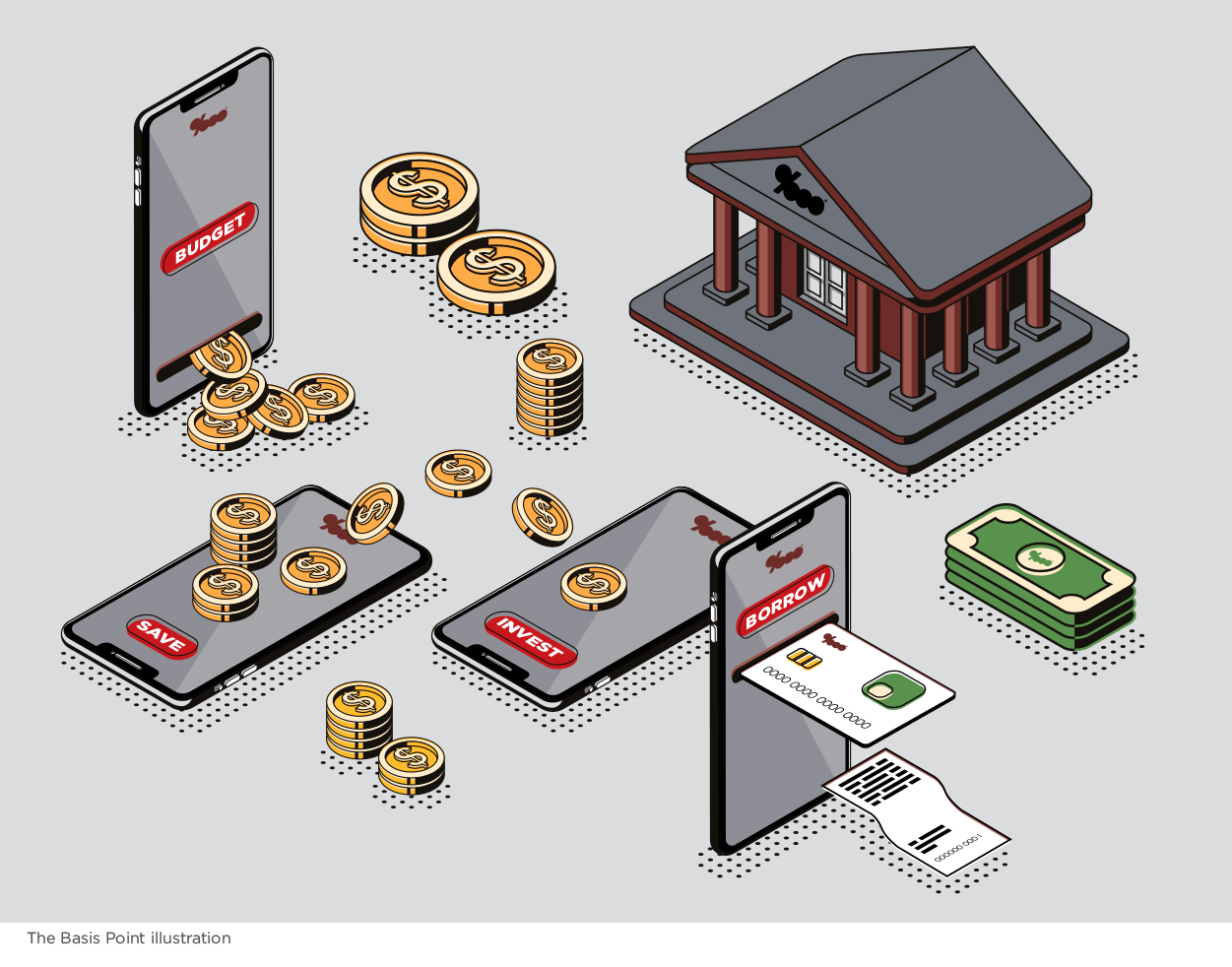

4 Ways Your Bank & Silicon Valley Are Fighting For Your Digital Wallet

Your bank and Silicon Valley are in the fight of their lives for your wallet, and the future of digital banking.

