LendIt Fintech 2019 Liveblog – Day 1

The Basis Point team is on-site at LendIt Fintech in San Francisco today and tomorrow, the who’s who of top dogs in consumer finance and technology. This conference is where the consumer finance industry previews a future where things like getting a mortgage aren’t a huge headache for you.

We’ll be bringing you all the things you need to know from LendIt here in our liveblog. Watch this space for updates.

+++

LendIt kicked off content with a discussion on how to get more people access to credit. Anyone who’s jumped through all the hoops of getting a loan knows even if you have good credit, it’s a slog. So what about people who don’t have a credit score or traditionally good credit but can still pay back a loan? Well, that’s where high tech like machine learning comes in.

ZestFinance CEO Douglas Merrill, Discover CEO Roger Hochschild and Bloomberg reporter Selina Wang talked about why Discover and ZestFinance teamed up. ZestFinance helps lenders give people access to credit by selling them super-high tech underwriting algorithms, and they just inked a deal with Discover to help Discover make loans to more people.

Wang pushed both Merrill and Hochschild on whether algorithms could still discriminate against potential borrowers. Merrill gave a little ground, saying “It’s not a slam dunk yet, but you’re pushing against the tide if you’re not behind AI.”

Hochschild said that since Discover is so heavily regulated, he has to make sure algorithms don’t discriminate (see what happened to Facebook lately when they didn’t do that).

Merrill gave a classic bit of Silicon Valley hyperbole, saying that the FICO credit score was one of the greatest inventions of the 20th century. He continued by saying we’ll always have credit scores—they aren’t going to be disrupted away. But next-gen credit scores might include different factors. (Side note: Merrill looks like a boss. Black skinny jeans, hair down to his shoulders, earrings, black nail polish—kudos to LendIt for waking us up with a finance rock star).

We totally mean it—the guy tweeting this has a nose piercing and earrings himself 😉 https://t.co/VCjzjo8Szu

— Julian Hebron (@TheBasisPoint) April 8, 2019

Hochschild followed up by saying “You know someone’s rating on eBay, their rider score on Uber. It’s not far-fetched to think data like that might become part of your credit score.”

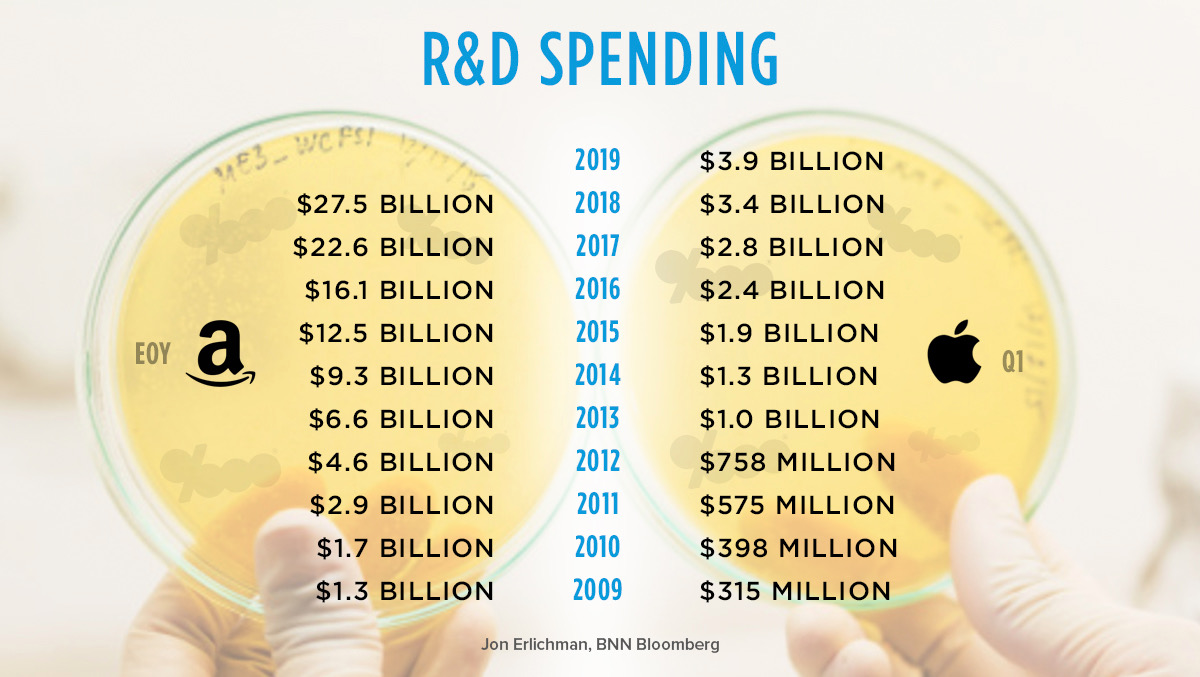

Wang asked Merrill and Hochschild if they’re afraid of going up against a potential Bank of Apple or Bank of Amazon. Hochschild isn’t afraid of them, though. He says Discover has so much experience dealing with regulators that Apple and Amazon don’t have, and it will take them time to catch up.

