines?

Let’s take a look.

CORONAVIRUS HITTING AT PEAK HOME BUYING SEASON

About 40% of home sales each year happen from March to June, per the National Association of Realtors (NAR).

March to June is the eye of the coronavirus storm this year, so it’s very likely home sales will slow.

If you’re a seller, do you really want crowds walking through your house right now?

If you’re a buyer, do you even want to buy until you know how bad the economy will get?

The NAR just revised home sales expectations based this sentiment, per WSJ:

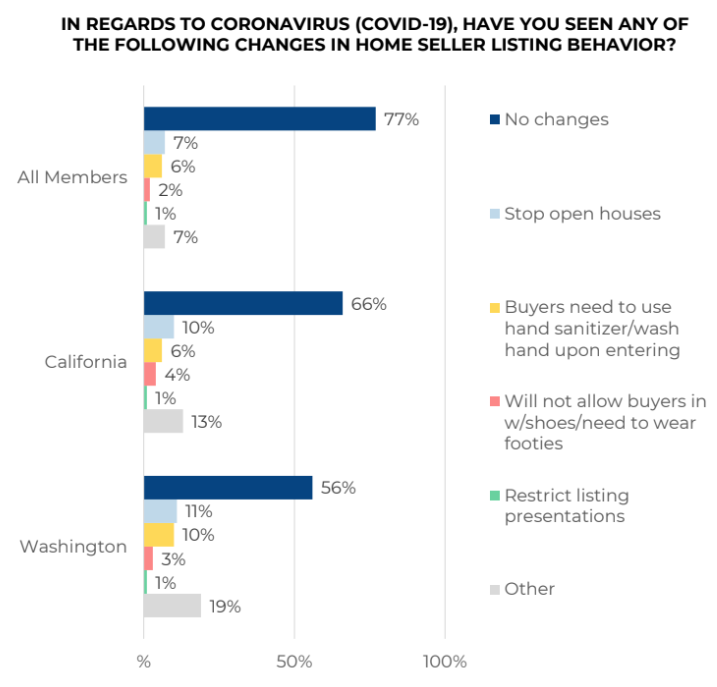

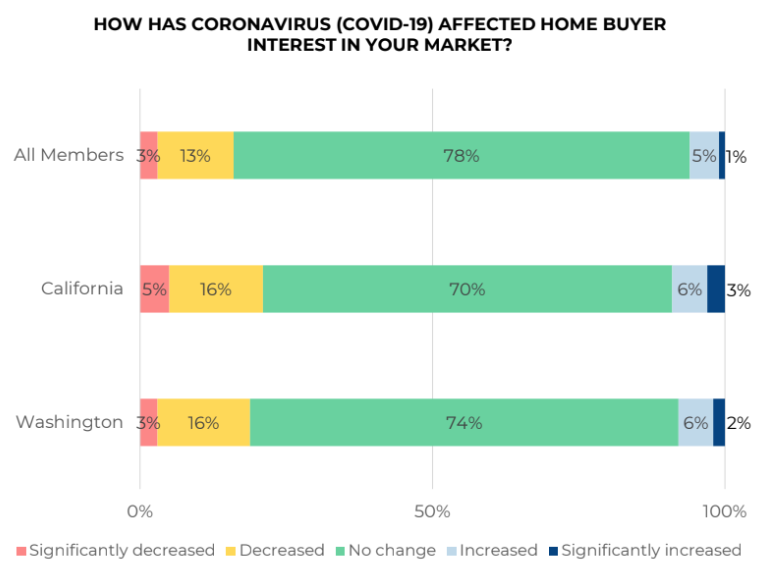

The association said Monday it expected a 10% near-term drop in home sales in the next month, compared with the period before the virus became prominent. In a survey of its members about the coronavirus, the association said 11% of respondents reported lower home-buyer traffic and 7% reported lower home-seller traffic.

NAR’s coronavirus survey* this week also showed most realtors saying everything is cool with buyers and sellers.

The charts below show 78% of realtors said coronavirus had no impact on homebuyer interest in their market, and 77% said they saw no changes in home seller listing behavior resulting from coronavirus.

I disagree with this realtor interpretation of buyer and seller sentiment until we get direct consumer data to review alongside this realtor interpretation.

When pressed, realtors I’ve worked with for years are telling me buyers are in wait-and-see mode and sellers aren’t sure what to do.

Many sellers are holding, and many others are refinancing into shorter term adjustable rate mortgages with crazy low rates in the 2.x% range.

This improves their monthly cash flow while they wait for this to play out.

CAN SELLERS BEAT HOME PRICE CORRECTIONS USING iBUYERS?

But what if you’re a seller who can’t wait because you don’t want home prices to fall if a recession sets in?

Or what if you can’t wait to sell because you’re relocating or growing your family?

One solution relevant to this coronavirus-infected market is selling your home to an iBuyer like Zillow or Opendoor.

This has two benefits: speed and convenience.

You fill out a form on their site, they send you an offer, and you can close within days.

No open houses. No fixing up the place. No staging.

The fees vary but you can count on these iBuyers charging roughly 7% of the sale price for this speed and convenience.

If you add up all the other fees you’d have as a seller, it’s competitive.

You’ll pay a realtor about 6% to sell your home in most markets. You might also pay for staging and/or repairs and improvements prior to listing. By the time you’re done with these items, it can end up around 7% anyway.

Then when your home is all polished and ready for the public market, you must prepare for a multi-week process.

Open houses, offers, waiting for the buyer’s loan to get approved are all normal timing factors for sellers.

This is when an instant offer can start to look good.

Close right away at today’s price.

And if you don’t like their initial offer, iBuyers like Zillow and Opendoor both connect you with agents to list your home the traditional way.

For example, here’s Opendoor explaining how you can sell directly to them or work with an agent.

If you want to dive deeper on these models, here’s my take on Zillow’s iBuyer model and Opendoor’s iBuyer model—more links are in each of these stories.

BUYERS CAN AVOID OPEN HOUSES WITH 3D ONLINE TOURS

Buyers tend to be less rushed, especially if they’re not selling another home first.

But if you’re a buyer who’s on a clock and don’t want to be out too much looking at homes, 3D tours have taken off.

Traditional real estate brokerages offer this, and also Zillow and Opendoor offer it on the inventory of homes they own and are now selling.

Here’s an example of a 3D tour of a home Zillow is selling.

BUT WON’T ZILLOW AND OPENDOOR BE HURT BY MARKET CORRECTION?

What if iBuyers like Opendoor and Zillow buy all these homes from sellers and home prices start dropping like stocks?

This has been a question about the iBuyer model since day one, and Monday I’ll explore that in my HousingWire column.

I cover these 4 issues:

1. Why iBuyers are a great option for home sellers who react fast in this coronavirus market.

2. How iBuyers will now be tested in a full market cycle.

3. All disruptive startup models, including iBuyer, skew traditional as they mature.

4. Where are iBuyers on my 4 stages of tech disruption.

Will post link here when it goes live.

And also see the other links below on how iBuyers can help you directly.

Please reach out with questions or comments.

___

Reference:

– Coronavirus looms over crucial Spring season for housing market

–Zillow is now the Netflix of homes

– Home buying & selling cruises toward car trade-in model, with Opendoor in the driver’s seat

– The 4 Stages of Fintech & Real Estate Startups

– * The NAR survey was delivered March 9, 2020 to 70,036 residential members including 7,000 members in California and Washington, and closed March 10, 2020. The survey had 2,518 useable responses, including 313 from California and 308 from Washington.