The good news is when they fight, you win. This is a guide to tell you what’s going on, and who you can trust with the 4 pillars of your financial life: budgeting, saving, borrowing, and investing.

Your bank does all of them today, but their tech is still pretty weak.

Meanwhile your digital banking options are growing as the financial technology (aka fintech) revolution turns your phone into a bank.

Can your bank catch up? Or will do you use a new digital bank?

Let’s get into it, starting with a rundown of the 4 pillars.

BANKING PILLAR 1: BUDGETING

This stage of your financial life usually begins in high school or college, but doesn’t get real until you get your first official job.

This stage of your financial life usually begins in high school or college, but doesn’t get real until you get your first official job.

You’re usually not too concerned about saving early career. You’re too busy doing your job, trying to rise up, and not letting the machine drive you nuts.

That last part leads to spending.

Retail and nightlife therapy. You spend money to reclaim your sanity.

At some point you realize you need to watch spending more closely. But where do you watch it?

Through your bank or credit card company? Or using a third-party app that links to your bank and credit card?

Mint pioneered the account linking approach 13 years ago. And these type of apps keep getting better at showing your bank and credit card data to you in a way that’s actually useful.

Big tech is moving in on budgeting too.

Apple, a brand we can all can agree is way cooler than any bank, now helps track spending with its Apple Card and Wallet app.

But Apple Card is still powered by Goldman Sachs, a global bank with about $900 billion in assets and its own slick digital bank called Marcus. So even the biggest tech players still rely on banks to serve you at scale.

Plus big banks and especially startup digital banks (aka challenger banks) are catching up on giving you a clear lens on budgeting and bill paying.

Wells Fargo launched its Control Tower app last Fall to help customers budget, pay bills, and manage accounts.

And UK digital banking startup valued at $2.4 billion called Monzo expanded to the U.S. this summer with its “clever budgeting app”.

Here’s what a digital bank or third party budget app should do for you:

– Categorize purchases by merchant and type (like Food & Beverage) so you can see where you spend most.

– Categorize spending by day, week, month so you can see when expenses hit.

– Let you manually enter and categorize cash transactions.

– Track and pay bills, including bill reminders and auto-pay options (the trick with nonbank autopay is there’s often a fee).

BANKING PILLAR 2: SAVING

This stage begins when your income starts rising. You’re killing it at work, and start seeing those bumps in base salary, bonus, and/or commissions.

This stage begins when your income starts rising. You’re killing it at work, and start seeing those bumps in base salary, bonus, and/or commissions.

And if you’ve developed a budget discipline, you can start saving.

The trick here is goals. What are you saving for? Do you even know what you have to work with? Like how much money is left after your bills?

Once you start budgeting, you’ll know how much you can put toward goals — even if your first goal is paying down credit cards or student loans.

When it’s time to start saving, here’s what you should be able to see and do on your phone:

– Get all budgeting and bill pay functionality as noted above.

– See your bank balances, including direct deposit from your job and/or deposits from entrepreneurial activities.

– See goal suggestions based on all of this data.

These budget tools must give you intel to make decisions. It’s not just money you put aside when you get paid. It’s knowledge and habits. Your bank and/or app should help you build both.

A third party app like Digit analyzes your spending and automatically saves a portion of your disposable income for you. If you want a low-stress way to start saving, this is what you need instead of another bank—unless your bank can do it the same or better.

Or another startup digital bank valued at almost $1 billion might do the trick too. MoneyLion’s Financial Heartbeat is another slick way to gamify budgeting and make it feel cool.

Spending control was your focus in the Budgeting pillar.

But in this Saving pillar, you add income to the equation (via bank account connections) to understand what you have to work with.

There is a relationship between this pillar and the fourth Investing pillar.

Budgeting is early stage with simple goals like knocking down debt, building up your work wardrobe, and prepping for Coachella.

As these goals become more advanced — like saving for retirement — that’s where the Investing pillar comes in. But first, you’ve got some life changes to work through. More on both below.

BANKING PILLAR 3: BORROWING

Even as you’re progressing through the first two pillars, Borrowing has probably been part of your financial life.

Even as you’re progressing through the first two pillars, Borrowing has probably been part of your financial life.