He should watch his back, given the ridiculous amounts of cash and talent Amazon and Apple put into R&D, as you can see here.

+++

Now we have PayPal mafioso and Affirm founder Max Levchin with CNBC’s Deirdre Bosa. Affirm lets you take out small loans to fund purchases, and the reason it’s A Big Deal is because you can use it to get a loan while checking out at a store or online very quickly.

Levchin just raised a ton of money to grow Affirm and signed a deal to offer layaway loans to Walmart customers, so they’re riding high.

Levchin: “Affirm’s NPS score is 83, so people think Affirm is the best thing since sliced bread.”

Bosa said some people have called Affirm “modern day loan sharks rebranded for millennials.” Levchin joked “loan sharks ask for payment bi-weekly, we do monthly.”

“A symptom of what’s wrong with financial services is executives at banks just think of their customers as return on equity,” Levchin said. “Working with Walmart was refreshing since everyone there is obsessed with customer experience.” He continued by referencing how Walmart no longer charged Walmart card holders deferred interest as a reason Affirm wanted to work with them.

“We don’t want to partner with companies that make half their money on late fees,” Levchin said.

Bosa said that Affirm has never been through a recession, and asked Levchin what his plan is. He said Affirm is definitely planning for a recession—they know it’s coming. “Anyone who’s not doing self-imposed stress testing [is setting themselves up to fail]. We have an example from 2008 that shows what happens when you have no capital left to lend.”

“When the tide goes out, you can tell who’s wearing underpants,” he concluded. “Not a lot of companies right now are wearing underpants.”

Bosa asked what Affirm would do if Amazon rolled out its own layaway program. Levchin said Amazon doesn’t keep him up at night (hiring engineers does), but that it’s better to assume they will go into financial services. “Amazon will embrace the kind of products Affirm creates, and that will be good for us. People are used to being hammered for fees, so if Amazon stands up and says ‘no more late fees,’ that will be good for the industry and everyone will benefit.”

+++

Next up is Sallie Krawcheck, CEO of Ellevest. Krawcheck was CFO of Citi and is one of the most decorated finance veterans out there, and she started Ellevest to put more money in the hands of women.

“Very few people are working on something that will help women get millions more dollars over the course of their lives, which is investing. That’s what Ellevest does,” Krawcheck said.

“The finance industry tells women they aren’t good at investing, so a lot of women don’t invest,” Krawcheck said. “We’ve built an industry that does a better job for guys—80% of financial advisors are men. We approach investing completely different. It’s not about just marketing to women, it’s building investing products that work for women, Women are goals-focused and investing for us should be about building to your goals.”

“Women control $7 trillion of investable assets across the world,” Krawcheck said. “We’re not a niche market!”

Ellevest customers tend to be women (and men!) who “have agency over their money.” They range from age 18 to 80 in all U.S. states.

“Financial advice isn’t ‘don’t buy a latte.’ It’s about the cost of taking a career break, and how investing can make up for that.”

Krawcheck made some great points about how women are financially disempowered and how financial imbalances of power fuel sexual harassment in the workplace.

“In order for gender equality to happen, we all need to do something different. Having powerful women come in to speak to your workforce doesn’t work. Women need to band together and engage management and demand change.”

+++

Next up is former SoFi CEO and current Figure CEO Mike Cagney.

Cagney dove right into a super-technical discussion of blockchain, which, as John Oliver once said when describing Bitcoin, is “everything you don’t know about money combined with everything you don’t know about computers.”

Basically, all you need to know is Figure and a company it works closely with called Provenance are making a fancy database that you’ll send all your loan documents to in the future. You’ll be able to access all your docs whenever you want and so will the bank so nothing will get lost in the shuffle.

Now it’s time for a quick break for some meetings. Check back here shortly for more of the latest in consumer finance and technology.

