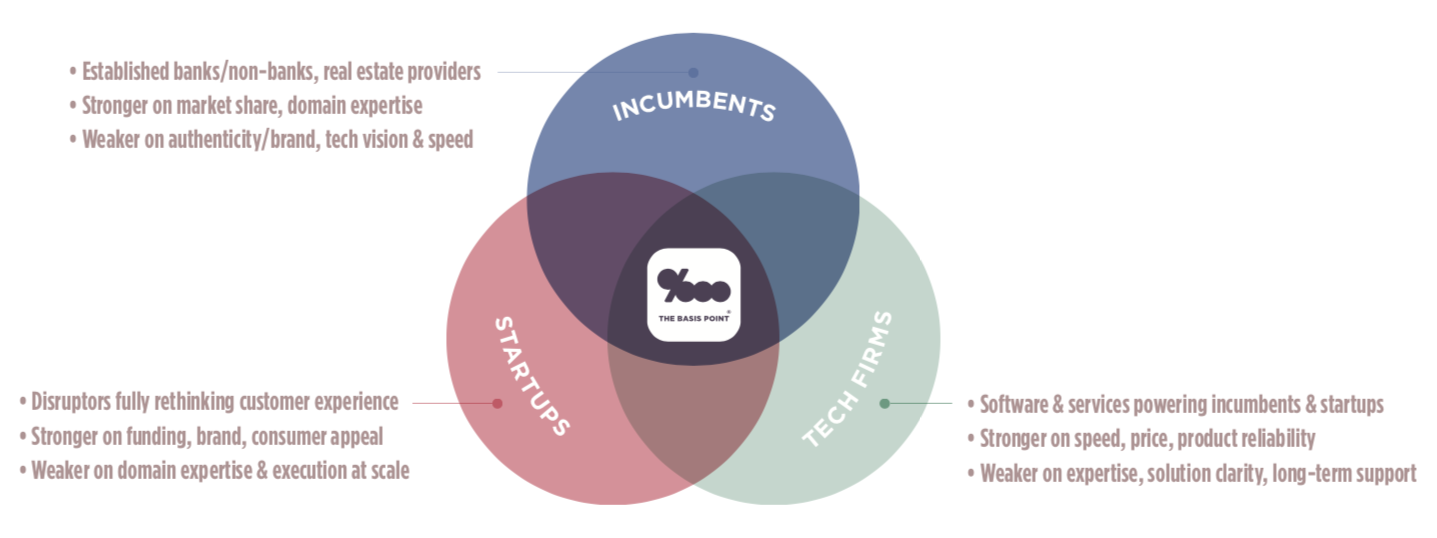

The 2020 Banking, Housing, Fintech Ecosystem In One Image

Here’s how The Basis Point sees the 2020 consumer banking and real estate world in one single image.

We use this Venn diagram to explain how our consulting business advises from the center of a converging landscape.

It’s also useful to explain to consumers how banks and real estate companies who serve you are offering more services under one roof.

YOUR BANK VS. APPLE & ZILLOW

Zillow used to just power your home search. Now you can buy, sell, or finance your home there. They were a Startup that’s maturing into an Incumbent.

Apple and T Mobile used to just power your mobile life. Now you can bank with them. These big tech Incumbents are now coming into consumer finance.

And all this innovation was starting to make your bank feel dusty. Now hot new software startups in the Tech Firm category power your bank and make it cool again.

WHAT BANKING & REAL ESTATE LOOKS LIKE IN 2020

Then there are Startups who serve you directly with banking and real state services.

– Today this category includes startups like SoFi, Chime, Varo Money, Acorns, Monzo, Revolut, and N26 who offer budgeting, saving, and non-mortgage borrowing like personal and student loans.

– Same for investing. Today Startup “robo-advisors” like Betterment, Wealthfront, and Personal Capital make it super easy to safely invest and manage your money on your phone.

– And same in real estate. Startups like Opendoor and Offerpad provide that same one-stop shop for home buying, selling and financing as Zillow does.

These Startups are starting to get 3 things right:

1. Mastering the art of connecting with you online.

2. Making it super easy to get loans, buy/sell homes, make investments, etc. on your phone.

3. Bringing in human advice seamlessly along a digitally driven process.

Meanwhile, the Tech Firms increasingly power Incumbents which already have you as a customer and smart humans to advise you. Now they’re plugging in new Tech Firm software to let you bank on your phone.

Plus Incumbents are very good at doing really hard, highly regulated products like mortgage.

Startup banks have major regulatory and product experience hurdles in areas like mortgage.

CAN INCUMBENTS INNOVATE BEFORE STARTUPS GET MARKET SHARE?

This is a key trend as we look forward to banking in 2020.

Will you do your other banking — saving, investing, etc. — with a startup because it’s cool and easy today?

Or will you hold with your current bank while they upgrade tech because they’ve already got a full product set?

All of this comes down to a question I’ve been asking as this plays out:

Can Incumbents get innovation before startups get market share?

Short answer: Yes.

Longer answer: All these categories will continue converging in the race to serve you better.

Convergence means marketing and tech partnerships, and it also means banking and real estate M&A.

This Venn image should generally hold in the banking 2020 landscape, but we’ll revise accordingly as it evolves.

In fact, we’ve already done a revision that I’ll share shortly.

But for now, please see Reference links below to dive deeper on these themes. And please hit me with questions.

___

Reference:

– 4 Ways Banks & Silicon Valley Are Fighting For Your Wallet

– Can incumbent banks get innovation before startups get market share?

– How Zillow Makes Billions Reinventing How We Buy & Sell Homes

– Credit card “created by Apple, not a bank” – powered by a giant bank

– Introducing…the bank of T Mobile?! Can you hear me now?

– Blend reaches unicorn status by making banks cool

– Who’ll be the Amazon of housing?

– Fintech lenders: ignore mortgage competitors at your own risk

– Fintech & real estate M&A tsunami rising into Fall 2019