Key stats & quotes from 1Q23 Wells Fargo, JP Morgan, Citigroup earnings

Bank earnings are especially important for 1Q23 given the acute strain the sector came under in March. Silicon Valley Bank and Signature Bank failed and were eventually sold to First Citizens and NYCB’s Flagstar division, respectively. And First Republic got a big bank bailout and fought off sale rumors.

First Republic doesn’t report earnings until April 24, but top big banks JP Morgan, Wells Fargo, and Citigroup have already reported. Here are some key stats from earnings reports and quotes on critical topics from conference calls — topics include commercial real estate, inflation, recession, and regulatory outlook after the March bank crisis.

1Q23 BANK EARNINGS: JP MORGAN CHASE

– $12.6 billion of net income on $39.3 billion in revenue.

– Estimated new deposits of about $50 billion during March crisis, but set expectations they might not keep all of this.

– Below are some key quotes on hot topics from their earnings call.

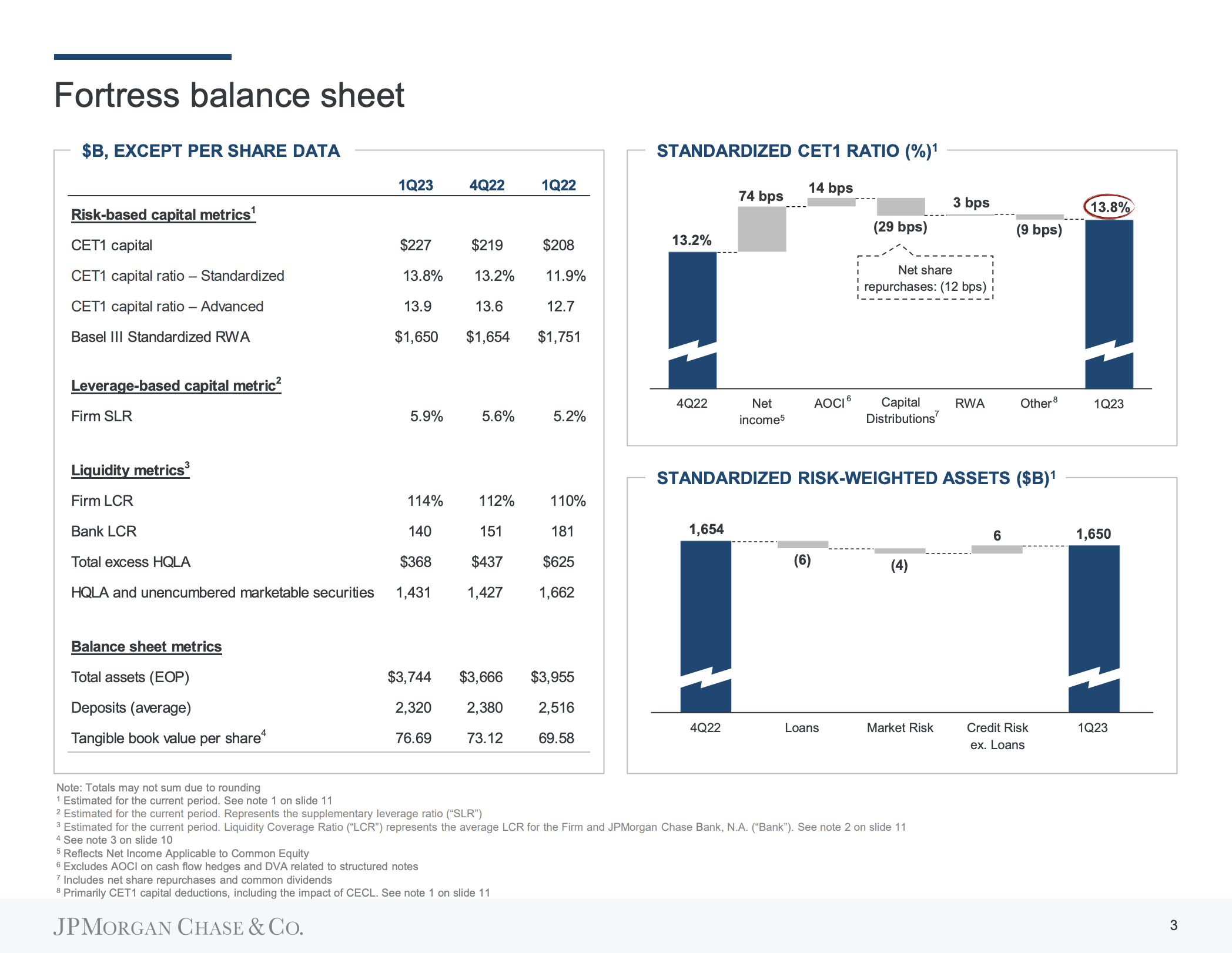

– Also below is JP Morgan’s “fortress balance sheet” which has $3.7 trillion in assets and $2.3 trillion in deposits.