+++

After a much-needed coffee break, I checked out a presentation by Stanford professor Ken Singleton titled “Fintech and the Roots of Financial Health.” Singleton talked about whether hot new finance apps and companies can really change peoples’ financial behavior. I myself frequently ask whether finance can disrupt itself out of peoples’ bad circumstances or bad habits (I’m not sold on whether it can yet), so this was keenly interesting to me.

Singleton thinks finance needs to create a “digital mentor” that can help people make financial decisions. He cited data that said millennials were more likely to start investing before they turned 21 if their parents mentored them as they started investing. While that’s kind of a “well, duh” moment, since obviously you’re more likely to start investing if your parents help you, it does go to show that people need help getting started planning their financial lives. There’s a big opportunity there for the fintech company that can replicate that kind of mentorship with an app.

That digital mentor will need to be gig-economy ready, Singleton said. Since the state of work/life balance is so f***ed up, financial services need to help full-time freelancers sort out their earnings.

+++

The next presentation featured MoneyLion CEO Dee Choubey, Tally CEO Jason Brown, Dave.com CEO Jason Wilk, Learlux CEO Rebecca Liebman and CIM partner Jacob Haar, all talking about how the hip new age of consumer finance products can help you make better financial decisions.

Tally is an automated debt manager—you download an app, scan your credit cards in, and Tally pays your credit card bills for you. You just pay Tally directly for the convenience.

MoneyLion is an app with a ton of financial products in it like a checking account, an investment manager, and a way to get loans directly from MoneyLion. (We’re big fans—check out how Dee talks to the consumer here).

Learlux sells digital financial advice software to employers to help their employees who can’t afford financial advisors lead better financial lives.

Dave.com is a personal budgeting tool that will also loan you small amounts of cash when you need it.

Jason Brown of Tally: before washing machine was invented, average American family spent 500 hours a year doing laundry. After washing machine invented, that number went down to 10. Brown wants Tally to do that same thing for all the time people spend thinking about finance for the 99%.

“Super wealthy people have a team of people in Connecticut who help them buy two yachts, pay 10% in taxes, and everything else,” Brown said. “Tally is going to be that tool for the rest of us.”

Dave.com CEO Jason Wilk: No one at the company is named Dave, but we want your finance app to be your friend. Choosing a relatable human name lets us do that.

The average transaction that triggers an overdraft is $20, Wilk said. Overdraft protection from a big bank is too expensive for most people, so they need the opportunity to get small amounts of cash to get necessities like gas and groceries. Also, app has “side hustle” feature that lets customers apply to drive for Uber, Lyft, other gig economy jobs.

Learnlux founder Rebecca Lietman was inspired by how easy consumer finance apps worked in Kenya while she was studying there and then founded Learnlux at MIT after she got back to the States. By selling to employers, Learnlux makes your career a part of your financial plan.

80% of credit card debt is held by people with good credit, Brown said. But people who consolidate debt tend to stagnate or put themselves in worse position. Automating credit card repayment takes major stress out of your life (and saves you money—credit card late fees made more money than revenue of NFL last year).

All these companies are going hard trying to be hip/relatable: MoneyLion sponsors NASCAR car, Diplo and Mark Cuban invested in Dave.com.

Tally says average user is 33-35 years old (80% Democrat).

“We go through phases of buzzwords in finance,” Leitman said. “Everyone’s thinking about financial wellness, but no one’s defined it. There’s not a way to measure its ROI—yet.”

“You don’t look at a credit score for a 3 digit number,” said Choubey. “You look at it to see what home you can buy.”

“The difference between giving your data to Tally or Dave and giving it to Facebook is that we’re using it to help you and not to sell ads to you,” Brown said. “We don’t make money through ads, we make money from saving people money on credit card interest.”

Unfortunately, I had to leave this panel early for a meeting, but pay attention to these companies—they’re laser-focused on helping you handle your money.

+++

I quickly met with Kate Adamson, head of mortgage at Plaid, the company secretly powering your mortgage. How you actually interact with Plaid when getting a mortgage blew my mind:

When you’re applying for a loan with a lender that uses Plaid’s Assets product, Plaid will right away introduce itself as the company handling your data, let you review its terms, and then show you the data points the lender is pulling to underwrite your loan. You can view anything Plaid makes available to the lender or the companies it’s affiliated with, down to individual data points. A key thing there—Plaid doesn’t “give” the lender your data—they handle it and only make it available when the lender needs it. For more on how this works, check out a Plaid demo here.

Giving you all that transparency is how companies like Plaid that link lenders to you will win your trust when you hear bad headlines about Facebook mishandling your data every day. “Our product fails if you don’t link your account because you don’t trust us,” Adamson said.

