The 4 Stages Of Fintech Startups – lessons from Personal Capital rebranding

Early digital wealth management pioneer (aka robo-advisor) Personal Capital just rebranded to be less robo and more personal. This move teaches us about the 4 stages of financial technology (aka fintech) startups. In simplest form, the stages go like this:

4 Stages Of Fintech Startups

1. Evangelize Technology. Consumer finance is totally broken, and this technology will reinvent the financial experience for consumers.

2. Master Customer Acquisition. Weaponize evangelism with super sophisticated and/or massive budget marketing enabling fintechs to gain millions of customers.

3. Go Mainstream. If you last 5 or more years and have gathered at least one million customers, you can make a play as a financial services provider.

4. Settle On Hybrid Digital/Human Model. You eventually figure out regulation and customer need for human advice prevent most financial products from being fully automated.

Quick History On Personal Capital, Wealthfront, Betterment

Personal Capital’s rebranding this week is a great case study on the stages.

I like their new brand positioning, and all self-proclaimed fintech disruptors should study their trajectory.

Personal Capital was founded as a mostly-automated investment advisory service 10 years ago. It was about a year after competitors Betterment and Wealthfront launched.

Together these 3 companies led a trend of getting consumers to put their money in low-cost funds mostly managed by technology.

It was basically Vanguard with sexy tech branding.

This is the right thing for consumers to do with their investable cash. Contribute slowly, let it grow, and don’t overpay on management fees.

But people need advice as life evolves: kids, houses, education, aging parents. Robots can cover some of this advice today. But even if they could cover it all, people still want human advice.

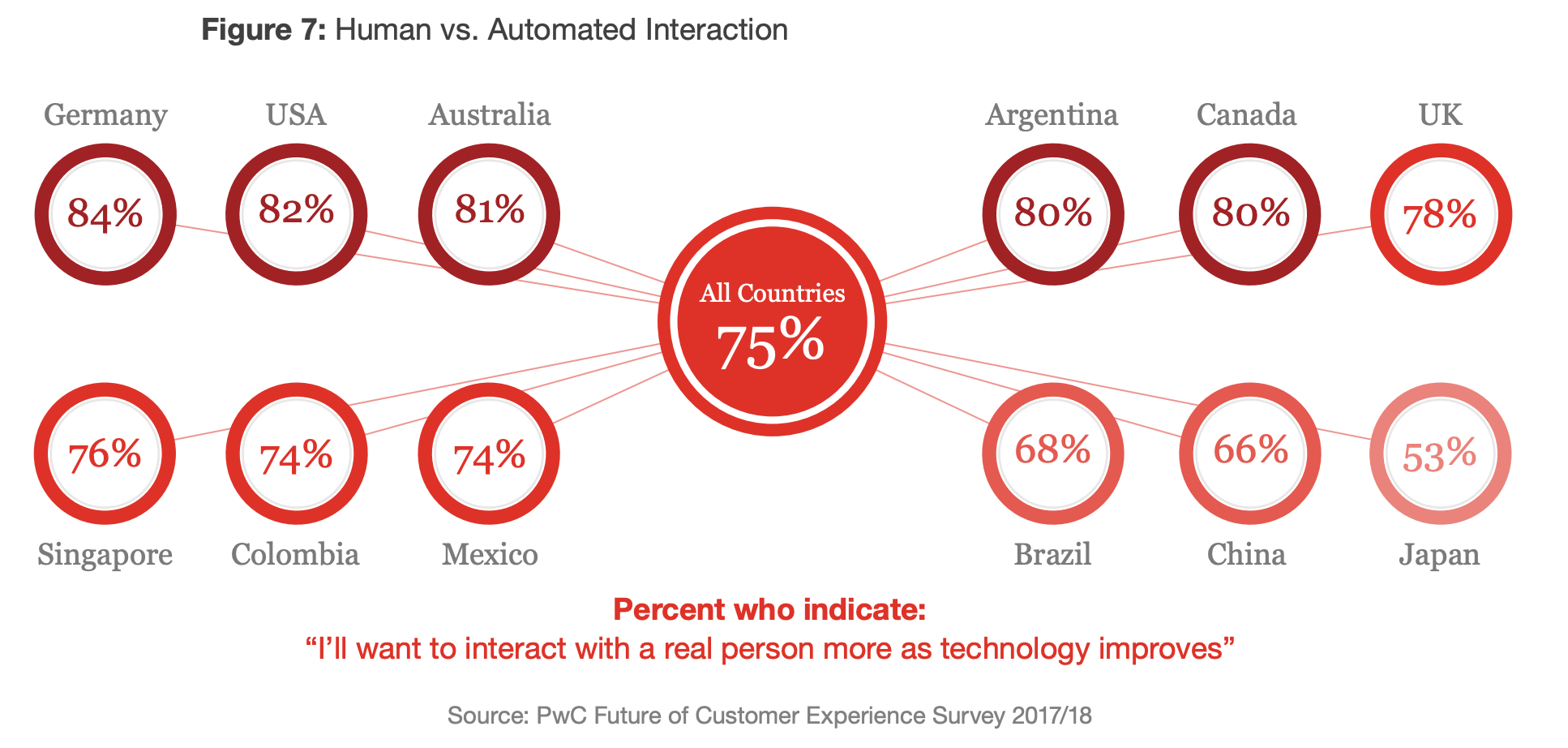

PwC research says 82% of Americans want to interact with a human more as technology improves.

Personal Capital Is Now The Most Human Robo-Advisor

I always thought Personal Capital got this more than most fintech firms, and their new branding validates my theory.

They’ve redone their brand to double down on the personal advice that helped them gather 2 million registered users and $11 billion in client assets.

Here is their old logo vs. their new logo which puts more visual weight on “Personal.”

And their CEO Jay Shah and CMO Porter Gale emphasized Personal Capital’s “North Star” in their brand announcement last week:

“Financial clarity and confidence for families through personalized advice from advisors and personalized insights from our technology.”

This explicit promotion of a hybrid digital/human officially puts Personal Capital into the 4th stage of fintech startups.

Fintech startup stage 4 also means a company is transitioning from startup to incumbent.

And as new incumbents go, Personal Capital is well-positioned to take care of financial services consumers they way they expect to be taken care of.

___

Reference:

– Personal Capital Rebranding Goes All-In On Customer Relationships

– 4 Ways Your Bank & Silicon Valley Are Fighting For Your Wallet

– The 2020 Banking, Housing, Fintech Ecosystem In One Image

– PwC Consumer Experience Research