– Jamie Dimon on whether re-regulation is needed or just an upgrading of definitions of systemically important banks so that regional banks don’t experience this issue again:

We’re hoping that everyone just takes a deep breath and looks at what happened, and the breadth and depth of regulations already in place. Obviously, when something happens like this, you should adjust, think about it. So I think down the road, there may be some limitations on held to maturity, maybe more TLAC for certain type size banks and more scrutiny and history exposure, stuff like that. But it doesn’t have to be a revamp of the whole system. It’s just recalibrating things the right way. I think it should be done knowing what you want the outcome to be. The outcome you should want is very strong community and regional banks. And certain actions are taking, which are drastic, it could actually make them weaker. So, that’s all it is. We do expect higher capital from Basel IV effectively. And obviously, there’s going to be an FDIC assessment. That will be what it is.

– Jamie Dimon on inflation and recession outlook:

Obviously, the short-term read is higher recessionary risk, but — and then inflation coming down. So I think inflation will come down a little bit. It could easily be stickier than people think, and therefore, the rate curve will have to go up a little bit.

– Jamie Dimon on whether banks will lend less and create a credit crunch, and whether commercial real estate (“certain real estate things”) contributes to this:

I wouldn’t use the word credit crunch, if I were you. Obviously, there’s going to be a little bit of tightening. And most of that will be around certain real estate things. You’ve heard it from real estate investors already. So I just look at that as a kind of a thumb on the scale. It just makes the finance conditions will be a little bit tighter, increases the odds of a recession. That’s what that is. It’s not like a credit crunch.

– Jamie Dimon on whether regional bank earnings will be good or bad.

You’re going to see next week regional banks have pretty good numbers. A lot of people are going to have — can take actions to remediate some of the issues they may have going forward. You’ve already seen things calm down quite a bit, particularly in deposit flows. Warren Buffett was on TV talking about that he would bet $1 million, I don’t know if you saw that, that no depositor will lose money in America. Of course you know, he is a very bright man. So, this crisis is not away. It will pass. And the one thing I pointed out is that when I answered the question just before about interest rates, people need to be prepared. They shouldn’t pray that they don’t go up. They should prepare for them going up. And if it doesn’t happen, serendipity.

1Q23 BANK EARNINGS: WELLS FARGO

– $5 billion in net income on revenue of $20.7 billion.