+++

After some meetings, I caught the tail end of a session with Stash CEO Brandon Krieg. Krieg said that a huge percentage of Americans can’t come up with $500 for an emergency expense, but the majority of Stash customers who use the company’s auto-saving app for a year can cover that. Stash has around 2 million users, so that’s a pretty huge impact.

+++

After Stash, Kabbage CEO Rob Frowhein stepped onstage. Frowhein is the master of lending to small businesses, and has the heart and soul of a small business owner. His talk is titled “You Might Need Glasses, Your Vision Sucks.” He started the session by sharing a story of how he got owned pitching a VC when the investor asked him what his vision is. He didn’t have an answer so he started to obsess over vision. Groups of Kabbage employees went row by row and passed out fake glasses to all of us in the audience to ram the joke home.

Since Frowhein thinks like a small business owner, he cares more about vision and goals more than metrics and numbers. He was talking right to the founders in the room and telling them they needed to figure out why people should actually care about their companies. This goes right to the heart of what we do at The Basis Point to cut through consumer finance marketing BS.

“If you think you can do everything, you’ll end up doing nothing,” he said, which is spot on in my opinion. If you have no singular thing you can call your North Star, you’ll flounder.

For a good consumer example of good and bad visions, Frowhein brought up Snapchat and Instagram. Snapchat’s vision? “We’re a camera company.” Except it doesn’t sell cameras…

Instagram’s vision? “To bring you closer to the people and things you love.” Bring you closer. That’s something any Instagram employee can think about when they’re struggling and it will keep their work in line with the company’s goals.

+++

After hooking myself up to a caffeine IV I’m ready for more LendIt. Next up is another talk moderated by Bloomberg’s Selina Wang featuring Elevate Credit CEO Ken Rees and SVP of partnerships at Mastercard Adam Granoff. Elevate Credit makes personal loans online to people with bad credit scores, and they offer a credit card through Mastercard that’s designed to give people with bad credit access to financial services they otherwise wouldn’t be able to get.

Hence, Wang, Rees and Granoff’s talk is called “Building Partnerships To Grow The Middle Class.”

“A lot of consumers have been left behind by traditional banking services,” said Mastercard’s Granoff, which is why they use Elevate to tap into the non-prime market with credit card called Today (is it cool to sling mud at financial services if you work at a traditional bank?).

Mastercard has been inking big fintech deals—also offers Square sellers a Mastercard debit card/business account.

Because of the rise of the gig economy, for 40% of Americans, 30% of their income is volatile, said Elevate Credit CEO Rees. Banks have no idea how to underwrite or serve these “tight-ropers,” which is what Elevate calls them. That’s why Mastercard turned to Elevate to make the Today credit card.

“New middle class” is signing up for Today card. They tend to make between $30 and $50k a year, have been to college and sometimes own homes, but since life is hard they’ve gotten bad credit over the years.

Only 17% of Elevate customers say cost of credit is in their top 3 priorities when looking for a loan (do your shopping, people! LendingTree is right there!)

+++

Coming up is one of everyone’s favorite topics: student loans! The panel “Results Based Lending: The Future of Student Loans” is all about calculating the ROI of a college education. On the panel: Ken Ruggiero, CEO of Ascent Student Loans, Susan Ehrlich, CEO of Earnest, Manu Smadja, CEO of MPOWER, and Angela Ceresnie, CEO of Climb Credit.

The panel discussed whether college should be a “transactional” experience or a “transformative” one. In non-jargon terms, that asks whether you should go to college to get a job or go to grow as a person. (It shouldn’t be a debate if you ask me—it should be both, and affordable above all).

However, the answer to that question matters to the people financing students’ education. Climb Credit views it as a purely transactional experience—that’s why it lends to people who go to trade schools for high-demand jobs. If schools don’t get graduates jobs, Climb Credit CEO Ceresnie said, Climb doesn’t work with them.

Ascent Student Loans plans to launch a calculator for expected earnings based on various majors. “You figure out what monthly payment you can afford when shopping for a home, but you don’t do that for education,” Ruggiero said.

“Schools should have some accountability to students who didn’t get what they paid for if schools are going to go with retail/MSRP sticker price model,” Earnest CEO Ehrlich said.

“If we want to change the system, we have to change the way schools make money on the system,” Ceresnie said. That’s why Climb Credit makes schools share in risk of loans it makes to students.