You’ve got $29,000 in student loans.

Your $8,500 credit card balance won’t seem to go down.

Your car loan is almost done, but so is your car, and you’ll need a loan to replace it.

This is where the Borrowing pillar starts.

According to June 2019 research The Basis Point conducted Blend and Source media, auto loans are the second most common banking product for 18-35 year olds after checking and savings accounts.

Makes sense. First you get your bank accounts going. Then you budget and save. Then you get the new car.

From there, you progress into home buying as you settle into your career and look toward family life.

If you’ve been engaging on the first two pillars, your bank and/or app now has the right data to help you borrow responsibly.

All lenders approve loans based on something they call a debt-to-income ratio (DTI).

DTI sounds technical, but it’s just your total monthly expenses divided by your total monthly income.

Lenders will make you loans if the resulting percentage isn’t too high.

For example, if you’re looking to buy a home, lenders don’t want your DTI too far above 43%, and you might want your DTI lower than that.

Borrowing is a part of life, so it should be way easier than it is. If you’re applying for a loan, you should be able to do the following from your phone or any other device:

– Apply for the loan

– Choose loan programs and rates

– Direct-connect to income and asset documentation and/or be able to upload documents needed to approve your loan

– Get updates on your application and loan status from any device

– Sign documents throughout the process

– Be able to talk to a smart human advisor any time you need something explained

Some hip digital banks have a head start on offering you this level of service. SoFi cut its teeth as a friendlier student lender that speaks your language.

Now SoFi is valued at $4.3 billion and is expanding into the other pillars to offer you that relatable service in all aspects of your financial life.

As you’ll see below, that’s the life cycle of these challenger banks.

BANKING PILLAR 4: INVESTING

The investing stage is the final pillar, and it means your financial life is stabilizing.

The investing stage is the final pillar, and it means your financial life is stabilizing.

Maybe you’ve been participating in your company’s 401(k) to this point.

You’ve also been promoted a couple times, maybe some stock has vested, and now it’s time to max out your annual contribution. Because you get to do so using pre-tax dollars.

Maybe you also bought a home, and you’re doing fine on the payments.

Then you have your first kid, and it hits you:

What about college? I’ll be 20 years older then, so what about retirement? And where will I even want to live then?

That’s when you must understand other investments like Roth IRAs, college savings plans like 529s, and perhaps a second home or rental property.

Right now today, there are digital-native investing companies like Wealthfront and Personal Capital that let you open brokerage and investing accounts to do this.

Until recently, they didn’t focus on the rest of the pillars you’ve been working on, but that’s changing fast.

Wealthfront now says “save, plan, and invest all in one place.”

Personal Capital says it’s the “smart way to track and manage your financial life.”

And another challenger bank called Betterment also started with a cheap, easy way for you to invest, and are now expanding into the savings pillar.

There are good standalone investing apps if you’re more into trading. The marketing leader right now is Robinhood, which is valued at $7.6 billion and is also expanding into the savings pillar. And Stocktwits is the coolest one for a pure trading and community experience.

But if we’re talking about building your life with the pillars, then you need investing services at this point in life that let you:

– See where all your assets are on your phone

– Project how well you’re doing on meeting your long-term goals

– Recommend investment products that work towards those goals

– And again, give you quick access to a human pro that can go deep as your planning gets more complex

On that note, Betterment is also doing smart deals with cool real life wealth managers like Ritholtz Wealth Management so you can get the best of digital simplicity AND smart human advice.

DO YOU WORK WITH A DIGITAL BANK STARTUP?

Now that you’ve seen how the 4 pillars play out, you can see why these digital banks are expanding to try and serve every aspect of your financial life.

But they’ve got huge competition from big tech companies, and from your bank which is rebuilding its tech under the hood as you read this.

So who do you work with?

Can you see and do all of the above functions on your phone with the bank you have today?

Unlikely.

But as noted, the challenger banks and financial apps are solving that.

They didn’t start with branches 100 years ago.

They got hundreds of millions in venture capital to fund their bank-on-your-phone vision in recent years. Now many of these companies — including the examples mentioned above — are worth billions.