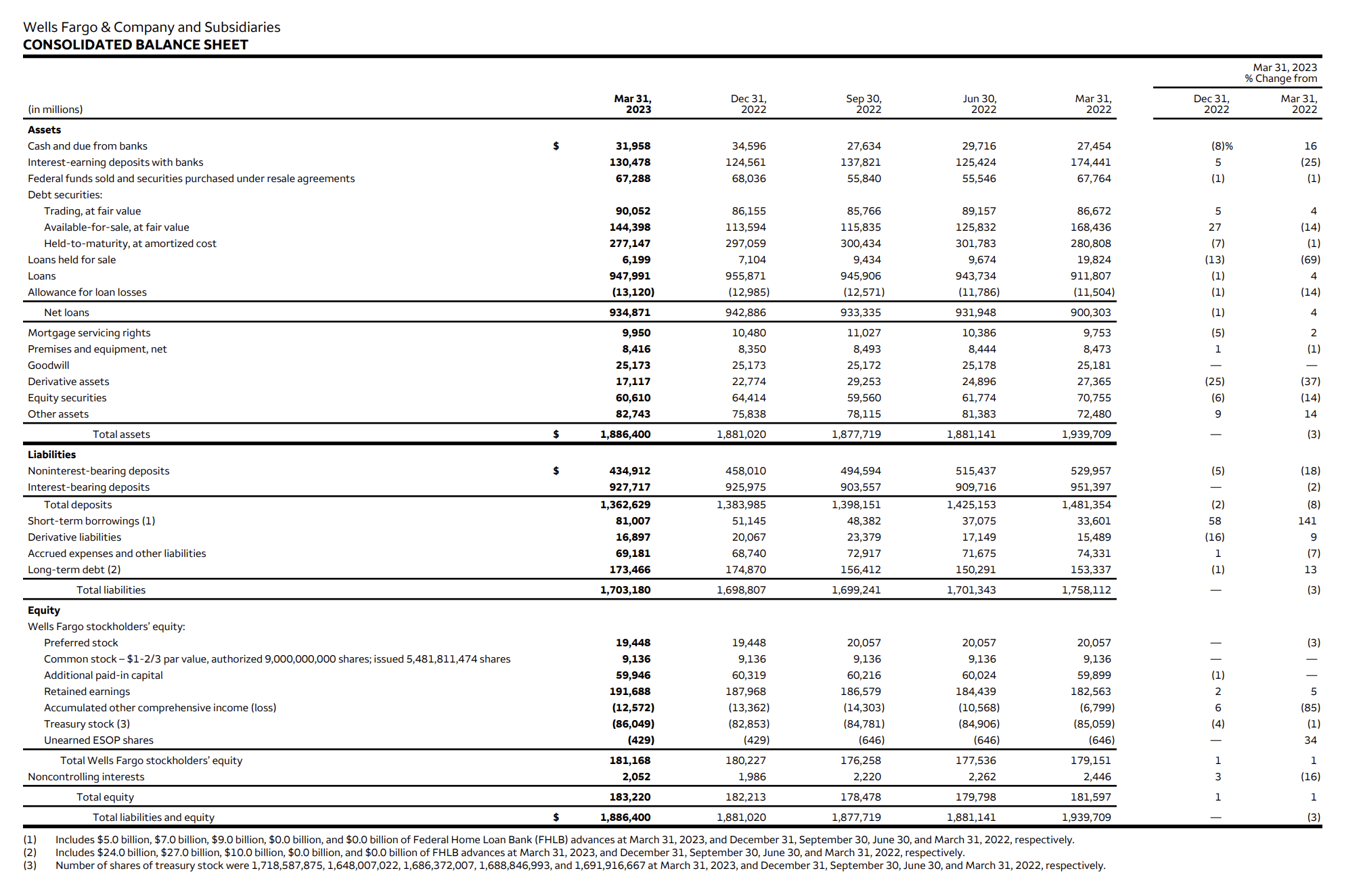

– The balance sheet below shows $1.9 trillion in assets and $1.3 trillion in deposits.

Charlie Scharf on helping regional banks and the need for banks of all sizes.

Along with 10 other large banks, we utilized our strength and liquidity, and we made a $5 billion uninsured deposit into First Republic Bank, reflecting our confidence in the country’s banking system and to help provide First Republic with liquidity to continue serving its customers.

I’m proud of everything our employees have done during this historic period to be there for our customers. We believe banks of all sizes are an important part of our financial system as each is uniquely positioned to serve their customers and communities. It’s important to recognize that banks have different operating models and that the banks that fail in the first quarter were quite different from what people think of when they think about the typical regional bank.

Charlie Scharf on digital adoption among Wells Fargo customers:

Digital adoption and usage among our consumer customers continued to increase. We added over 500,000 mobile active customers in the first quarter and digital logins increased 6% from a year ago. Since rolling out Vantage, our new enhanced digital experience for our commercial and corporate clients late last year, we’ve received overwhelmingly positive feedback on the new user experience. Vantage uses AI and machine learning to provide a tailored and intuitive platform based on our clients’ specific needs.

Charlie Scharf on racial equity initiatives:

We also continued to make progress on our environmental, social, and governance work. We announced a $50 million grant to the NAACP to support efforts to advance racial equity in America.

This is the single largest donation at the NAACP has ever received from the corporation and builds on our long-standing relationship with the NAACP that spans more than 20 years. The Wells Fargo Foundation expanded its commitment to housing affordability through another $20 million housing affordability breakthrough challenge to advance ideas to help meet the need for more affordable homes across the country.

We also announced a $20 million commitment to advance economic opportunities in Native American communities including addressing housing, small business, financial health and sustainability. Before concluding, I wanted to highlight the management changes we announced yesterday.

Charlie Scharf on Wells Fargo commercial real estate risk:

We have $154.7 billion of commercial real estate loans outstanding at the end of the first quarter with 35.7% of office loans, which represented 4% of our total loans outstanding. The office market continues to show signs of weakness due to lower demand, higher financing costs and challenging capital market conditions. While we haven’t seen this translate to meaningful loss content yet, we expect to see more stress over time.

As you would expect, we have been derisking the office portfolio, which resulted in commitments declining 5% from a year ago, and we continue to proactively work with borrowers to manage our exposure, including structural enhancements and paydowns as warranted. [In] the office portfolio, approximately 12% is owner occupied. Therefore, the loan performance is mostly tied to the cash flow of the owner’s operating business rather than rents paid by tenants. Nearly one third had recourse to a guarantor typically through a repayment guarantee. The portfolio is geographically diverse, and as you’d expect, the largest concentrations are in California and New York. Over two third of our office loans are in the corporate investment banking business, and the vast majority of this portfolio is institutional quality real estate with high-caliber sponsors.