$440 billion is spent a year on higher ed in U.S. every year. For some context, Amazon’s 2018 revenue was $232 billion. 50% of all students who start higher ed graduate within 6 years.

“Why does the Department of Education and big lenders use outdated underwriting like FICO?” MPOWER CEO Smadja said. “They discriminate against young people, against immigrants, and cut them off from financing.”

+++

Now the main event: Julian is moderating a panel on where we are in the credit cycle! Joining him is: Joseph Breeden, CEO of Prescient Models, Ram Ahluwalia, CEO of PeerIQ, Jason Laky, consumer lending business leader of TransUnion, and Ashish Gupta, chief credit officer of Prosper.

Prescient Models builds credit models, PeerIQ is the Bloomberg for loans focusing on providing data around small business and consumer loans, TransUnion is of course the credit reporting agency, and Prosper is a loan marketplace and a lender.

PeerIQ CEO Ahluwalia says the conference board leading economic index is a good indicator of recession—it has always gone negative before a recession. Unemployment is a lagging indicator so will only make sense in hindsight. But if unemployment goes above 36 month moving average, that shows you’re in a recession. The most reliable survey is the purchasing managers index. Small business optimism index is also good.

Now we’re in a “synchronized slowdown” across advanced economies. Hard to tell if it turns to recession.

“You can’t talk macro without talking the Fed,” Julian said, teeing up a round of Fed predictions (which got some laughs given the fact that we’re probably about to have pizza godfather Herman Cain on the Fed Board).

Panelists were tight-lipped on Fed predictions, but panelists generally agreed that Fed Chair Powell was holding the line and reacting to markets more so than pressure from Donald Trump.

Prosper’s Gupta said Prosper had to make sure it increased prices alongside the Fed’s rate hikes, but even though the Fed halted hikes this year, the market is getting riskier.

Q4 Fed data said $4 trillion in consumer debt. TransUnion’s Laky said lots of warning signs in economy, but the consumer is in “pretty good credit health” given consistent demand for credit and lenders willing to extend it. Unemployment remains at “unseen” low levels and wages are increasing, which is good for consumers.

“For 10 years of this recovery, it’s always seemed like we’re 6 to 8 months away from the next recession, but it hasn’t happened,” he said.

Breeden of Prescient Models said when loan demand is high, credit risk is low. But loan demand in all categories is contracting, which means financially conservative consumers are pulling out of credit markets. Data on loan volume is lagging, as well, which means it’s an indicator of slowdown.

Consumer debt to GDP ratio is 80%, in 2006 that was 100%.

“The late 2000s was a really unique recession historically,” Laky said. “When I look forward, I don’t worry about individual credit cycles. The next recession will likely be regional or smaller scale.”

“Investors are far more savvy than they were 10 years ago,” Ahluwalia said. Breeden also said investors are asking for stress tests and more information on debt investments, which indicates higher standards for investing and less malfeasance.

7 million people behind on auto loans—what’s that mean?

Laky said auto sector is pretty healthy, lots of pent-up demand that translated into peak auto sales a few years ago. Auto sales slowed down in 2016 and then delinquencies increased notably. Auto industry then self-corrected—some lenders went out of business or stopped lending. Underwriting standards are now higher. We watched an auto credit cycle happen.

$5.7 trillion in tappable equity among extremely creditworthy high-earning borrowers—when are they coming out to play?

“Highest-end customers are most dynamic,” Breeden said, “But not the source of biggest losses.”

People aren’t taking out HELOCs because the process is so complicated, even if they’re good borrower candidates for home equity loans, said Prosper’s Gupta.

Also, companies like Prosper have made personal loans way easier than HELOCs so people will get them even if they’re more expensive.

+++

We’re almost done! Last panel of the day: “Winter Is Coming And So Are The Big Internet Brands,” or, basically, “What Are We Going To Do About The Amazon Bank?” Panelists include: Kathryn Petralia, COO of Kabbage, Kavanc Onan, head of North American innovation at Alibaba, Salman Syed, VP of business development at Marqeta, and Devin Banerjee, finance editor at LinkedIn.

Alibaba and Kabbage inked a big deal a few months ago to make small business loans together.

Onan of Alibaba said that since Alibaba prioritized speed in looking for a partner for a small biz loans product, it glossed over partnering with traditional banks and went for Kabbage.

“If Apple wanted to get into small business lending, well, we modeled our experience on the Apple design philosophy, so we’d be happy to partner with them to do that,” Kabbage’s Petralia said.

+++

That’s a wrap for day one—come back tomorrow for another day of reporting from LendIt!