Most of these startups that began as apps pivoted to banking service providers.

Each one starts with a different financial life pillar, but they generally all get your financial life trajectory of budgeting, saving, borrowing, investing.

A few more leading challenger banks to consider that aren’t mentioned above are:

– Acorns, valued at almost $1 billion, started with saving and investing, and now it has a savings account, debit card, and financial education brand with CNBC.

–Varo, which has an undisclosed valuation, is the closest to being a real bank approved by U.S. regulators. They’re a mobile banking app with no account fees, high-yield savings, and the ability to get your paycheck direct deposited 2 days early.

– Chime, valued at $1.5 billion, focuses on budgeting and saving pillars, and helps people “lead healthier financial lives.” In the race with Varo, they now also push getting paid 2 days early.

– Revolut, another UK firm valued at $1.7 billion that’s expanding to the U.S. like Monzo. They focus on budgeting as well as payments and transfers (think Venmo but global).

– N26, a German bank valued at $3.5 billion that’s expanding to the U.S. They also began with budgeting and global payments and transfers. But now they’re expanding into borrowing. And yes, you can get paid 2 days early by direct depositing your paycheck!

The endgame for all is to to be your bank.

SHOULD APPLE OR T-MOBILE BE YOUR NEW DIGITAL BANK?

You can also now start your banking services with Apple.

No joke.

The Apple Credit Card noted in the budgeting pillar above has taken hits for “just being a credit card.”

But who’s better than Apple at making complex things simple?

They show your spending in a way that’s so cool, it’s almost fun to budget.

So when you get sucked in on the budgeting, you can add the other pillars.

All the other companies discussed are doing this. But most of us already have an iPhone in hand, so Apple Card seems like an easy addition.

And speaking of budgeting with your phone in hand, next time you look at your T Mobile bill, remember this:

T Mobile Money launched this year, so they’re a bank now too.

Yes, your mobile service provider can now give you high-yield checking and savings and a credit card as your saving and borrowing pillars.

Of all banking services, this one leads to the most questions of whether you can trust it.

OR CAN YOUR CURRENT BANK GO DIGITAL?

Remember this question from above: Who’s better than Apple at making complex things simple?

Now let’s answer it: Your bank, when powered by a separate crop of fintech companies.

There are two classes of fintechs, those that are trying to be banks as discussed above, and those that power the bank you already have.

Some of these companies also have billion dollar valuations, and they make your bank cool again.

One example here is Blend, which is worth about a billion, counts giant banks like Wells Fargo and US Bank as customers, and they began by supporting banks on the borrowing pillar.

You don’t overtly see these companies as a consumer, but a company like Blend processes $2 billion in loans per day for lenders that comprise about 25% of the U.S. mortgage market. And now they’re moving into deposits, insurance, and the rest of your bank’s offerings.

That’s the thing: your bank already offers all 4 pillars, they have all the regulatory compliance, and safety.

But they don’t have that beautiful bank-on-your-phone experience. Yet.

So they team up with startups like Blend and Plaid to give you the experience you deserve across all the pillars.

HOW DO YOU CHOOSE TODAY?

As this plays out in the next 1-3 years, you may be well served to stick with a fintech-powered bank.

They already know all 4 pillars, and now they’re getting the technology.

So ask them if they can offer you each of these pillars on your phone.

If they don’t have budgeting — which is one of the coolest ways for you to engage with your finances daily — ask them when they’re getting it.

And if they don’t have a good answer, you may want to go with one of these new digital banks — even if it’s just for that budgeting function.

But don’t be surprised if one of them is bought by the bank you’re already with. This has already started to happen.

For example, Clarity Money was started in 2016 by Adam Dell, brother of PC computer king Michael Dell, as a pillar 1 budgeting app. And in 2018, he sold it to the 149 year-old banking giant Goldman Sachs and it became the front end of their new full service digital bank called Marcus.

We’ll start to see this more and more as the fintech cycle matures, and the economic cycle turns in 2020.

Next time, we’ll go deeper on bank and startup dealmaking trends.

Follow along with the buttons below. And hit us with questions.