While approximately 80% of its cost, keep in mind that this is a single measure that is hard to evaluate in isolation. For example, newer or refurbished properties may perform better regardless of whether they are at A or B. We are providing this data to give you more insight into the portfolio, but as is usually the case in commercial real estate, each property situation is different and a myriad of other variables, such as leasing rates, loan-to-value and debt yields can determine performance, which is why we regularly review the portfolio on a loan-by-loan basis.

Charlie Scharf on Wells Fargo reducing their mortgage business as previously announced:

Our home lending revenue declined 42% from a year ago, driven by lower mortgage originations and including a significant decline from the correspondent channel and lower revenue from the resecuritization of loans purchased from securitization pools.

We continue to reduce headcount in the first quarter, and we expect staffing levels will continue to decline due to the strategic changes we announced earlier this year. We stopped accepting applications from the correspondent channel as announced in January and begin to reduce the complexity and the size of the servicing book.

During the first quarter, we successfully marketed mortgage servicing rights for approximately $50 billion of loans serviced for others that we expect to close later this year. We will continue to look for additional opportunities to simplify and reduce the size of our servicing business.

1Q23 BANK EARNINGS: CITIBANK

– $4.6 billion in net income on revenue of $21.4 billion.

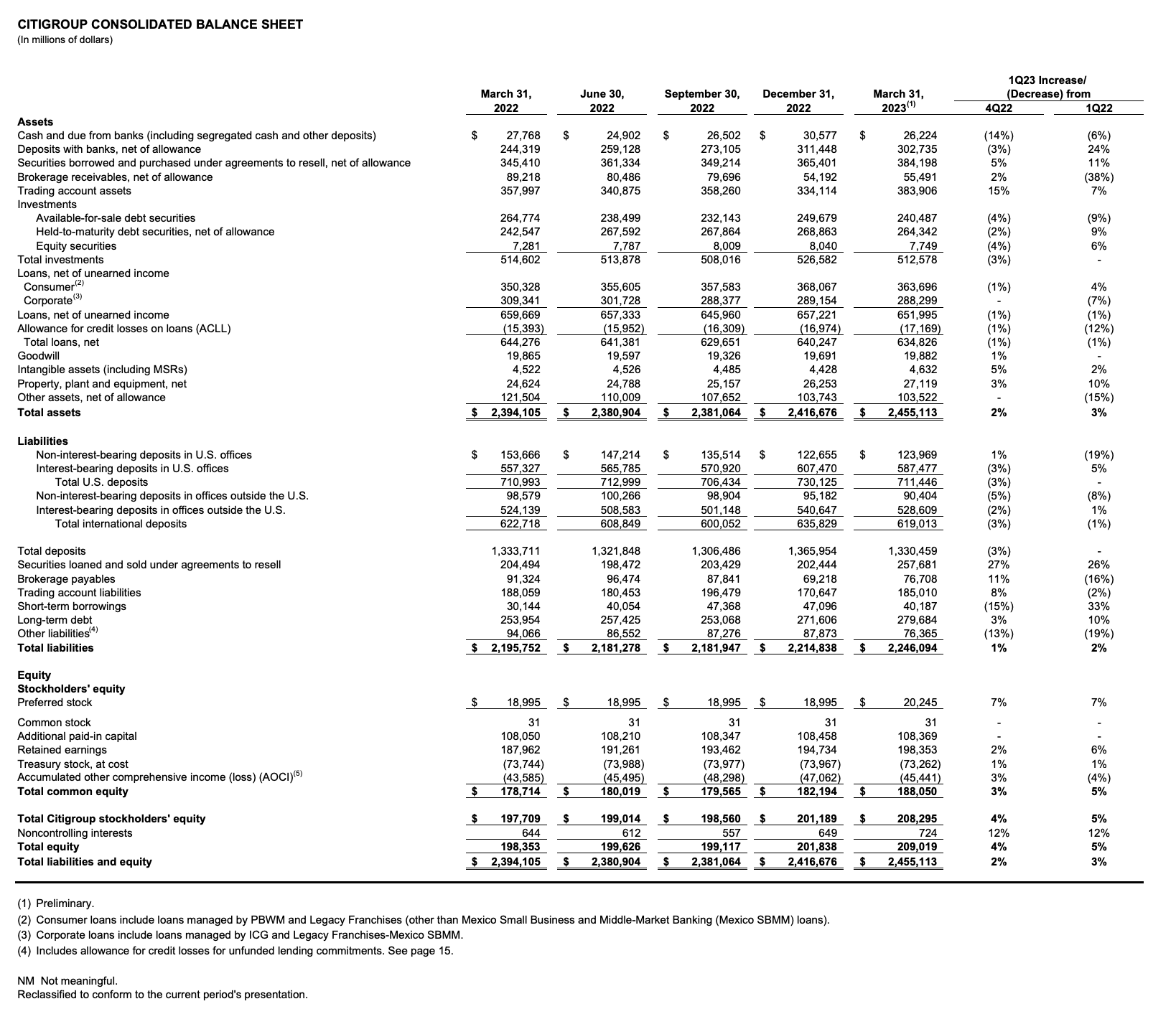

– The balance sheet below shows $2.4 trillion in assets and $1.3 trillion in deposits.

– Jane Fraser on the role of big banks like Citi in a crisis:

First, our banking system as a whole is very strong. While a small handful of institutions still have challenges to overcome, the U.S. financial system remains unmatched globally. And I feel confident saying that as someone who has worked in many different systems around the world. The U.S. system comprises a healthy mix of community banks, regional banks and larger global banks, including Citi. We all have important but different roles to play, serving different clients with different needs and on different scale.

I would also point to the rapid response by state, federal and international regulators that help reinforce confidence in the system at a very critical juncture. I am pleased that Citi has been a source of stability for the financial system and a source of strength for our clients. That’s not an accident. We are in a position to play this role, because our strategy is delivering a simpler, more focused bank. We benefit from a diversified earnings base and resilient business model. This is reinforced by our robust balance sheet management, liquidity position and strong risk management frameworks. We are disciplined in how we run the firm from client selection to capital planning. And it’s also thanks to our people. And I want to express my pride in our colleagues around the world who worked tirelessly last month to serve clients as they turn to Citi as a port in the storm. Recent events have shown that prudent asset and liability management is absolutely paramount.

Jane Fraser on whether deposits are stickier or harder to retain in a digital age:

I feel very comfortable about how very well diversified our deposit bases across different countries, industries, clients and currencies. And it’s extremely strong in that respect. And as you say, the majority of the institutional deposits are integrated into the operating accounts all around the world to enable the clients to run their day-to-day operations, the payroll, the working capital, the supplier financing, etcetera.

And I think what’s changed in the more digital world is, frankly, these have become even stickier because the amount of data, the extent of integration into the technology platforms and systems of the clients and the value that we extract and present back to the clients from the combination of our FX, trade, cash, etcetera, flows is incredibly important for their – and driving their efficiency, their risk management and their financial performance as well. So both the extent of that diversification and the increasing stickiness versus history is something that we’re certainly not complacent about.

Note Fraser also spoke about digital era bank runs and deposit challenges here.

– Jane Fraser on whether more regulation is needed to avert crisis going forward:

Well, I would say that we hope that there will be a thoughtful and targeted approach to any changes in the regulatory and capital framework, and that they address the root causes of what actually happened here. And what happened is a combination of macro impacts from the sharp rapid rate increases and some idiosyncratic situation, namely a lack of proper asset and liability management at a small handful of banks.

We don’t see these issues as pervasive throughout the broader banking industry. But the events certainly highlight the importance of prudent asset and liability management. We still believe that there is plenty of capital amongst the large banks. And if capital requirements were to increase for the large banks by the regulators, it would exacerbate any credit tightening that might go on.

What continues to keep me most awake at night is the quantity and quality of activity in the shadow banking industry. It does not benefit from the same regulatory frameworks and protections for participants. And I amongst others fear that more activity getting driven into it, if the banking capital requirements increase, will be through the detriment of system, strength and stability. So, we hope that this approach will be thoughtful and targeted to where the issues actually were.

We thought that the regulators, both at the local and the national and the international level, were very – were swift and effective in making sure that they tackle the issues that were in front, and we were absolutely delighted that the large banks acted as a source of strength.

In the face of tremendous market uncertainty, 11 of the largest U.S. banks were able to come together to inject $30 billion of deposits into First Republic in little over one day. And that speaks volumes for our capital and balance sheet positions.

I think the responsibility of large institutions and recognizing that we also play an important role here in helping stabilize situations like this. And we thought it was very important to help buy some time and also demonstrate our confidence in the overall U.S. banking system.

___

Reference:

– 1Q 2023 bank earnings dates & signals (TBP)

– There Was No Crisis for JPMorgan and Its Big-Bank Peers (WSJ)